- Analytics

- News and Tools

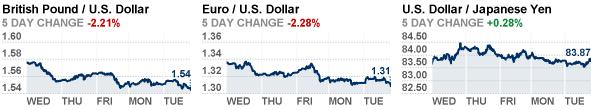

- Market News

- American focus: the Canadian dollar traded near the lowest level in almost three weeks versus its U.S. counterpart as a report showing slower inflation overshadowed another that said retail sales rose more than forecast.

American focus: the Canadian dollar traded near the lowest level in almost three weeks versus its U.S. counterpart as a report showing slower inflation overshadowed another that said retail sales rose more than forecast.

Canada’s currency, nicknamed the loonie, fell versus most of its 16 major peers. It pared losses as stocks and crude oil, the nation’s biggest export, rose. The consumer price index increased less than economists anticipated, bolstering bets that the central bank will keep interest rates on hold.

“The CPI number wasn’t enough to change perceptions of the Bank of Canada, and the retail sales number, which might have caused a little bit more Canadian dollar strength, actually had a little bit of a squishy undertone,” said David Watt, senior currency strategist at Royal Bank of Canada’s RBC Capital unit in Toronto. “We’re still weaker than yesterday’s close, but it’s pretty tightly packed around that closing level.”

Consumer prices advanced 2 percent in November from a year earlier after a 2.4 percent gain in October, Statistics Canada said today in Ottawa. The median forecast of 22 economists in a Bloomberg News survey was for a 2.2 percent pace.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.