- Analytics

- News and Tools

- Market News

- Mexican Peso edges higher amid steady risk appetite

Mexican Peso edges higher amid steady risk appetite

- The Mexican Peso is moderating higher on Thursday as the global risk appetite supports emerging market currencies.

- The Peso weakened across the board on Wednesday after the Fed announced a mega 0.50% rate cut.

- USD/MXN is consolidating at the base of a rising channel and the 50-day SMA.

The Mexican Peso (MXN) edges higher in its most heavily-traded pairs during the European session on Thursday as global stocks rally amid an upbeat tone that is generally positive for emerging market FX.

On Wednesday, however, the Peso lost ground following the US Federal Reserve’s (Fed) decision to cut interest rates by a larger 0.50% at its meeting. MXN weakened by an average of 1.1% against the US Dollar (USD), Euro (EUR), and Pound Sterling (GBP) on the day.

The Mexican Peso was probably not helped by comments from Victor Manuel Herrera, President of the National Economic Research Committee at Instituto Mexicano de Ejecutivos de Finanzas (IMEF) on Wednesday. Herrera said that the Mexican government’s controversial judicial reforms and the scrapping of independent industry regulatory bodies might harm the Mexican economy by reducing its attractiveness to foreign investors, especially from the US.

Mexican Peso still overvalued – Capital Economics

The Mexican Peso remains overpriced, according to London-based advisory service Capital Economics, and given the state of precarious public finances, is, therefore, set for further declines in the future.

Well-publicized concerns about the left-leaning government’s radical constitutional reform plans aside, Mexico’s public finances are in poor shape, and the country’s indebtedness puts the economy at risk.

“President-elect Sheinbaum, protégé of the outgoing President Amlo, will inherit a myriad of economic issues. Most notably, the deteriorating public finances that are compounded by the heavily indebted state oil firm, Pemex, and could threaten Mexico’s investment grade sovereign credit rating,” says Joe Maher, Assistant Economist at Capital Economics.

Another factor weighing on the Peso is the unwinding of the so-called “carry trade,” in which investors borrow in a currency where interest rates are low, such as the Japanese Yen (JPY), and use the loan to buy a currency where interest rates are high, like the Peso. As long as the Peso does not depreciate against the Yen, those investors stand to earn the difference in the interest repayments on the Yen loan and the interest earned by being in Pesos. However, since the Yen has begun appreciating on the back of expectations that the Bank of Japan (BoJ) will raise interest rates, the carry trade has lost its luster.

