- Analytics

- News and Tools

- Market News

- US GDP set to show economy expanded at solid pace in Q3

US GDP set to show economy expanded at solid pace in Q3

- The United States Gross Domestic Product is expected to grow at an annualised rate of 3.0% in Q3.

- The US economy continues to outperform its G10 peers.

- Investors anticipate the Federal Reserve will reduce interest rates by 25 bps in November.

The US Bureau of Economic Analysis (BEA) is scheduled to release the preliminary estimate of the US Gross Domestic Product (GDP) for the July-September quarter on Wednesday. Analysts anticipate that the report will indicate an annualised economic growth rate of 3.0%, matching the expansion recorded in the previous quarter.

Unveiling US economic growth: GDP forecast insights

This Wednesday, the US Bureau of Economic Analysis (BEA) is set to release the first estimate of the Gross Domestic Product (GDP) for the third quarter (July-September) at 12:30 GMT. Initial projections point to an annualised economic growth rate of 3.0%, in line with the expansion seen in the previous period and indicating a robust pace for the domestic economy, which continues to outpace its G10 counterparts.

The updated Summary of Economic Projections at the Federal Reserve’s (Fed) September meeting revealed several changes from June. The Fed’s median forecast for real GDP growth remained mostly steady at 2.0% for 2024, 2025 and 2026, and 1.8% for the long term.

The Fed also announced that it had raised the median unemployment rate projections to 4.4% for both 2024 and 2025, 4.3% for 2026 and 4.2% in the long run, up from the previous estimates of 4.0%, 4.2%, 4.1% and 4.2%, respectively.

Regarding inflation, the Fed reported that the median estimate for the core Personal Consumption Expenditures (PCE) price index was revised down to 2.6% for 2024, 2.2% for 2025 and 2.0% for 2026,from earlier projections of 2.8%, 2.3% and 2.0%.

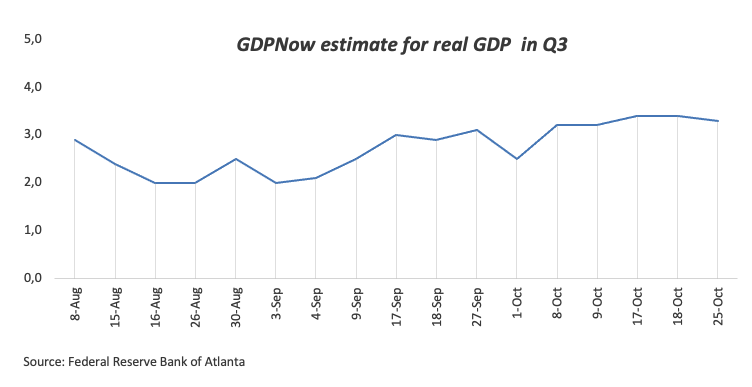

The latest GDPNow forecast from the Federal Reserve Bank of Atlanta, released on Friday, projects that the US economy expanded at an annual rate of 3.3% in the third quarter.

Market observers will be paying close attention to the GDP Price Index, which tracks changes in the prices of goods and services produced domestically, including exports but excluding imports. This index provides a clear view of how inflation is affecting GDP. For the third quarter, the GDP Price Index is expected to increase by 2.7%, up from the 2.5% rise seen in the second quarter.

Along withthe GDP Price Index, the upcoming GDP report will include the quarterly Personal Consumption Expenditures (PCE) Price Index and the core PCE Price Index. These metrics are crucial for assessing inflation, with the core PCE Price Index being the Federal Reserve’s preferred measure.

Ahead of the GDP release, analysts at TD Securities shared their insights: “US Q3 GDP strength is likely to persist with a 3% gain, driven by strong domestic demand and a resilient consumer base.”

When will the GDP print be released, and how can it affect the USD?

The US GDP report will be published at 12:30 GMT on Wednesday. In addition to the headline real GDP figure,changes in private domestic purchases, the GDP Price Index and the Q3 PCE Price Index figures could impact the US Dollar’s (USD) valuation.

Sticky inflation readings in September, combined with the still robust US labour market, have recently fuelled expectations for a smaller Fed rate cut in November.

According to the CME FedWatch Tool, a 25 basis points (bps) rate reduction in November is almost fully priced in.

Looking at the USD, a firm GDP could provide the Fed with additional justification to go for the small option at next month’s meeting. On the other hand, a disappointing GDP print—albeit unlikely—could motivate the Greenback to take a momentary breather, if any at all.

Pablo Piovano, Senior Analyst at FXStreet, gives his view on the technical outlook for the US Dollar Index (DXY): “Amidst the ongoing rally in the US Dollar Index (DXY), the next key target is the October 29 high of 104.63 (October 29). Once this region is cleared, the index could embark on a potential test of the weekly top of 104.79 (July 30).”

“On the downside, strong support remains at the year-to-date low of 100.15 (September 27). Should selling pressure reappear and the DXY breach this level, it may retest the psychological 100.00 milestone, potentially leading to a drop to the 2023 low of 99.57 (July 14)”, added Pablo.

Economic Indicator

Gross Domestic Product Annualized

The real Gross Domestic Product (GDP) Annualized, released quarterly by the US Bureau of Economic Analysis, measures the value of the final goods and services produced in the United States in a given period of time. Changes in GDP are the most popular indicator of the nation’s overall economic health. The data is expressed at an annualized rate, which means that the rate has been adjusted to reflect the amount GDP would have changed over a year’s time, had it continued to grow at that specific rate. Generally speaking, a high reading is seen as bullish for the US Dollar (USD), while a low reading is seen as bearish.

Read more.Next release: Wed Oct 30, 2024 12:30 (Prel)

Frequency: Quarterly

Consensus: 3%

Previous: 3%

Source: US Bureau of Economic Analysis

The US Bureau of Economic Analysis (BEA) releases the Gross Domestic Product (GDP) growth on an annualized basis for each quarter. After publishing the first estimate, the BEA revises the data two more times, with the third release representing the final reading. Usually, the first estimate is the main market mover and a positive surprise is seen as a USD-positive development while a disappointing print is likely to weigh on the greenback. Market participants usually dismiss the second and third releases as they are generally not significant enough to meaningfully alter the growth picture.

GDP FAQs

A country’s Gross Domestic Product (GDP) measures the rate of growth of its economy over a given period of time, usually a quarter. The most reliable figures are those that compare GDP to the previous quarter e.g Q2 of 2023 vs Q1 of 2023, or to the same period in the previous year, e.g Q2 of 2023 vs Q2 of 2022. Annualized quarterly GDP figures extrapolate the growth rate of the quarter as if it were constant for the rest of the year. These can be misleading, however, if temporary shocks impact growth in one quarter but are unlikely to last all year – such as happened in the first quarter of 2020 at the outbreak of the covid pandemic, when growth plummeted.

A higher GDP result is generally positive for a nation’s currency as it reflects a growing economy, which is more likely to produce goods and services that can be exported, as well as attracting higher foreign investment. By the same token, when GDP falls it is usually negative for the currency. When an economy grows people tend to spend more, which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation with the side effect of attracting more capital inflows from global investors, thus helping the local currency appreciate.

When an economy grows and GDP is rising, people tend to spend more which leads to inflation. The country’s central bank then has to put up interest rates to combat the inflation. Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold versus placing the money in a cash deposit account. Therefore, a higher GDP growth rate is usually a bearish factor for Gold price.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.