- Analytics

- News and Tools

- Market News

- USD/JPY steady amid tariff threats ahead of BoJ’s meeting

USD/JPY steady amid tariff threats ahead of BoJ’s meeting

- USD/JPY stable despite volatility after Trump announces possible 25% tariffs on neighboring countries.

- US Dollar Index (DXY) gains 0.29%, reaching 108.30, amid positive market sentiment.

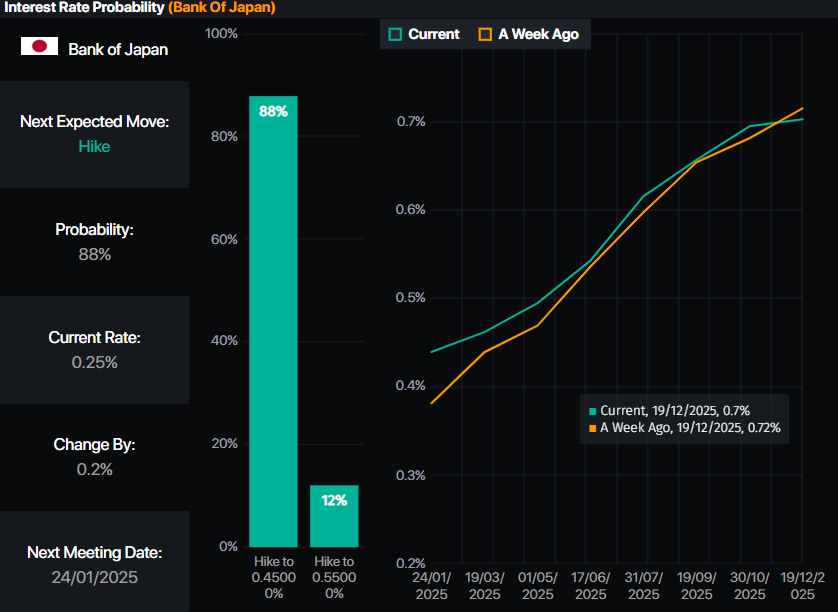

- Focus on upcoming Bank of Japan meeting; potential for 25 basis point rate hike expected.

The USD/JPY was virtually unchanged during the North American session on Tuesday, as traders assessed US President Donald Trump’s threats to impose 25% tariffs on Canada and Mexico as soon as February 1. The Greenback recovered as the major hit a daily high of 156.20. However, fears faded as the pair traded near 155.54, virtually unchanged.

USD/JPY consolidates near 155.50 on President Trump's proposed tariffs on Canada and Mexico

Market sentiment remains upbeat, and the US Dollar climbs, as depicted by the US Dollar Index (DXY), which tracks the basket of six currencies against the buck, rising 0.29% to 108.30.

Meanwhile, traders in the FX markets would continue to be attentive to Trump’s rhetoric, which sent ripples late Monday in the US as he signed a tranche of executive orders, including illegal immigration and naming cartels as global terrorist organizations.

In addition, USD/JPY traders are focused on the Bank of Japan's (BoJ) next monetary policy meeting. Interest rate probabilities suggest the BoJ would likely raise rates by 25 basis points to 0.50% for the first time since July last year.

Source: Prime Market Terminal

This week, the US economic schedule remains absent until Thursday, when the Initial Jobless Claims data will be released, followed by Friday’s S&P Flash PMIs. In Japan, the docket will feature Trade Balance data and foreign Investment figures ahead of the BoJ meeting.

USD/JPY Price Forecast: Technical outlook

The USD/JPY uptrend remains intact, but recently, sellers stepped in and dragged spot prices from around 158.80 to the current level. Despite this, bears failed to clear a support trendline drawn from September 2024 lows near 154.50. Nevertheless, if USD/JPY holds below 156.00, further downside is seen once 155.00 is cleared. The next support would be the 154.50, followed by the 154.00 mark.

On the other hand, if USD/JPY rises past the Senkou-span A at 156.41, a test of 157.00 is on the cards. If surpassed, a jump toward the January 15 high of 158.03 is likely.

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Canadian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.25% | 0.30% | -0.06% | 0.56% | 0.33% | 0.45% | 0.20% | |

| EUR | -0.25% | 0.06% | -0.24% | 0.30% | 0.08% | 0.21% | -0.07% | |

| GBP | -0.30% | -0.06% | -0.34% | 0.24% | 0.01% | 0.14% | -0.12% | |

| JPY | 0.06% | 0.24% | 0.34% | 0.61% | 0.37% | 0.48% | 0.23% | |

| CAD | -0.56% | -0.30% | -0.24% | -0.61% | -0.23% | -0.10% | -0.37% | |

| AUD | -0.33% | -0.08% | -0.01% | -0.37% | 0.23% | 0.12% | -0.14% | |

| NZD | -0.45% | -0.21% | -0.14% | -0.48% | 0.10% | -0.12% | -0.27% | |

| CHF | -0.20% | 0.07% | 0.12% | -0.23% | 0.37% | 0.14% | 0.27% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.