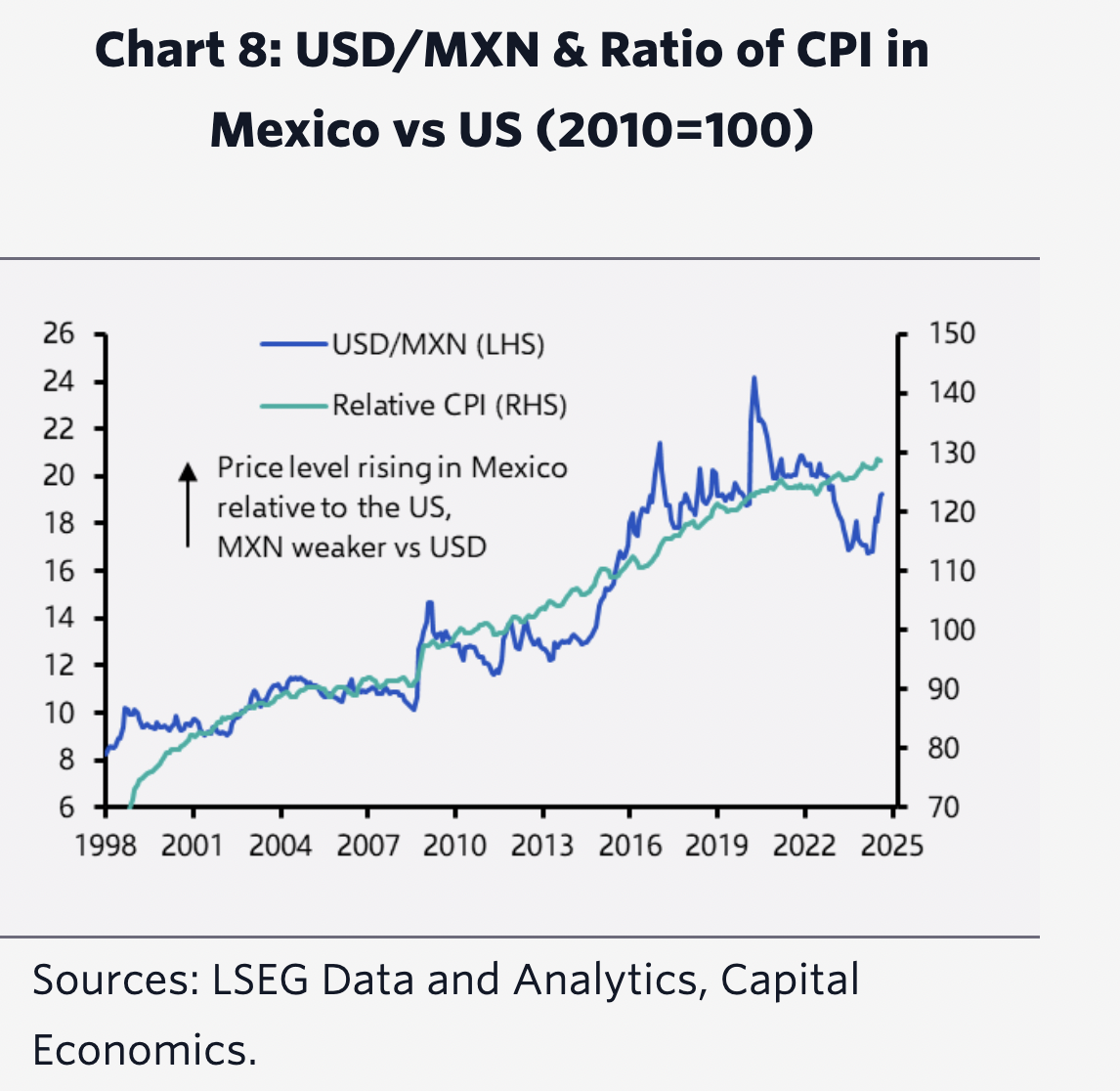

Maher sees further downside pressure on the Peso from being overvalued on a Price Purchasing Parity (PPP) basis.

“The Peso has room to weaken further. For example, it is still somewhat stronger than what is implied by relative price levels in the US and Mexico,” says the Assistant Economist

That said, the Mexican currency will gain some support from upbeat risk appetite. Capital Economics’s base case is that the US economy will avoid a recession, and if this holds true then the Peso should see gains.

“If we are correct in thinking that the US economy will avoid a recession, global risk appetite will probably stay strong, which would support Mexican assets and the peso,” he adds.

Nevertheless, Capital Economics revises down its forecasts, expecting the Peso to weaken to USD/MXN 20.00 by the end of 2024 and 21.00 by the end of 2025.

Technical Analysis: USD/MXN consolidates near bottom of channel

USD/MXN is consolidating near the bottom of a long-term rising channel.

The pair declined last week after forming a Three Black Crows Japanese candlestick pattern (shaded rectangle in the chart below). The pattern indicates prices could fall even further in the short term. Key support from the base of the channel and the 50-day Simple Moving Average at 19.02, however, stand in the way.

USD/MXN Daily Chart

USD/MXN could extend weakness a little to the lower channel line at around 19.01 and the 50 SMA nearby. Despite being in a short-term downtrend, these firm support levels will be tough nuts for bears to crack. There is a risk that USD/MXN will simply stabilize and use the support shelf to launch a recovery within the channel, thereby extending the medium and long-term uptrends.

A decisive break below the lower channel line and 50 SMA would be required to alter the outlook and indicate a continuation of the down move.

A decisive break would be one accompanied by a long red candle that pierced well below the channel line and closed near its low, or three down days in a row that broke clearly below the line.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.