- Analytics

- News and Tools

- Market News

- Canada Interest Rate Decision Preview: BoC set to cut interest rates after six on-hold meetings

Canada Interest Rate Decision Preview: BoC set to cut interest rates after six on-hold meetings

- The Bank of Canada (BoC) is anticipated to cut its policy rate by 25 bps.

- The Canadian Dollar maintains its consolidative phase vs. the US Dollar.

- Inflation in Canada has accelerated its downtrend since December.

- Money markets see around 21 bps of easing at the June meeting.

There is universal anticipation that the Bank of Canada (BoC) will reduce its policy rate by 25 bps at its upcoming gathering on Wednesday, June 5. It will be the first rate cut after six consecutive meetings of keeping rates unchanged at 5.00%.

Since the start of the year, the Canadian Dollar (CAD) has been gradually depreciating against its US counterpart (USD), though it has mostly been in a broader consolidation phase for the last couple of months.

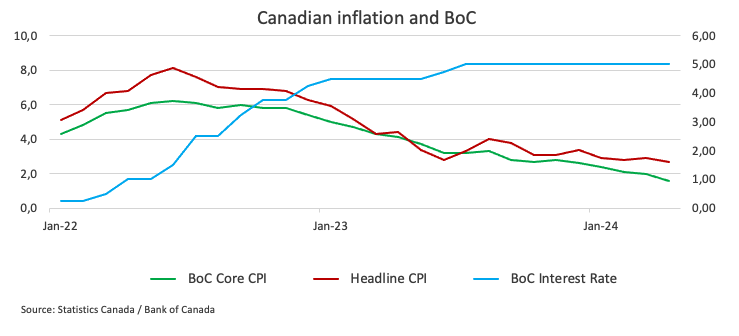

In April, annual domestic inflation tracked by the headline Consumer Price Index (CPI) showed another downtick, while the BoC's Core CPI dropped below the 2.0% threshold (1.6% YoY).

The reasoning behind the potential rate cut by the central bank may be found in the persistent decline in consumer prices, while further cooling of the Canadian labour market is also expected to contribute to the decision to reduce rates.

Inflation has been below 3% since January, in keeping with the central bank's prediction for the first half of 2024, with carefully watched core consumer price indicators also falling steadily.

It is also expected that the BoC maintain its data dependency when it comes to future moves on rates. So far, money markets see around 30 bps of easing in July and nearly 42 bps in September. The BoC is expected to keep a cautious approach, it may also show some flexibility given the ongoing decline in domestic inflation.

A hawkish cut?

Despite the expected rate cut, the overall tone from the central bank could lean towards the cautious side, highlighting the current data-dependent stance while keeping a close eye on inflation developments.

In fact, BoC’s Governor Tiff Macklem told the House of Commons finance committee early in May that there is a limit to how much US and Canadian interest rates can diverge, but he emphasized that they are certainly not near that limit.

Furthermore, in his testimony to the Senate banking committee on May 1, Macklem mentioned that inflation was decreasing and acknowledged that Canadians were eager to know when the central bank would begin cutting interest rates. He stated that "the short answer is that we are getting closer."

When will the BoC release its monetary policy decision, and how could it affect USD/CAD?

The Bank of Canada will announce its policy decision at 13:45 GMT on Wednesday, June 5, followed by Governor Macklem’s press conference at 14:30 GMT.

Eliminating any potential surprises, the impact on the Canadian currency is expected to come mainly from the message of the bank rather than the move on the interest rate per se. Taking a conservative approach may result in more support for CAD and a subsequent dip in USD/CAD. If the bank indicates that it intends to decrease interest rates further, the Canadian Dollar may see a significant drop in the near future.

According to Pablo Piovano, Senior Analyst at FXStreet.com, "the gradual uptrend in USD/CAD that has been in place since the beginning of the year appears to be reinforced by the recent surpass of the key 200-day SMA (1.3506)." However, this trend has so far encountered significant resistance around the year-to-date highs at 1.3650. A sustained break above this zone might drive the pair to go for the November 2023 high of 1.3898 (November 1).

Pablo adds: "If sellers get the upper hand, the 200-day SMA should provide excellent support until the March low of 1.3419 (March 8). Extra weakening from here might lead to a move below the weekly low of 1.3358 (January 31)."

Economic Indicator

BoC Interest Rate Decision

The Bank of Canada (BoC) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoC believes inflation will be above target (hawkish), it will raise interest rates in order to bring it down. This is bullish for the CAD since higher interest rates attract greater inflows of foreign capital. Likewise, if the BoC sees inflation falling below target (dovish) it will lower interest rates in order to give the Canadian economy a boost in the hope inflation will rise back up. This is bearish for CAD since it detracts from foreign capital flowing into the country.

Read more.Next release: Wed Jun 05, 2024 13:45

Frequency: Irregular

Consensus: 4.75%

Previous: 5%

Source: Bank of Canada

Bank of Canada FAQs

The Bank of Canada (BoC), based in Ottawa, is the institution that sets interest rates and manages monetary policy for Canada. It does so at eight scheduled meetings a year and ad hoc emergency meetings that are held as required. The BoC primary mandate is to maintain price stability, which means keeping inflation at between 1-3%. Its main tool for achieving this is by raising or lowering interest rates. Relatively high interest rates will usually result in a stronger Canadian Dollar (CAD) and vice versa. Other tools used include quantitative easing and tightening.

In extreme situations, the Bank of Canada can enact a policy tool called Quantitative Easing. QE is the process by which the BoC prints Canadian Dollars for the purpose of buying assets – usually government or corporate bonds – from financial institutions. QE usually results in a weaker CAD. QE is a last resort when simply lowering interest rates is unlikely to achieve the objective of price stability. The Bank of Canada used the measure during the Great Financial Crisis of 2009-11 when credit froze after banks lost faith in each other’s ability to repay debts.

Quantitative tightening (QT) is the reverse of QE. It is undertaken after QE when an economic recovery is underway and inflation starts rising. Whilst in QE the Bank of Canada purchases government and corporate bonds from financial institutions to provide them with liquidity, in QT the BoC stops buying more assets, and stops reinvesting the principal maturing on the bonds it already holds. It is usually positive (or bullish) for the Canadian Dollar.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.