- Analytics

- News and Tools

- Market News

- BoE Interest Rate Decision Preview: Dovish hold is on the cards as inflation cools more than expected

BoE Interest Rate Decision Preview: Dovish hold is on the cards as inflation cools more than expected

- The UK central bank is expected to keep its policy rate unchanged at 5.25%.

- The Bank of England is seen reducing its rates earlier than estimated after softer-than-expected inflation data.

- GBP/USD will closely follow the BoE’s decision as well as the Minutes.

The Bank of England (BoE) is set to hold its policy rate for a fifth meeting in a row on Thursday amidst some recent pick-up in speculation over interest rate cuts by the central bank.

Bank of England predicted keeping the “wait-and-see” mode

The Bank of England is expected to leave the benchmark interest rate unchanged at 5.25% following its policy meeting on Thursday at 12:00 GMT. The bank’s decision on the policy rate will come in tandem with the release of the Monetary Policy Minutes.

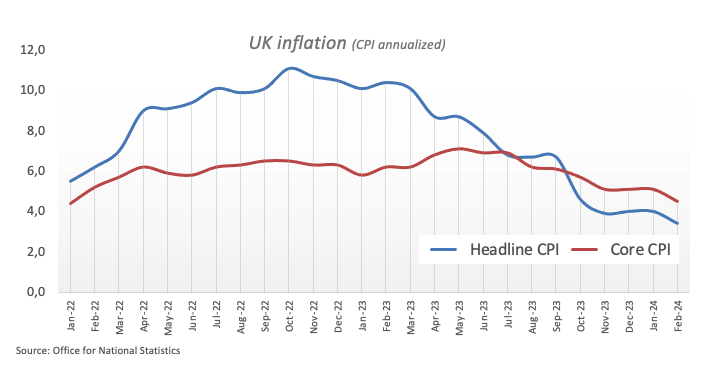

While market participants originally expected the BoE to lag both the Federal Reserve (Fed) and the European Central Bank (ECB) in kick-starting their easing cycles, the persistent disinflationary pressures not only accelerated in the UK in February, but also seem to have now underpinned the view of an earlier commencement of the interest rate reductions.

Speaking about inflation, the headline Consumer Price Index (CPI) in the UK rose by 3.4% in the year to February and 4.5% when it came to the Core CPI, that is, excluding food and energy costs.

In fact, these latest UK inflation figures appear to put to the test the insofar “higher for longer” narrative by the BoE. Looking at the upcoming event, a decision to maintain rates unchanged is anticipated to be a done deal, while the central bank is also expected to extend its “wait-and-see” stance and probably drop some cautious tone regarding its inflation outlook.

Still around inflation, the latest BoE’s Decision Maker Panel survey (DMP) indicated that businesses anticipate a decrease in their output price inflation over the upcoming year. Furthermore, one-year ahead CPI inflation expectations declined to 3.3% in February, down from 3.4% in January, while the expected year-ahead wage growth remained steady at 5.2%. In addition, three-year ahead CPI inflation expectations dropped to 2.8% from 2.9%.

BoE’s Governor Andrew Bailey emphasized on March 12 that the pivotal issue revolves around the restrictiveness of policy, adding that the central question is the duration for which this restrictive stance needs to be maintained. He expressed satisfaction with the effectiveness of monetary policy, noting that inflation expectations seem firmly anchored. Additionally, Bailey noted that there has been minimal evidence indicating a rise in unemployment as a prerequisite for inflation reduction, while concerns regarding the entrenchment of second-round effects have diminished.

Ahead of the BoE gathering, analysts at TD Securities said, “We expect the MPC to hold its Bank Rate at 5.25% and leave key guidance largely unchanged, with a wait-and-see message. There's scope to soften the language around underlying inflation, but little else should change”.

How will the BoE interest rate decision impact the GBP/USD?

In light of the latest inflation figures, the probability of a hawkish hold by the central bank now looks markedly dwindled. That said, an outcome in line with market expectations should leave the Pound Sterling (GBP) trading within its familiar ranges, or even spark some fresh bouts of weakness in the very near future.

In that case, GBP/USD could decisively break below the key 200-day SMA at 1.2592, allowing for extra selling pressure to kick in. “Further losses could see Cable revisit the 2024 low of 1.2518 recorded on February 5," notes FXStreet Senior Analyst Pablo Piovano. Pablo adds that “a sustained breach of the latter is not contemplated for the time being, as it would involve a bigger deterioration of the currency’s outlook.”

On the upside, Pablo points at “the initial resistance at the YTD peak of 1.2893 (March 8). The surpassing of this level could prompt GBP/USD to embark on a move to, initially, the psychological 1.3000 yardstick.”

Economic Indicator

United Kingdom BoE Interest Rate Decision

The Bank of England (BoE) announces its interest rate decision at the end of its eight scheduled meetings per year. If the BoE is hawkish about the inflationary outlook of the economy and raises interest rates it is usually bullish for the Pound Sterling (GBP). Likewise, if the BoE adopts a dovish view on the UK economy and keeps interest rates unchanged, or cuts them, it is seen as bearish for GBP.

Read more.Pound Sterling price today

The table below shows the percentage change of Pound Sterling (GBP) against listed major currencies today. Pound Sterling was the weakest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.11% | 0.07% | -0.03% | -0.06% | 0.40% | 0.21% | 0.31% | |

| EUR | -0.11% | -0.03% | -0.13% | -0.14% | 0.30% | 0.11% | 0.21% | |

| GBP | -0.07% | 0.03% | -0.11% | -0.12% | 0.32% | 0.13% | 0.25% | |

| CAD | 0.03% | 0.14% | 0.14% | -0.02% | 0.43% | 0.25% | 0.35% | |

| AUD | 0.04% | 0.15% | 0.13% | 0.01% | 0.44% | 0.26% | 0.35% | |

| JPY | -0.40% | -0.29% | -0.33% | -0.44% | -0.42% | -0.19% | -0.09% | |

| NZD | -0.22% | -0.11% | -0.14% | -0.25% | -0.27% | 0.18% | 0.10% | |

| CHF | -0.33% | -0.20% | -0.24% | -0.36% | -0.38% | 0.07% | -0.08% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.