- Analytics

- News and Tools

- Market News

- Pound Sterling broadly steadies as traders turn focus towards US core PCE inflation

Pound Sterling broadly steadies as traders turn focus towards US core PCE inflation

- The Pound Sterling rises slightly against the US Dollar but the overall direction remains uncertain.

- Economists expect that the US core PCE inflation softened in May.

- The uncertainty over the UK elections outcome keeps the Pound Sterling on its toes.

The Pound Sterling (GBP) finds a cushion above the round-level support of 1.2600 against the US Dollar (USD) in Thursday’s London session. The GBP/USD pair gauges ground as the US Dollar registers a modest correction. The US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, edges down after posting a fresh eight-week high near 106.10.

However, the near-term outlook of the US Dollar remains firm as investors are expected to trade cautiously ahead of the United States (US) core Personal Consumption Expenditure price index (PCE) data for May, which will be published on Friday. Core PCE inflation, the Federal Reserve’s (Fed) preferred inflation measure, is estimated to grow at a slower pace of 0.1% against 0.2% in April month-on-month. Annually, the underlying inflation is projected to decelerate to 2.6% from 2.8% in April.

A scenario in which PCE inflation declines, as economists expect, would boost expectations for the Fed to begin reducing interest rates from September. According to the CME FedWatch tool, traders see a 62.3% that interest rates will be reduced from their current levels. The tool also shows that the Fed will cut interest rates twice this year. However, Fed policymakers signaled in their latest dot plot that there will be only on rate cut this year.

In Thursday’s session, investors will focus on the Initial Jobless Claims data for the week ending June 21, the revised Q1 Gross Domestic Product (GDP) estimates, and Durable Goods Orders data for May.

Daily digest market movers: Pound Sterling weakens against Asian peers

- The Pound Sterling gains against its European peers and the US Dollar but is exhibiting weakness against Asian currencies in Thursday’s European session. In Asia, the Japanese Yen (JPY) rises as fears of Japan’s intervention in the FX domain have intensified. Meanwhile, antipodean currencies are showing strength as investors expect that the Reserve Bank of Australia (RBA) and the Reserve Bank of New Zealand (RBNZ) will not pivot to policy normalization this year.

- The British currency is expected to face volatility as the United Kingdom (UK) parliamentary elections are held on July 4. According to polls, UK Prime Minister Rishi Sunak’s Conservative Party is expected to suffer a defeat from the opposition Labour Party.

- On the economic front, the deteriorating economic outlook due to the Bank of England's (BoE) higher interest rates and stubborn wage growth keep policymakers concerned. The preliminary S&P Global/CIPS Purchasing Managers’ Index (PMI) for June showed that business activity in the manufacturing sector expanded at a faster pace, while operations in the service sector unexpectedly slowed. Meanwhile, high wage growth continues to empower individuals with high purchasing power, making it more difficult for policymakers to kick-start the policy-easing cycle.

- Financial markets expect the BoE to start reducing interest rates from the August meeting. Meanwhile, investors will focus on the revised UK Q1 GDP estimates, which will be published on Friday.

Pound Sterling Price Today:

British Pound PRICE Today

The table below shows the percentage change of British Pound (GBP) against listed major currencies today. British Pound was the strongest against the US Dollar.

| GBP | USD | EUR | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| GBP | 0.16% | 0.03% | -0.02% | 0.06% | -0.11% | -0.01% | 0.11% | |

| USD | -0.16% | -0.13% | -0.21% | -0.11% | -0.30% | -0.19% | -0.05% | |

| EUR | -0.03% | 0.13% | -0.10% | 0.00% | -0.17% | -0.09% | 0.06% | |

| JPY | 0.02% | 0.21% | 0.10% | 0.12% | -0.08% | -0.00% | 0.17% | |

| CAD | -0.06% | 0.11% | -0.01% | -0.12% | -0.21% | -0.09% | 0.04% | |

| AUD | 0.11% | 0.30% | 0.17% | 0.08% | 0.21% | 0.11% | 0.22% | |

| NZD | 0.01% | 0.19% | 0.09% | 0.00% | 0.09% | -0.11% | 0.13% | |

| CHF | -0.11% | 0.05% | -0.06% | -0.17% | -0.04% | -0.22% | -0.13% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the British Pound from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent GBP (base)/USD (quote).

