- Analytics

- News and Tools

- Market News

- USD/JPY Price Forecast: Climbs but stays below 147.50

USD/JPY Price Forecast: Climbs but stays below 147.50

- USD/JPY trades at 147.28, up 0.38%, still unable to clear 147.89 resistance.

- Bearish bias persists despite recovery from under 144.00 on dovish BoJ comments.

- A break above 148.00 targets 148.45 and 149.00; below 147.00 sees support at 145.44 and 144.28.

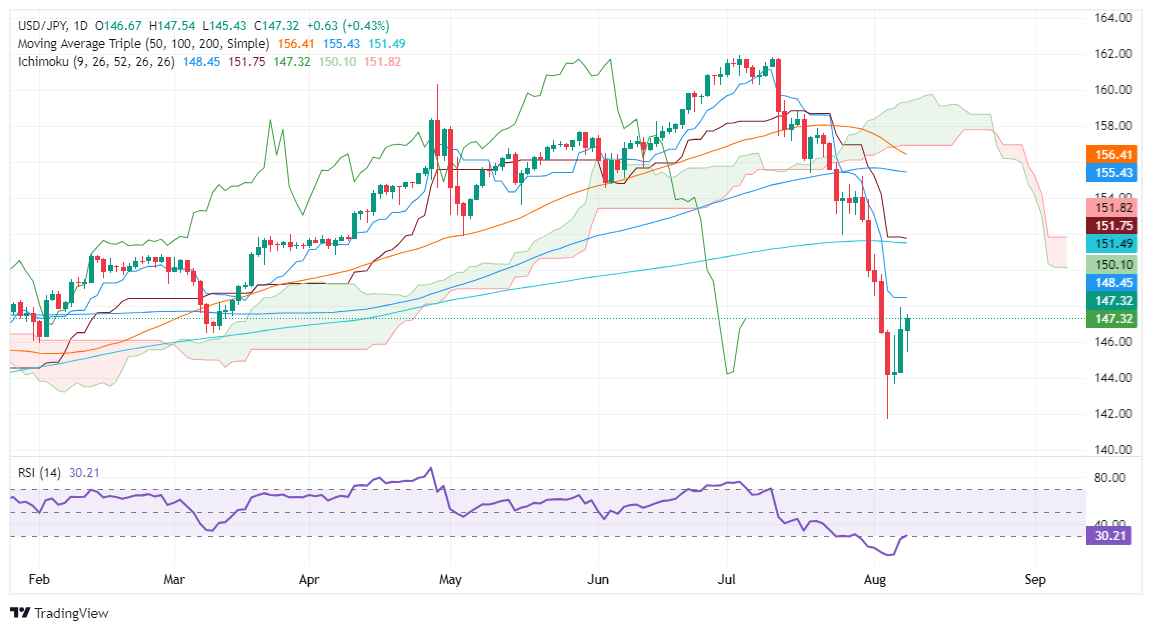

The USD/JPY rises for the third straight session. However, it remains within familiar levels, unable to decisively clear the August 7 daily high at 147.89, after solid US jobs data boosted the Greenback. At the time of writing, the pair trades at 147.28, up 0.38%

USD/JPY Price Forecast: Technical outlook

The USD/JPY is bearishly biased despite registering a recovery that saw the pair rally from under 144.00 to the current exchange rate after dovish comments by a Bank of Japan Deputy Governor.

Momentum remains bearish, even though the Relative Strength Index (RSI) exited from oversold territory, but its slope remains flat, hinting at a USD/JPY consolidation.

If the pair climbs past 148.00, the next resistance will be the Tenkan-Sen at 148.45. Prices could follow an upward path if they rise above 149.00, challenging the psychological 150.00 figure.

Conversely, and the path of least resistance, if USD/JPY drops below 147.00, the next support woud be the August 8 low of 145.44, followed by August 7 bottom at 144.28. Once those levels are surpassed, the next support would be the August 6 daily low at 143.61, followed by the latest cycle low of 141.69.

USD/JPY Price Action – Daily Chart

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.