- Analytics

- News and Tools

- Market News

- Crude Oil nosedives, shrugging off Israeli ground incursion into Lebanon

Crude Oil nosedives, shrugging off Israeli ground incursion into Lebanon

- Crude Oil falls over 2% as Israel breaches Lebanon’s borders for a military operation.

- Traders are sending Crude Oil lower with anticipations of a full-scale invasion being priced out.

- The US Dollar Index jumps driven by Fed Chairman Powell’s cautious outlook over interest rate cuts and geopolitics.

Crude Oil slides lower on Tuesday, extending Monday’s losses, even as Israel began its ground incursion into Lebanon. Traders seemed to be expecting a much bigger or even full-blown ground offensive, which doesn’t seem to be the case. Rather, the incursion seems to be based on several special operations and very specific targets being taken out around border posts and villages in Lebanon, limiting the actual impact on other countries in the Middle East.

The US Dollar Index (DXY), which tracks the performance of the Greenback against six other currencies, is enjoying some inflow on the back of comments from Federal Reserve (Fed) Chairman Jerome Powell. The Fed Chairman pushed back against calls for another big rate cut in November, pointing out that the Fed remains data dependent. On the docket for this Tuesday, Manufacturing data from the Institute for Supply Management and the JOLTS Job openings for August will shed more light on the state of the US economy.

At the time of writing, Crude Oil (WTI) trades at $67.48 and Brent Crude at $71.22.

Oil news and market movers: How a military excursion can be negative for Oil

- Israel Defense Forces are striking local villages close to the border that potentially could pose an immediate threat to Israeli communities in Northern Israel, Reuters reports.

- The United Arab Emirates has expressed “deep concern” over Israel’s ground operation in Lebanon, pointing out the possible repercussions of this dangerous situation for the region, Bloomberg reports.

- Hezbollah is retaliating with missles being fired deep into Israel, Reuters reports.

- From the demand side, bad news came from China with manufacturing activity shrinking in September as new orders both domestically and abroad cooled down, Reuters reports.

Oil Technical Analysis: You can’t buy the dip

Crude Oil prices is showcasing a textbook example here of “buy the rumour, sell the fact” wisdom when trading financial product assets. Tensions were building up towards this incursion from Israel into Lebanon over the past few days. With the actual event now being less severe and less impactful as first anticipated, the risk premium that got priced in last week is now fully being priced out.