Technical Analysis: Pound Sterling finds temporary support near 1.2600

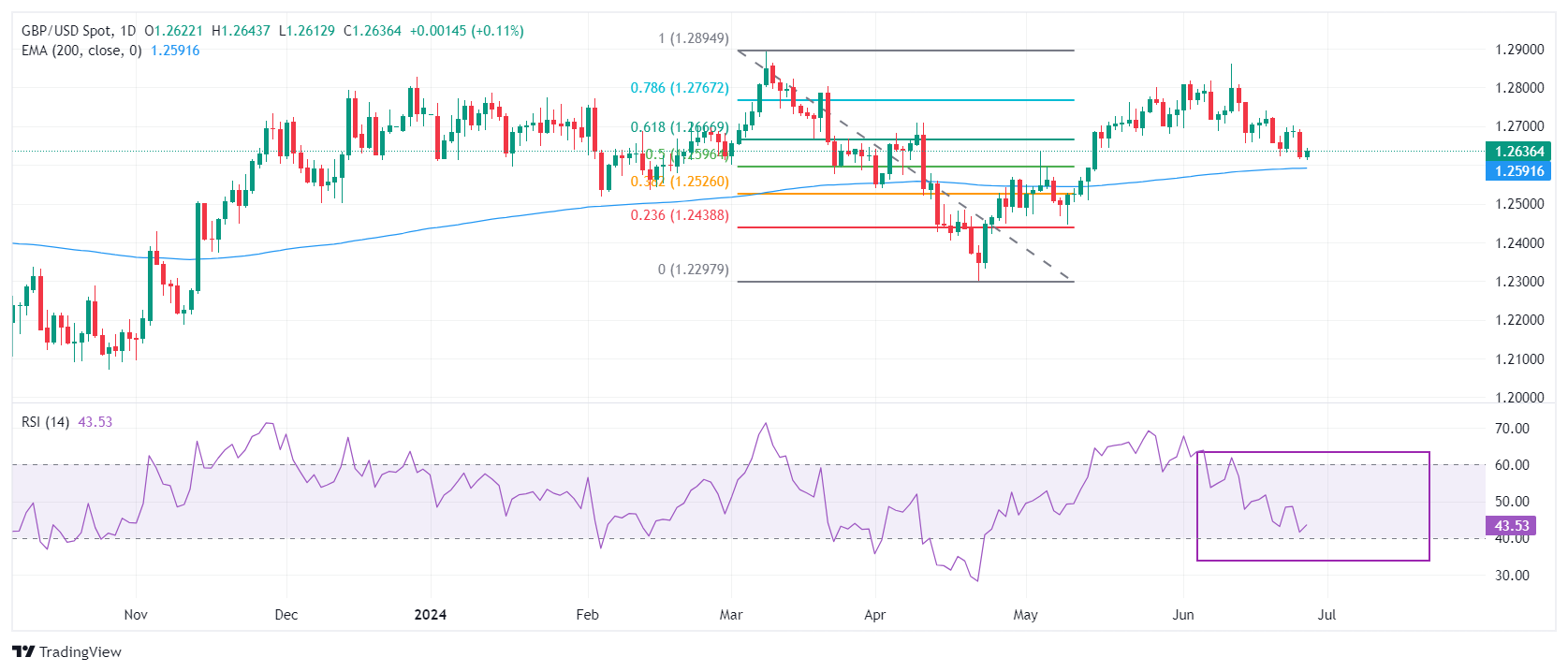

The Pound Sterling finds interim support near 1.2600 against the US Dollar. The GBP/USD pair has come under pressure after breaking below the crucial support of 1.2700. The Cable declines toward the 200-day Exponential Moving Average (EMA), which trades around 1.2590.

The Cable has dropped below the 61.8% Fibonacci retracement support at 1.2667, plotted from the March 8 high of 1.2900 to the April 22 low at 1.2300.

The 14-day Relative Strength Index (RSI) oscillates inside the 40.00-60.00 range, indicating consolidation ahead.

Pound Sterling FAQs

The Pound Sterling (GBP) is the oldest currency in the world (886 AD) and the official currency of the United Kingdom. It is the fourth most traded unit for foreign exchange (FX) in the world, accounting for 12% of all transactions, averaging $630 billion a day, according to 2022 data. Its key trading pairs are GBP/USD, aka ‘Cable’, which accounts for 11% of FX, GBP/JPY, or the ‘Dragon’ as it is known by traders (3%), and EUR/GBP (2%). The Pound Sterling is issued by the Bank of England (BoE).

The single most important factor influencing the value of the Pound Sterling is monetary policy decided by the Bank of England. The BoE bases its decisions on whether it has achieved its primary goal of “price stability” – a steady inflation rate of around 2%. Its primary tool for achieving this is the adjustment of interest rates. When inflation is too high, the BoE will try to rein it in by raising interest rates, making it more expensive for people and businesses to access credit. This is generally positive for GBP, as higher interest rates make the UK a more attractive place for global investors to park their money. When inflation falls too low it is a sign economic growth is slowing. In this scenario, the BoE will consider lowering interest rates to cheapen credit so businesses will borrow more to invest in growth-generating projects.

Data releases gauge the health of the economy and can impact the value of the Pound Sterling. Indicators such as GDP, Manufacturing and Services PMIs, and employment can all influence the direction of the GBP. A strong economy is good for Sterling. Not only does it attract more foreign investment but it may encourage the BoE to put up interest rates, which will directly strengthen GBP. Otherwise, if economic data is weak, the Pound Sterling is likely to fall.

Another significant data release for the Pound Sterling is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought-after exports, its currency will benefit purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.