- Analytics

- News and Tools

- Market News

- AUD/USD extends downside after negative Chinese data

AUD/USD extends downside after negative Chinese data

- The Australian Dollar is hit by negative Chinese House Price data on Friday.

- A fall in Chinese New Loans and M2 Money Supply add to the narrative of constraint.

- AUD/USD tumbled on Thursday after US data showed inflationary tendencies in the US economy.

AUD/USD is trading almost two tenths of a percent lower on Friday, extending Thursday’s sell-off into the weekend. The pair is feeling pressure from negative Chinese housing and lending data which indicates the property sector of the world’s second largest economy is still in the eye of the storm.

The weak Chinese data is a negative factor for the Australian Dollar which relies heavily on the Chinese market for its exports, particularly Iron Ore, which is Australia’s largest export commodity.

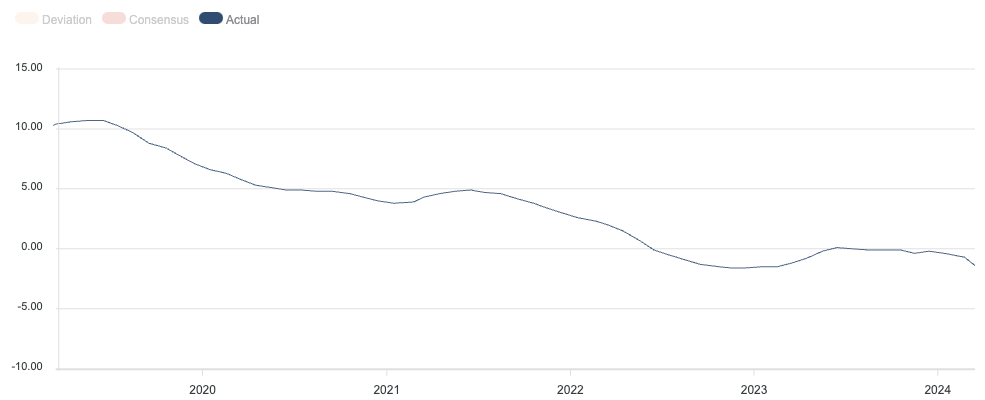

The Chinese House Price Index showed a decline in house prices of minus 1.4% in February from minus 0.7% in the previous month of January, according to data from the National Bureau of Statistics of China, released early Friday. This continues the down trend in Chinese house prices since 2019.

Chinese property market woes have had a direct impact on Iron Ore prices, because the country uses so much of the ore to make the steel girders it uses in its buildings. Iron Ore prices have registered a roughly 25% drop since the start of 2024 alone.

Other data out on Friday showed an unexpected fall in New Loans in China, in February. New Loans shrank to ㍐1,450 billion, according to data from The People’s Bank of China (Pboc). This was a decline from the 4,920 billion Yuan in January and below estimates of 1,500 billion. The data indicates less lending, which could be growth limiting, especially for the borrowing intensive property sector.

Data showing lower-than-expected Money Supply M2, which increased by 8.7% YoY in February versus the 8.8% forecast, suggests a brake on liquidity.

US factory gate inflation rises

AUD/USD fell over half a percent on Thursday after the release of US macroeconomic data indicated the US economy was hotter-than-expected.

The US Producer Price Index, which measures factory-gate price inflation, rose to 1.6%, easily beating the 1.1% expected and 1.0% previous, suggesting continued inflationary tendencies.

Core PPI also rose by more than estimated. The data suggests the inflation will be passed on to consumers and turn up later to bug shoppers in the Consumer Price Index.

The higher inflation makes it less likely the Federal Reserve (Fed) will be in a hurry to cut interest rates. Whilst market expectations continue to see the probabilities favor a rate cut in June, the chance of a reduction in May has dwindled to virtually zero.

Higher interest rates for longer are positive for USD because they attract more foreign capital inflows. They are negative for the AUD/USD which measures the number of Australian Dollars purchasable with one US Dollar. As such the data was negative for the pair, which declined substantially after the release on Thursday.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.

-638461042762640597.png)