- Analytics

- News and Tools

- Market News

- USD/JPY Price Forecast: Slips from 4-day peak, hovers below 142.00

USD/JPY Price Forecast: Slips from 4-day peak, hovers below 142.00

- USD/JPY downtrend persists, with the RSI favoring sellers ahead of the Fed's rate cut decision.

- A 25-bps Fed rate cut could push USD/JPY higher toward 142.47, with potential to target the 143.00 figure.

- A 50-bps cut could lead to a retest of 140.32, with further downside aiming for the YTD low of 139.58.

The USD/JPY dropped after reaching a four-day high of 142.47, yet it remains range-bound during the North American session. The rise in US Treasury yields and a soft US Dollar keeps the pair trapped within the September 17 trading range. Therefore, the major trades at 141.88, losses 0.36%

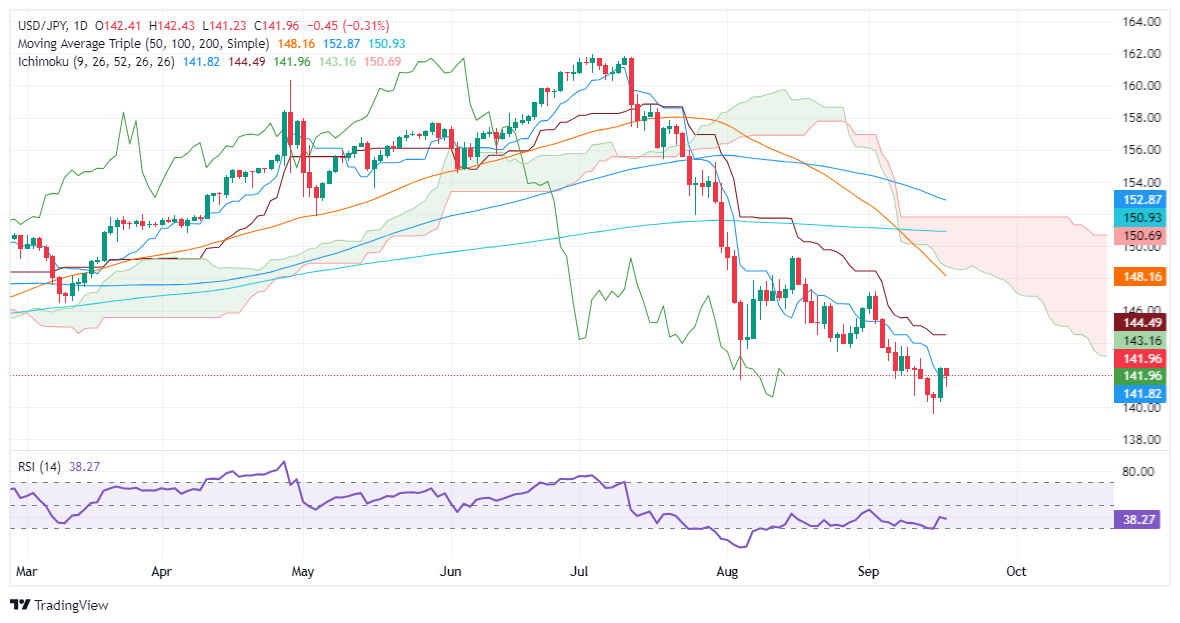

USD/JPY Price Forecast: Technical outlook

The USD/JPY downtrend remains in place, but the Federal Reserve’s decision to cut rates by a smaller or larger size could trigger different reactions. The Relative Strength Index (RSI) favors sellers, hence further downside.

If the Fed lowers rates by 25 basis points, this could be bullish for the USD/JPY and push prices toward the September 17 high at 142.47, which, if cleared, will expose the 143.00 figure.

On the other hand, a 50 bps rate cut could allow the September 17 low of 140.32 to be retested and pave the way for the challenge of the year-to-date (YTD) low of 139.58.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.04% | -0.32% | -0.31% | -0.04% | -0.16% | -0.37% | -0.19% | |

| EUR | 0.04% | -0.29% | -0.30% | -0.01% | -0.12% | -0.35% | -0.15% | |

| GBP | 0.32% | 0.29% | 0.00% | 0.28% | 0.18% | -0.07% | 0.17% | |

| JPY | 0.31% | 0.30% | 0.00% | 0.27% | 0.16% | -0.05% | 0.17% | |

| CAD | 0.04% | 0.01% | -0.28% | -0.27% | -0.12% | -0.34% | -0.11% | |

| AUD | 0.16% | 0.12% | -0.18% | -0.16% | 0.12% | -0.21% | 0.00% | |

| NZD | 0.37% | 0.35% | 0.07% | 0.05% | 0.34% | 0.21% | 0.21% | |

| CHF | 0.19% | 0.15% | -0.17% | -0.17% | 0.11% | -0.01% | -0.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.