- Analytics

- News and Tools

- Market News

- AUD/USD Price Forecast: Defends 50% Fibo., bulls seem non committed above 0.6800

AUD/USD Price Forecast: Defends 50% Fibo., bulls seem non committed above 0.6800

- AUD/USD attracts some dip-buyers on Monday, though the uptick lacks bullish conviction.

- The technical setup warrants caution before positioning for any further appreciating move.

- Bearish traders need to wait for a break below the 50% Fibo. level before placing fresh bets.

The AUD/USD pair kicks off the new week on a positive note, snapping a two-day losing streak and stalling its recent pullback from the highest level since February 2023 touched last Monday. Spot prices currently trade just above the 0.6800 mark, up 0.20% for the day, though lack follow-through buying amid a bullish US Dollar (USD).

The upbeat US monthly employment details released on Friday eased concerns about an economic slowdown, which, along with the optimism over China's stimulus, remains supportive of the risk-on mood. Apart from this, the Reserve Bank of Australia's (RBA) hawkish stance benefits the risk-sensitive Aussie. Meanwhile, diminishing odds for a more aggressive policy easing by the Federal Reserve (Fed) and escalating geopolitical tensions in the Middle East assist the safe-haven buck to stand tall near a seven-week high. This, in turn, acts as a headwind for the AUD/USD pair.

