- Analytics

- News and Tools

- Market News

- Forex: Wednesday's review

Forex: Wednesday's review

Data released

09:30 UK BoE meeting minutes (09-10.03)

10:00 EU(17) Industrial orders (February) 0.1% 1.2% 2.7 (2.1)%

10:00 EU(17) Industrial orders (February) Y/Y 20.9% 21.5% 19.2 (18.5)%

14:00 USA New home sales (February) 250K 290K 301 (284)K

23:50 Japan Trade balance (February) unadjusted, trln 0.654 0.897 -0.471

The euro slumped against most of its major counterparts as Portugal began debating a budget that may lead the government to fall and European leaders pushed back a decision on funding a regional bailout mechanism.

The 17-nation currency fell for a second day against the dollar before a Portuguese vote that may force the nation to an early election and bailout and reports the expansion of the European Union European Financial Stability Facility will not be decided until June.

The yen strengthened against most of its major counterparts as Luxembourg Prime Minister Jean-Claude Juncker said Europe, the U.S. and the Group of Seven are “ready” to act to curb the currency’s rise.

Demand for Japanese debt rose as radiation levels at Japan’s Fukushima Dai-Ichi nuclear power plant hampered efforts to repair reactors.

The yen rose against most major currencies even after Jean- Claude Juncker said the Japanese currency is “slowly moving in the wrong direction”. The G-7 nations intervened March 18 to bring the currency down from a postwar high.

Juncker also said March 21 his “personal guess” is that the EFSF would be decided in June and would increase guarantees. The decision won’t be made by the end of this week’s meeting of policy makers, Reuters reported citing a draft document.

“Portugal has been on the radar screen, but the statement that was most damaging is that the EFSF was put off to the end of June,” said Steven Englander at Citigroup Inc.. “Everything we heard and seen for the last three months was telling us that everything would be wrapped up this weekend and now it’s not.”

The pound fell against all its major counterparts after the Bank of England minutes showed policy makers voted 6-3 to keep rates steady on March 10.

Chancellor of the Exchequer George Osborne said the British economy will more grow more slowly this year than previously forecast.

The Office for Budget Responsibility predicts annual growth in 2011 of 1.7 percent, down from the 2.1 percent forecast in November, Osborne said.

EUR/USD initially rose to $1.4213, but failed to hold above the figure and retreated to lows around $1.4074. Rate's attempts to recover were short-lived.

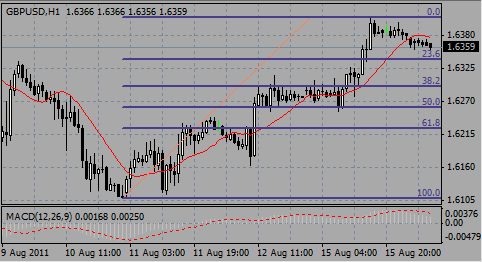

GBP/USD printed high on $1.6380, but declined after МРС's minutes release. Session lows were matched at $1.6212. Later rate recovered to $1.6270.

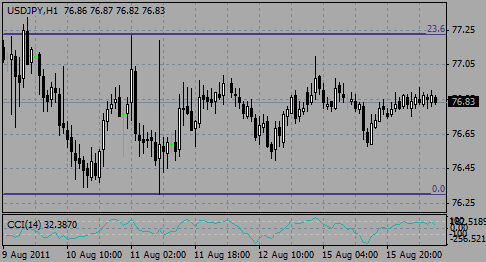

USD/JPY continued to hold within the narrow range, limited by Y80.70/Y81.10.

UK' retail sales is due to come at 09:30 GMT. Madian forecast is for 1.9% rise after -0.5% month earlier.

Jubless claims is scheduled to release at 12:30 GMT.

The focus will be on Durable goods orders at 12:30 GMT. Analysts predict orders rose 3.2% in Feb after +1.0% in Jan.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.