- Analytics

- News and Tools

- Market News

- USD/JPY Price Forecast: Subdued around 157.50, eyes on US CPI data

USD/JPY Price Forecast: Subdued around 157.50, eyes on US CPI data

- USD/JPY hovers at the mid-range of the 157.00-158.00, set to finish in the red.

- Uptrend's extension lies above 158.00 and 158.88, but BoJ intervention fears loom.

- A drop below the Tenkan-sen, opens the door towards 157.00.

The US Dollar losses some ground against the Japanese Yen on Monday amid a bank holiday in Japan as the USD/JPY shrugged off a rise in the US 10-year T-note yield. At the time of writing, the pair trades at 157.54, down by 0.11%.

USD/JPY Price Forecast: Technical outlook

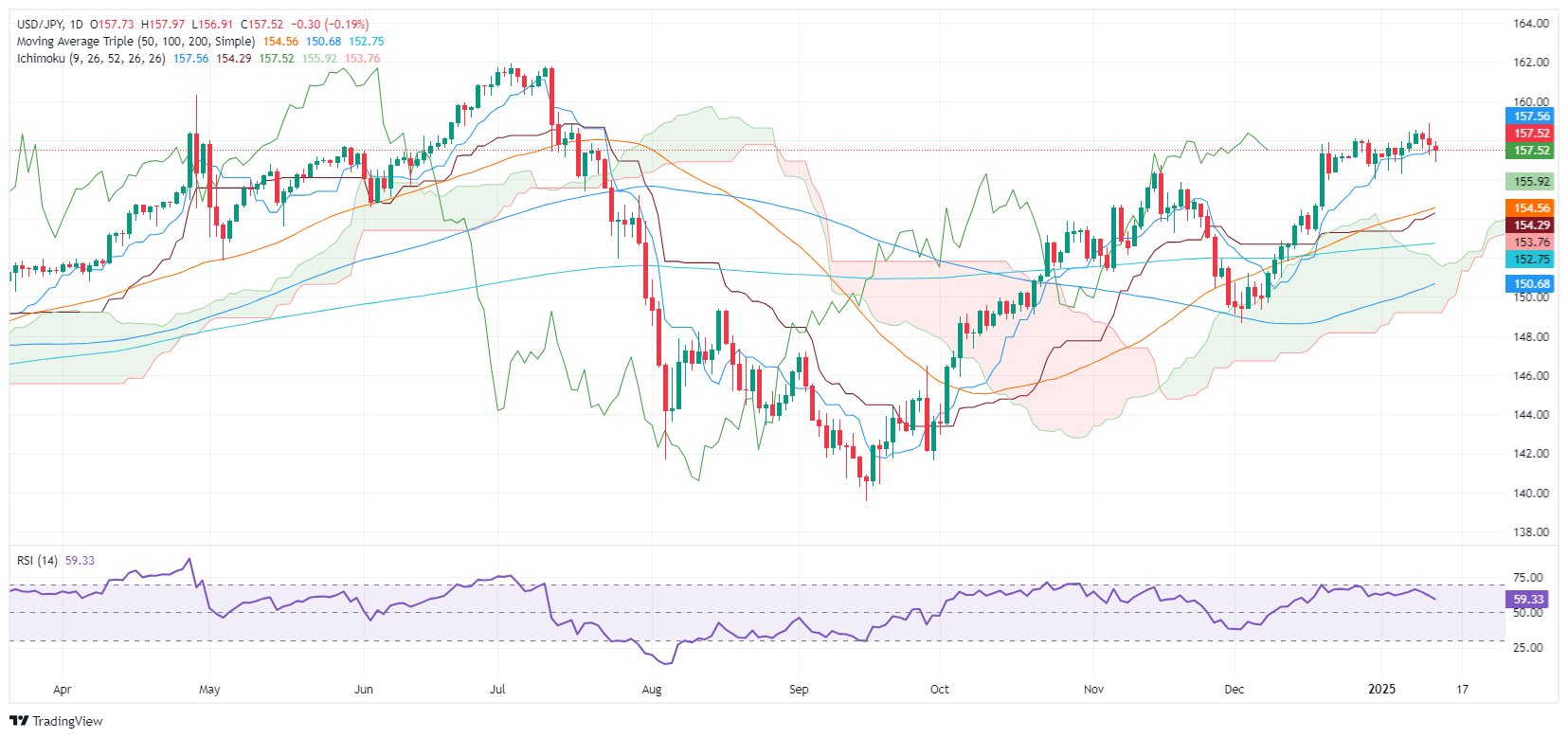

The USD/JPY daily chart remains upward biased, but faces strong resistance at 158.00, amid fears that the Bank of Japan (BoJ) might intervene in the Forex markets. Momentum favors further upside, after the 50-day Simple Moving Average (SMA) at 154.58 crossed above the 200-day SMA, forming a 'golden cross,' implying that further upside is seen.

For a bullish continuation, the USD/JPY first ceiling level would be the 158.00 figure followed by the January 10 peak hit following US NFP data on Friday at 158.88. A breach of the latter will expose 159.00.

If USD/JPY tumbles below Tenkan-sen, the next support would be the January 6 low of 156.24, followed by the December 31 pivot low of 156.02.

USD/JPY Price Chart - Daily

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.25% | -0.20% | -0.11% | -0.13% | -0.23% | -0.31% | -0.16% | |

| EUR | 0.25% | 0.07% | 0.11% | 0.13% | 0.02% | -0.06% | 0.13% | |

| GBP | 0.20% | -0.07% | 0.10% | 0.07% | -0.04% | -0.13% | 0.04% | |

| JPY | 0.11% | -0.11% | -0.10% | 0.06% | -0.15% | -0.22% | -0.04% | |

| CAD | 0.13% | -0.13% | -0.07% | -0.06% | -0.14% | -0.17% | 0.01% | |

| AUD | 0.23% | -0.02% | 0.04% | 0.15% | 0.14% | -0.08% | 0.08% | |

| NZD | 0.31% | 0.06% | 0.13% | 0.22% | 0.17% | 0.08% | 0.17% | |

| CHF | 0.16% | -0.13% | -0.04% | 0.04% | -0.01% | -0.08% | -0.17% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.