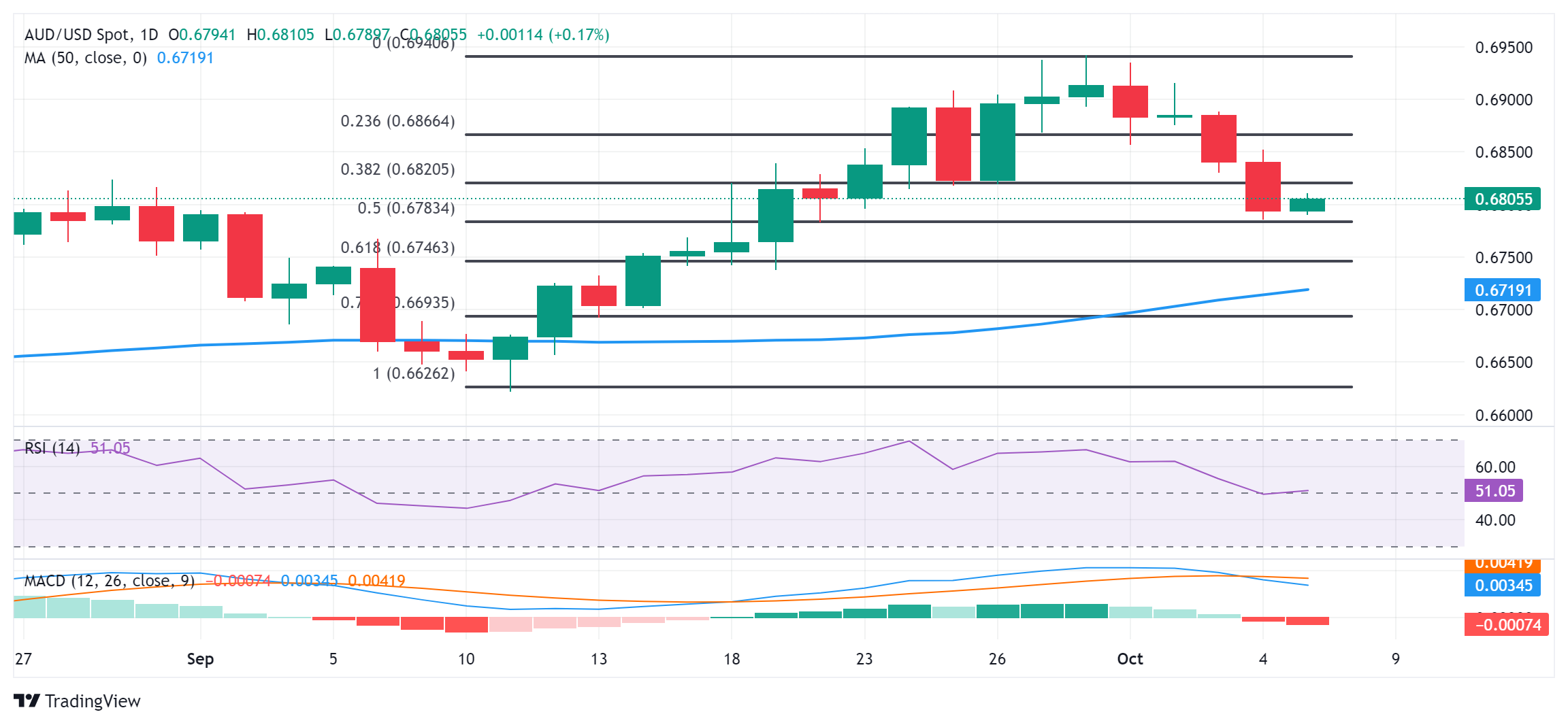

From a technical perspective, spot prices on Friday found support near the 0.6785 region, or the 50% Fibonacci retracement level of the September move-up. The subsequent move up favors bullish traders, though the fact that oscillators on the daily chart have just started gaining negative traction warrants some caution before positioning for any further appreciating move. In the meantime, the 0.6820 region, or the 38.2% Fibo. level is likely to act as an immediate hurdle, above which the AUD/USD pair could accelerate the positive move towards the 0.6865-0.6870 region.

The latter near the 23.6% Fibo. level breakpoint, which if cleared will suggest that the corrective slide has run its course and prompt fresh buying. Spot prices might then aim to reclaim the 0.6900 round-figure mark and extend the momentum further towards the 0.6940-0.6945 region, or the year-to-date (YTD) peak touched last week.

On the flip side, bearish traders need to wait for a sustained break and acceptance below the 50% Fibo. level, around the 0.6785 region, before placing fresh bets. The AUD/USD pair might then slide to the 61.8 % Fibo. level, around the 0.6745 region, before eventually dropping en route to sub-0.6700 levels, or the 100-day Simple Moving Average (SMA).

AUD/USD daily chart

Australian Dollar FAQs

One of the most significant factors for the Australian Dollar (AUD) is the level of interest rates set by the Reserve Bank of Australia (RBA). Because Australia is a resource-rich country another key driver is the price of its biggest export, Iron Ore. The health of the Chinese economy, its largest trading partner, is a factor, as well as inflation in Australia, its growth rate and Trade Balance. Market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – is also a factor, with risk-on positive for AUD.

The Reserve Bank of Australia (RBA) influences the Australian Dollar (AUD) by setting the level of interest rates that Australian banks can lend to each other. This influences the level of interest rates in the economy as a whole. The main goal of the RBA is to maintain a stable inflation rate of 2-3% by adjusting interest rates up or down. Relatively high interest rates compared to other major central banks support the AUD, and the opposite for relatively low. The RBA can also use quantitative easing and tightening to influence credit conditions, with the former AUD-negative and the latter AUD-positive.

China is Australia’s largest trading partner so the health of the Chinese economy is a major influence on the value of the Australian Dollar (AUD). When the Chinese economy is doing well it purchases more raw materials, goods and services from Australia, lifting demand for the AUD, and pushing up its value. The opposite is the case when the Chinese economy is not growing as fast as expected. Positive or negative surprises in Chinese growth data, therefore, often have a direct impact on the Australian Dollar and its pairs.

Iron Ore is Australia’s largest export, accounting for $118 billion a year according to data from 2021, with China as its primary destination. The price of Iron Ore, therefore, can be a driver of the Australian Dollar. Generally, if the price of Iron Ore rises, AUD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Iron Ore falls. Higher Iron Ore prices also tend to result in a greater likelihood of a positive Trade Balance for Australia, which is also positive of the AUD.

The Trade Balance, which is the difference between what a country earns from its exports versus what it pays for its imports, is another factor that can influence the value of the Australian Dollar. If Australia produces highly sought after exports, then its currency will gain in value purely from the surplus demand created from foreign buyers seeking to purchase its exports versus what it spends to purchase imports. Therefore, a positive net Trade Balance strengthens the AUD, with the opposite effect if the Trade Balance is negative.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.