- Analytics

- News and Tools

- Market News

- USD/JPY Price Forecast: Tumbles on hawkish BoJ tone, firm below 146.00

USD/JPY Price Forecast: Tumbles on hawkish BoJ tone, firm below 146.00

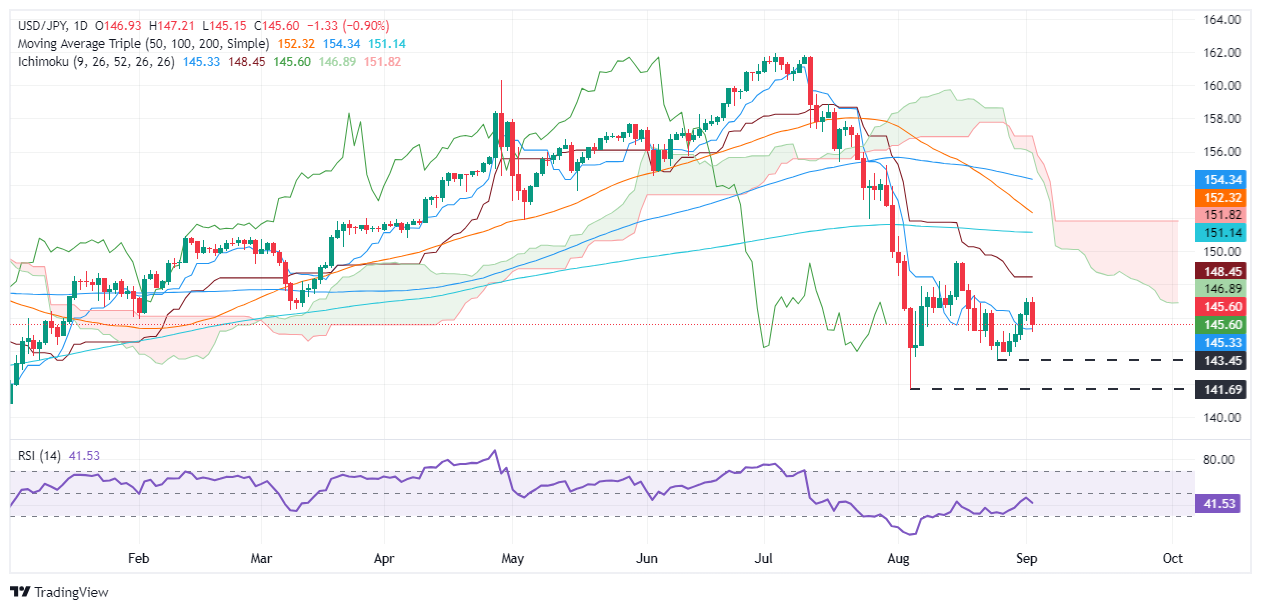

- USD/JPY forms a bearish engulfing pattern, signaling potential further downside in the near term.

- RSI momentum supports sellers, with first support eyed at Tenkan-Sen 145.33 and psychological 145.00 level.

- Bulls must reclaim Kijun-Sen at 148.45, with 150.00 needed to reverse the bearish trend.

The USD/JPY dropped late in the North American session, registering losses of over 0.80% or more than 100 pips. It now trades at 145.68.

During the overnight session for US traders, headlines revealed that Bank of Japan (BoJ) Governor Kazuo Ueda reiterated his hawkish stance on remarks submitted to a government panel. This was the main driver of the pair, along with the plunge of the yield of the US 10-year Treasury note.

USD/JPY Price Forecast: Technical outlook

From a technical standpoint, the USD/JPY is downward biased, forming a ‘bearish engulfing’ chart pattern. This hints that more downside is seen, further confirmed by the Relative Strength Index (RSI), reassuring that momentum supports sellers.

With the path of least resistance tilted to the downside, USD/JPY's first support would be the Tenkan-Sen at 145.33. If hurdled, the next stop would be the 145.00 figure, ahead of testing the next cycle low of 143.45, the August 26 daily low. This would be the last line of defense for bulls, ahead of the August 5 low of 141.69.

For bulls to regain control, they must regain the Kijun-Sen at 148.45 before reclaiming the 150.00 figure above the latest cycle high of 149.39.

USD/JPY Price Action – Daily Chart

Japanese Yen PRICE Today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.26% | 0.28% | -0.92% | 0.42% | 1.19% | 0.93% | -0.12% | |

| EUR | -0.26% | 0.00% | -1.16% | 0.14% | 0.91% | 0.55% | -0.39% | |

| GBP | -0.28% | -0.01% | -1.18% | 0.14% | 0.90% | 0.55% | -0.39% | |

| JPY | 0.92% | 1.16% | 1.18% | 1.32% | 2.10% | 1.67% | 0.77% | |

| CAD | -0.42% | -0.14% | -0.14% | -1.32% | 0.75% | 0.32% | -0.53% | |

| AUD | -1.19% | -0.91% | -0.90% | -2.10% | -0.75% | -0.46% | -1.29% | |

| NZD | -0.93% | -0.55% | -0.55% | -1.67% | -0.32% | 0.46% | -0.83% | |

| CHF | 0.12% | 0.39% | 0.39% | -0.77% | 0.53% | 1.29% | 0.83% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Japanese Yen from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent JPY (base)/USD (quote).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.