- Analytics

- News and Tools

- Market News

- BoE expected to hold interest rate at 4.50% amid stubborn inflation and weak economic outlook

BoE expected to hold interest rate at 4.50% amid stubborn inflation and weak economic outlook

- The Bank of England is expected to hold its policy rate at 4.50%.

- UK inflation figures remain well above the BoE’s target.

- GBP/USD extends its rally past the psychological 1.3000 barrier.

The Bank of England (BoE) is set to reveal its monetary policy decision on Thursday, marking the second meeting of 2025.

Expectations are high among market watchers that the central bank will keep its benchmark rate at 4.50%, following a 25 basis point reduction in the previous month.

Alongside the decision, the BoE will publish the meeting Minutes, and Governor Andrew Bailey will hold a press conference to shed light on the reasoning behind the move.

Barring any surprises in the interest rate decision, all eyes will then shift to the bank’s forward guidance and economic outlook.

UK economic outlook: Stubborn inflation, fading growth

The Bank of England (BoE) lived up to expectations in February, delivering a hawkish rate cut backed unanimously by the nine-member Monetary Policy Committee (MPC).

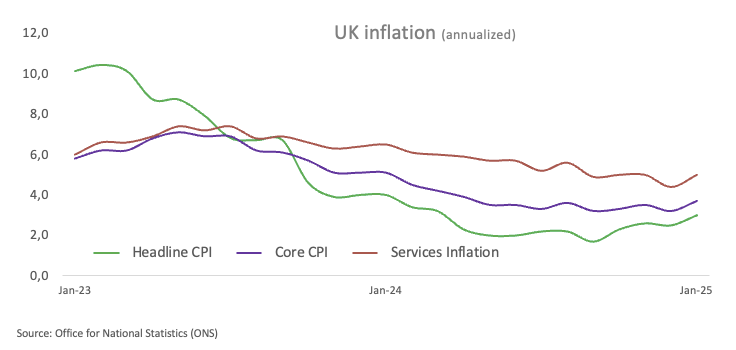

Meanwhile, fresh data from the Office for National Statistics (ONS) revealed an unexpected uptick in the UK’s annual headline inflation, which climbed to 3.0% in January from 2.5% in December. Core inflation, which excludes food and energy costs, also rose, hitting 3.7% over the last 12 months.

In addition, growth figures painted a less optimistic picture. The UK’s Gross Domestic Product (GDP) unexpectedly shrank by 0.1% in January. Furthermore, downbeat Industrial and Manufacturing Production data also added to the gloomy picture, while the S&P Global Manufacturing PMI remained stuck in contraction territory during the same month.

Following these disheartening prints, the swaps market now sees around 56 basis points of easing by the BoE through year-end.

At the BoE’s latest monetary policy gathering, Governor Andrew Bailey explained that global economic uncertainty played a key role in the decision to add the word "careful" to the bank's future interest rate guidance.

At a news conference, he remarked that this uncertainty was "two-sided" — suggesting it could either hinder the disinflation process or, conversely, accelerate it.

"It could lead to conditions which actually make the path of disinflation less assured," Bailey noted, before adding that it "frankly could also... lead to conditions which have the opposite effect and lead to it being a faster path for disinflation."

How will the BoE interest rate decision impact GBP/USD?

As previously mentioned, investors widely anticipate the BoE keeping its interest rate unchanged on Thursday at 12:00 GMT.

With that in mind, the British Pound (GBP) will likely stand pat to the decision, but it could show some reaction to how rate-setters vote. Investors will also pay close attention to Governor Andrew Bailey’s remarks.

Ahead of the event, GBP/USD managed to trespass, albeit briefly, the psychological 1.3000 barrier, with the pair closely following USD dynamics as well as developments in the US tariff narrative.

Pablo Piovano, Senior Analyst at FXStreet, noted that GBP/USD managed to break above the critical 1.3000 hurdle earlier in the week, coming under some renewed downside pressure since then.

“Once Cable clears its 2025 high of 1.3009 (set on March 18), it could embark on a potential visit to the November 2024 top at 1.3047”, Piovano added.

“On the downside, the 200-day SMA at 1.2795 serves as the initial safety net, supported by the transitory 100-day SMA at 1.2621 and the weekly low of 1.2558 (February 28). If selling pressure accelerates, the pair could dip toward the 55-day SMA at 1.2552, followed by deeper support at the February trough of 1.2248 (February 3) and the 2025 bottom at 1.2099 (January 13)”, Piovano concluded.

Economic Indicator

BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Next release: Thu Mar 20, 2025 12:00

Frequency: Irregular

Consensus: 4.5%

Previous: 4.5%

Source: Bank of England

UK gilt yields FAQs

UK Gilt Yields measure the annual return an investor can expect from holding UK government bonds, or Gilts. Like other bonds, Gilts pay interest to holders at regular intervals, the ‘coupon’, followed by the full value of the bond at maturity. The coupon is fixed but the Yield varies as it takes into account changes in the bond's price. For example, a Gilt worth 100 Pounds Sterling might have a coupon of 5.0%. If the Gilt's price were to fall to 98 Pounds, the coupon would still be 5.0%, but the Gilt Yield would rise to 5.102% to reflect the decline in price.

Many factors influence Gilt yields, but the main ones are interest rates, the strength of the British economy, the liquidity of the bond market and the value of the Pound Sterling. Rising inflation will generally weaken Gilt prices and lead to higher Gilt yields because Gilts are long-term investments susceptible to inflation, which erodes their value. Higher interest rates impact existing Gilt yields because newly-issued Gilts will carry a higher, more attractive coupon. Liquidity can be a risk when there is a lack of buyers or sellers due to panic or preference for riskier assets.

Probably the most important factor influencing the level of Gilt yields is interest rates. These are set by the Bank of England (BoE) to ensure price stability. Higher interest rates will raise yields and lower the price of Gilts because new Gilts issued will bear a higher, more attractive coupon, reducing demand for older Gilts, which will see a corresponding decline in price.

Inflation is a key factor affecting Gilt yields as it impacts the value of the principal received by the holder at the end of the term, as well as the relative value of the repayments. Higher inflation deteriorates the value of Gilts over time, reflected in a higher yield (lower price). The opposite is true of lower inflation. In rare cases of deflation, a Gilt may rise in price – represented by a negative yield.

Foreign holders of Gilts are exposed to exchange-rate risk since Gilts are denominated in Pound Sterling. If the currency strengthens investors will realize a higher return and vice versa if it weakens. In addition, Gilt yields are highly correlated to the Pound Sterling. This is because yields are a reflection of interest rates and interest rate expectations, a key driver of Pound Sterling. Higher interest rates, raise the coupon on newly-issued Gilts, attracting more global investors. Since they are priced in Pounds, this increases demand for Pound Sterling.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.