- Analytics

- News and Tools

- Market News

- Canada CPI Preview: Inflation expected to rebound slightly to 3.1% in February

Canada CPI Preview: Inflation expected to rebound slightly to 3.1% in February

- The Canadian Consumer Price Index is expected to have risen by 3.1% YoY in February.

- The BoC shows no rush to lower its interest rate.

- The Canadian Dollar maintains its multi-day lows against the US Dollar around 1.3540.

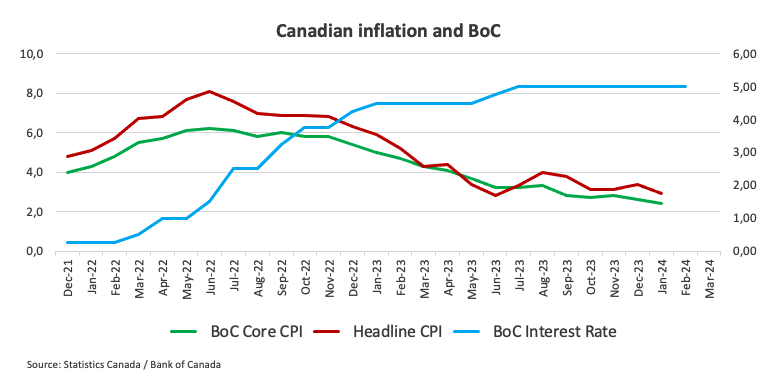

Canada is slated to unveil the always-relevant inflation-related figures on Tuesday. Statistics Canada will release the Consumer Price Index (CPI) for the month of February, with expectations pointing towards a year-on-year rise of 3.1% in the headline print, slightly surpassing January’s 2.9% increase. Monthly projections anticipate a 0.6% increase in the index compared to the previous month's flat reading.

Alongside the CPI data, the Bank of Canada (BoC) will release its Core Consumer Price Index gauge, which excludes volatile elements like food and energy costs. In January, the BoC Core CPI indicated a monthly uptick of 0.1% and a year-on-year rise of 2.4%.

These statistics will be closely monitored as they could influence the trajectory of the Canadian Dollar (CAD) and shape outlooks regarding the Bank of Canada's monetary policy. Speaking about the Canadian Dollar (CAD), it has shown weakness against the US Dollar (USD) in past sessions and presently hovers around multi-session lows well past the 1.3500 yardstick.

What to expect from Canada’s inflation rate?

Analysts expect a pick-up of price pressures throughout Canada during last month. In fact, inflation measured by annual changes in the Consumer Price Index, is forecast to resume its upward trajectory in February, mirroring trends observed in many of Canada's G10 counterparts, notably its neighbour, the US. After reaching 4% in August, the CPI has shown a downward trend, with the exception of the bounce recorded in the last month of the year. All in all, inflation indicators still remain well above the Bank of Canada's 2% target.

Should the forthcoming data confirm the anticipated increase in inflationary pressures, investors might consider the possibility of the central bank keeping the current restrictive stance in place for a longer duration than originally predicted. Still, any additional tightening of monetary conditions seems unlikely, as per comments from the bank’s officials.

The latter situation would necessitate a sudden and sustained resurgence of price pressures and a rapid increase in consumer demand, both of which seem improbable in the foreseeable future.

During his remarks at the latest BoC meeting, Governor Tiff Macklem expressed optimism about the ongoing battle against inflation, noting current progress and anticipating further advancements. He highlighted the significance of core inflation measures, suggesting that if they remain unchanged, the forecasts for overall inflation reduction may not come to fruition. He assessed the risks to the inflation outlook as reasonably balanced and noted that well-anchored inflation expectations are aiding efforts to bring inflation back under control.

When is the Canada CPI data due and how could it affect USD/CAD?

On Tuesday at 12:30 GMT, Canada is set to release the Consumer Price Index for February. The Canadian Dollar's potential response is tied to changes in monetary policy expectations by the Bank of Canada. However, barring any real surprise in either direction, the BoC is unlikely to change its current cautious monetary policy stance, in line with other central banks such as the Federal Reserve (Fed).

The USD/CAD has started the new trading year in quite a bullish fashion, although the uptrend appears to have met a decent barrier around the 1.3600 zone.

Pablo Piovano, Senior Analyst at FXStreet, says: “There is a strong likelihood of USD/CAD maintaining the constructive bias as long as it remains above the significant 200-day Simple Moving Average (SMA) at 1.3479. The bullish sentiment is expected to strengthen even more if there is a sustained break above the so-far yearly tops around 1.3600. On the flip side, the breach of the 200-day SMA could open the door to extra losses and a potential move to the January low of 1.3358 (January 31). South from here, there are no support levels of note prior to the December 2023 bottom of 1.3177, which occurred on December 27”.

Pablo adds: "Significant increases in volatility around CAD would require unexpected inflation figures. If the numbers fall below expectations, it could strengthen the argument for potential interest rate cuts by the BoC in the next few months, further appreciating USD/CAD. However, a rebound in the CPI, similar to trends observed in the US, might provide some support to the Canadian Dollar, although to a limited extent. A higher-than-anticipated inflation reading would intensify pressure on the Bank of Canada to maintain elevated rates for an extended period, potentially resulting in prolonged challenges for many Canadians dealing with higher interest rates, as highlighted by Bank of Canada Governor Macklem."

Economic Indicator

Canada Consumer Price Index (MoM)

The Consumer Price Index (CPI), released by Statistics Canada on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. The MoM figure compares the prices of goods in the reference month to the previous month. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Canadian Dollar price in the last 7 days

The table below shows the percentage change of Canadian Dollar (CAD) against listed major currencies in the last 7 days. Canadian Dollar was the weakest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.48% | 0.96% | 0.44% | 0.93% | 1.69% | 1.46% | 0.86% | |

| EUR | -0.50% | 0.46% | -0.06% | 0.43% | 1.20% | 0.98% | 0.37% | |

| GBP | -0.97% | -0.48% | -0.53% | -0.03% | 0.74% | 0.52% | -0.09% | |

| CAD | -0.44% | 0.07% | 0.52% | 0.48% | 1.22% | 1.03% | 0.39% | |

| AUD | -0.94% | -0.45% | 0.03% | -0.50% | 0.77% | 0.55% | -0.06% | |

| JPY | -1.69% | -1.22% | -0.49% | -1.27% | -0.76% | -0.21% | -0.83% | |

| NZD | -1.48% | -0.99% | -0.52% | -1.05% | -0.54% | 0.22% | -0.61% | |

| CHF | -0.89% | -0.40% | 0.08% | -0.43% | 0.05% | 0.81% | 0.59% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.