- Analytics

- News and Tools

- Market News

- USD/TRY climbs to all-time highs near 34.0000 post-CBRT

USD/TRY climbs to all-time highs near 34.0000 post-CBRT

- The Turkish currency sinks to record lows vs. the US Dollar.

- The CBRT left its One-Week Repo Rate unchanged at 50.00%.

- The central bank said it will maintain its restrictive stance.

The Turkish lira weakens further and sends USD/TRY to fresh all-time highs in levels shy of the 34.0000 barrier on Tuesday.

The CBRT kept rates unchanged, as expected

USD/TRY extended its uptrend for yet another session on Tuesday, marking its fifth daily gain in a row so far.

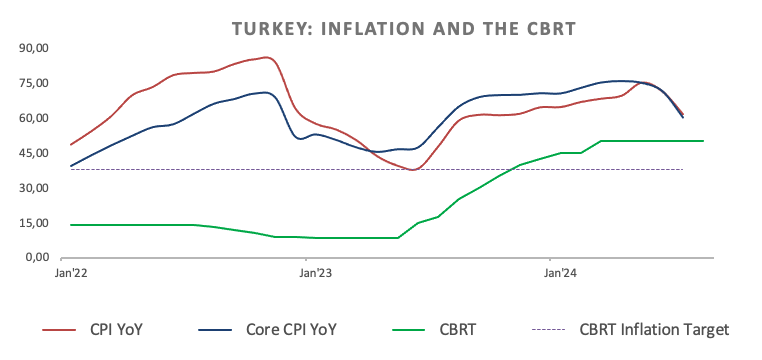

Extra losses in TRY accelerated after the Turkish central bank (CBRT) maintained its One-Week Repo Rate at 50.00% for the fifth month in a row at its meeting on Tuesday.

The bank indicated that the underlying trend of monthly inflation had edged up slightly in July but remained below its second-quarter average. It also reiterated its commitment to maintaining a tight monetary stance until it observes "a significant and sustained decline in the underlying trend of monthly inflation" and expectations align with the projected forecast range.

The statement also mentioned that the monetary policy stance would be tightened if a significant and persistent deterioration in inflation is anticipated.

It is worth mentioning that, since 2022, the pair only closed in negative territory in three months (November 2022, August 2023, and May 2024). During that period, the lira depreciated around 165% vs. the Greenback.

USD/TRY levels to watch

At the time of writing, USD/TRY is up by 0.49% to 33.8716 and faces the next barrier at the all-time peak of 33.8737 (August 20). On the downside, there is provisional support at the 55-day SMA of 32.9085, seconded by the weekly low of 32.7623 (July 26) and the July bottom of 32.4595 (July 3).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.