- Analytics

- News and Tools

- Market News

- GBP/USD falls further as BoE looms ahead

GBP/USD falls further as BoE looms ahead

- GBP/USD slid below 1.2860 on Thursday as GBP softens.

- Markets see roughly-even odds of a BoE rate cut.

- Lopsided US data bolstered the Greenback slightly, adding to Cable losses.

GBP/USD floundered on Thursday, chalking in a third straight trading day in the red and declining below 1.2860 as market expectations of a Bank of England (BoE) rate cut next week weigh down the Pound Sterling.

Forex Today: Can US PCE confirm a rate cut in September?

US Gross Domestic Product (GDP) lurched higher in the second quarter, bringing annualized Q2 growth to 2.8%, well above the forecast 2.0% and piling onto the first quarter’s 1.4%. Markets initially recoiled from the firm upswing in growth figures, but a sharp contraction in US Durable Goods Orders helped keep hopes pinned for softening data to help push the Federal Reserve (Fed) toward a September rate cut.

US Personal Consumption Expenditures Price Index (PCE) inflation is in the barrel for Friday, and median market forecasts expect a downtick to 2.5% in core PCE inflation for the year ended in June compared to the previous period’s 2.6%.

A one-two punch of central bank action is on the books for next week, with the Fed’s July rate call slated for Wednesday and the BoE’s own rate decision on Thursday. The Fed is still broadly expected to keep rates pinned for one more meeting, but markets are seeing roughly even odds of a quarter-point rate cut from the BoE. Money markets see the BoE’s benchmark rate getting trimmed to 5.0% from 5.25%, and expectations of a widening of the GBP’s rate differential is putting downward pressure on the Pound Sterling.

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the New Zealand Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.05% | 0.44% | -0.02% | 0.14% | 0.69% | 0.74% | -0.47% | |

| EUR | 0.05% | 0.48% | 0.02% | 0.19% | 0.74% | 0.77% | -0.43% | |

| GBP | -0.44% | -0.48% | -0.45% | -0.30% | 0.27% | 0.29% | -0.91% | |

| JPY | 0.02% | -0.02% | 0.45% | 0.17% | 0.70% | 0.74% | -0.46% | |

| CAD | -0.14% | -0.19% | 0.30% | -0.17% | 0.55% | 0.59% | -0.62% | |

| AUD | -0.69% | -0.74% | -0.27% | -0.70% | -0.55% | 0.06% | -1.16% | |

| NZD | -0.74% | -0.77% | -0.29% | -0.74% | -0.59% | -0.06% | -1.21% | |

| CHF | 0.47% | 0.43% | 0.91% | 0.46% | 0.62% | 1.16% | 1.21% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

GBP/USD technical outlook

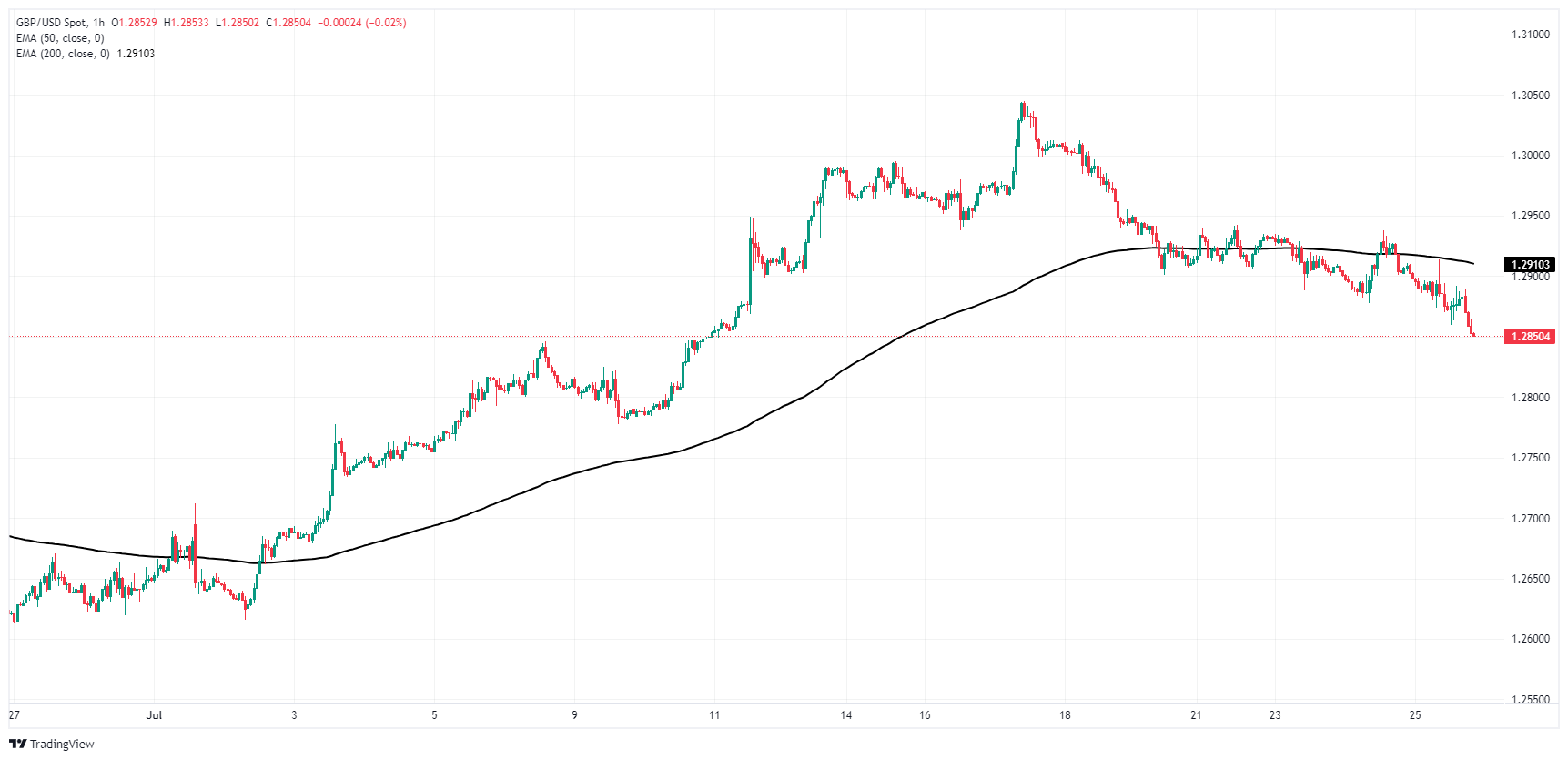

Cable has declined -1.5% and counting from last week’s 52-week peak near 1.3045, and the pair is on pace to close in the red for five of the last six straight trading days. Intraday trading has turned firmly bearish as GBP/USD drops away from the 200-hour Exponential Moving Average (EMA) at 1.2910.

Despite a near-term pullback, the Cable is still trading deep into bull country, holding chart territory well north of the 200-day EMA at 1.2638. However, a sustained pullback could see the pair fall into a deep rising trendline drawn from last October’s lows near 1.2040.

GBP/USD hourly chart

GBP/USD daily chart

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.