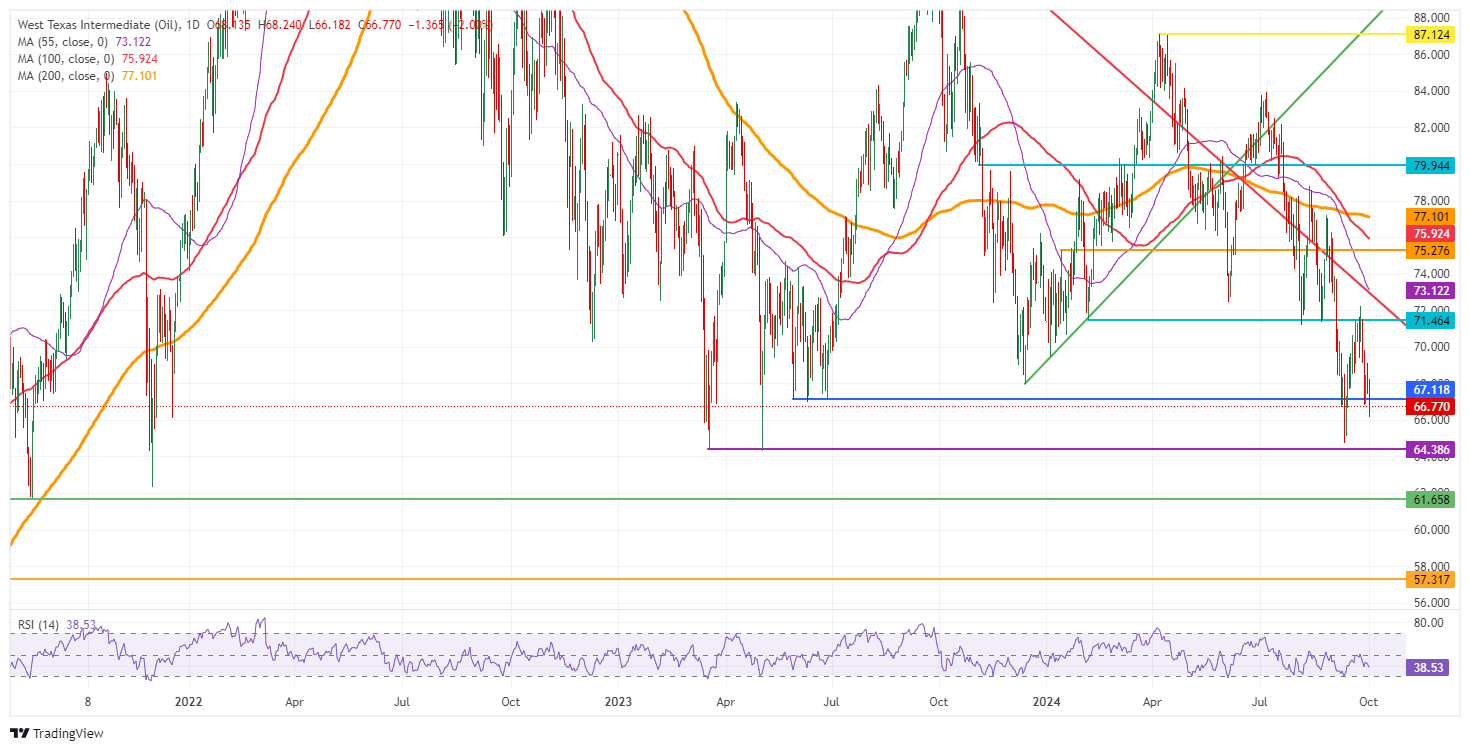

At current levels, $71.46 remains in focus after a brief false break last week. If a supportive catalyst remains present, a return to $75.27 (the January 12 high) could play out. Along the way towards that level, the 55-day Simple Moving Average (SMA) at $73.36 could ease the rally a bit. Once above $75.27, the first resistance to follow is $76.03, with the 100-day SMA in play.

On the downside, $67.11, a triple bottom in the summer of 2023, could still hold as support once traders that want to buy the dip push price action back above this level. If that is not the case, further down the next level is $64.38, the low from March and May 2023. Even $61.65 could come into play should a ceasefire emerge or if Israel signals it is done with its special operation into Lebanon.

US WTI Crude Oil: Daily Chart

WTI Oil FAQs

WTI Oil is a type of Crude Oil sold on international markets. The WTI stands for West Texas Intermediate, one of three major types including Brent and Dubai Crude. WTI is also referred to as “light” and “sweet” because of its relatively low gravity and sulfur content respectively. It is considered a high quality Oil that is easily refined. It is sourced in the United States and distributed via the Cushing hub, which is considered “The Pipeline Crossroads of the World”. It is a benchmark for the Oil market and WTI price is frequently quoted in the media.

Like all assets, supply and demand are the key drivers of WTI Oil price. As such, global growth can be a driver of increased demand and vice versa for weak global growth. Political instability, wars, and sanctions can disrupt supply and impact prices. The decisions of OPEC, a group of major Oil-producing countries, is another key driver of price. The value of the US Dollar influences the price of WTI Crude Oil, since Oil is predominantly traded in US Dollars, thus a weaker US Dollar can make Oil more affordable and vice versa.

The weekly Oil inventory reports published by the American Petroleum Institute (API) and the Energy Information Agency (EIA) impact the price of WTI Oil. Changes in inventories reflect fluctuating supply and demand. If the data shows a drop in inventories it can indicate increased demand, pushing up Oil price. Higher inventories can reflect increased supply, pushing down prices. API’s report is published every Tuesday and EIA’s the day after. Their results are usually similar, falling within 1% of each other 75% of the time. The EIA data is considered more reliable, since it is a government agency.

OPEC (Organization of the Petroleum Exporting Countries) is a group of 12 Oil-producing nations who collectively decide production quotas for member countries at twice-yearly meetings. Their decisions often impact WTI Oil prices. When OPEC decides to lower quotas, it can tighten supply, pushing up Oil prices. When OPEC increases production, it has the opposite effect. OPEC+ refers to an expanded group that includes ten extra non-OPEC members, the most notable of which is Russia.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.