- Analytics

- News and Tools

- Market News

- USD/JPY Price Forecast: Soars past 146.00 boosted by US yields

USD/JPY Price Forecast: Soars past 146.00 boosted by US yields

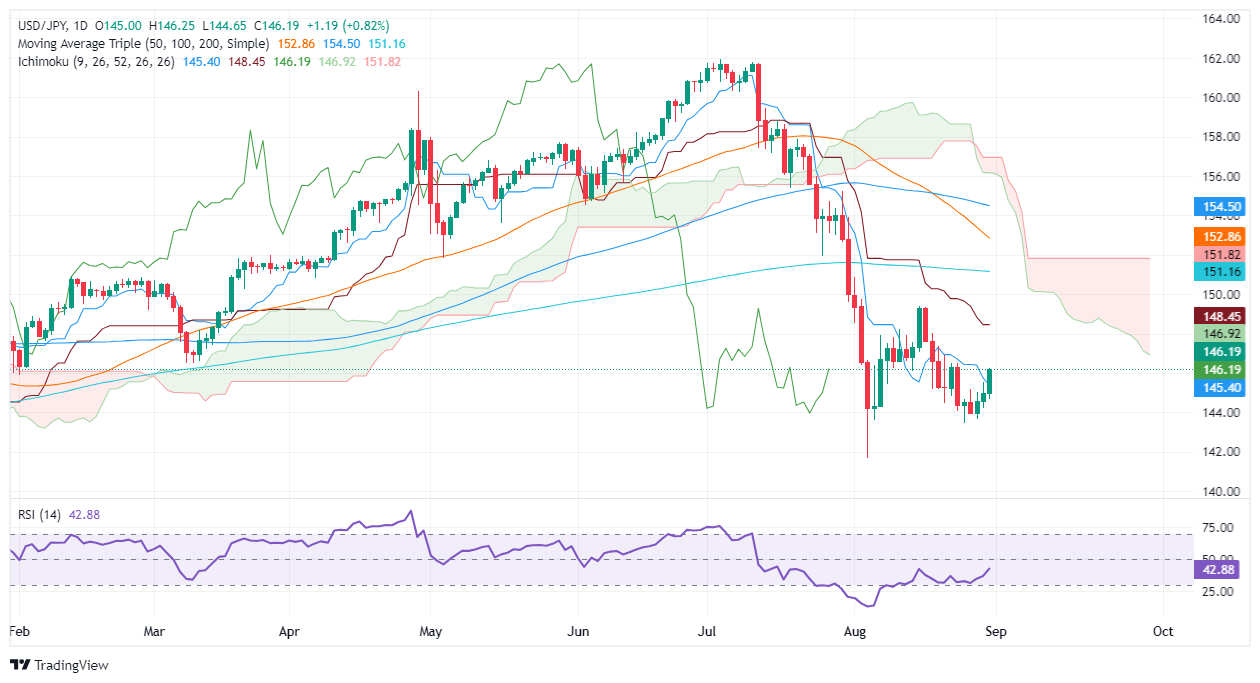

- USD/JPY maintains a downward bias, needing to break key resistances for a bullish shift.

- Short-term buyer momentum faces obstacles at 146.93 (Senkou Span A) and 148.46 (Kijun-Sen), with an eye on the 149.39 peak.

- Mixed RSI signals suggest short-term buyer dominance but an unclear broader trend.

- A drop below 145.39 (Tenkan-Sen) could trigger further losses, with supports at 143.44 (August 26 low) and 141.69 (August 5 low).

The USD/JPY rallied past the 146.00 figure for the first time of the week, as US Treasury bond yields rose sharply following the release of the Fed’s favorite inflation report. The US 10-year Treasury note yield rose four and a half basis points to 3.909%, underpinning the major towards 146.17 after bouncing off daily lows of 145.56.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is downward biased despite surpassing above the Tenkan-Sen lying at 145.39. The Relative Strength Index (RSI) shows that momentum is mixed, with the indicator being at bearish territory but aiming up.

Short-term buyers are in charge, but they must push the USD/JPY spot price above the Senkou Span A at 146.93 and clear the Kijun-Sen at 148.46 before they can clear the latest cycle high at 149.39, the August 15 daily high.

Conversely, a USD/JPY move below the Tenkan-Sen will expose the latest cycle low, seen at 143.44, the August 26 low. The pair could extend its losses past that level, and sellers could target August 5 through 141.69.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.