- Analytics

- News and Tools

- Market News

- EUR/USD dips below 1.0750 on strong US ISM PMI reading

EUR/USD dips below 1.0750 on strong US ISM PMI reading

- EUR/USD declines following upbeat US Manufacturing PMI and Prices Paid Index, hinting the Fed might refrain from easing policy.

- The rise in the US Dollar Index and Treasury yields reflects growing confidence in the US economic outlook.

- Upcoming Eurozone manufacturing PMIs could push the EUR/USD further down, with estimates expected to contract further.

The Euro extends its losses against the US Dollar, with most European markets being closed in observance of Easter Monday. Data from the United States sponsored a leg down in the EUR/USD, which tumbled more than 0.40% and traded at 1.0742.

Strong US ISM Manufacturing PMI and a jump in prices paid, to keep Fed on hold

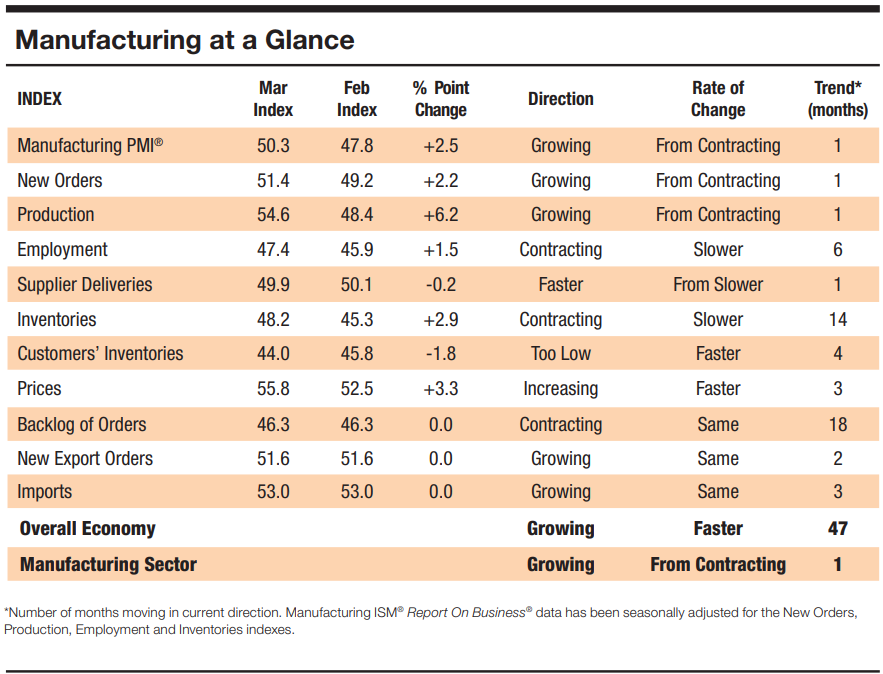

The Institute for Supply Management (ISM) revealed that business activity in March expanded for the first time since September 2022, an indication that the economy remains solid. The Manufacturing PMI came at 50.3, exceeding estimates of 48.4 and smashing February’s 47.8 reading. The same report revealed that the Prices Paid Index expanded to 55.8, its highest level since August 2022, when it hit 52.5. This could deter the Federal Reserve from easing policy, as the economy fares better than expected.

At around 13:45 GMT, S&P Global revealed the latest revision of March’s Manufacturing PMI for the United States, coming at 51.9, below the previous reading of 52.2.

Following the data, the EUR/USD has extended its losses past the psychological 1.0750 figure, which could exacerbate a test of the February 14 swing low of 1.0694.

In the meantime, the US Dollar Index (DXY), which measures the buck’s performance against a basket of peers rally 0.36%, is up at 105.93, while US Treasury yields rise. The 10-year benchmark note rate is at 4.305%, up almost ten basis points.

Following the data release, money market traders see a 61% chance of the Fed cutting rates by 25 basis points, as depicted via the CME FedWatch Tool.

Across the pond, the Eurozone (EU) economic docket will feature the release of the HCOB manufacturing PMI for Spain, Italy, France, Germany, and the whole bloc. Most readings, except for Spain, are expected to deteriorate further and remain in recessionary territory.

EUR/USD Price Analysis: Technical outlook

The EUR/USD daily chart portrays the pair as aiming toward the 1.0700 figure, ahead of challenging 1.0694, February’s 14 low. A breach of the latter will expose the November 10 low intermediate support level at 1.0656, followed by major support at 1.0516, the November 1 swing low. On the other hand, if buyers reclaim 1.0750, look for an upside correction toward 1.0800.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.