- Analytics

- News and Tools

- Market News

- Dow Jones Industrial Average Forecast: DJIA softly up on Monday, buoyed by 38,500.00

Dow Jones Industrial Average Forecast: DJIA softly up on Monday, buoyed by 38,500.00

- The Dow Jones is the best of the indexes on Monday.

- S&P 500, NASDAQ slightly in the red as Dow Jones holds steady.

- Markets gear up for US CPI inflation on Tuesday.

The Dow Jones Industrial Average (DJIA) is up on thin margins for Monday, trading on the high side of 38,500.00 as its counterpart indexes are slightly softer on the day. Investors are buckling down for Tuesday’s US Consumer Price Index (CPI) inflation print, and investors will be looking for easing price growth to signal the approach of rate cuts from the US Federal Reserve (Fed).

Dow Jones News: Markets spread as investors await the next iteration of US CPI inflation

The Materials and Energy Sectors are Monday’s top performers halfway through the day’s trading session, up 1.1% and 0.56% respectively. On the low side, Industrials and Real Estate are both i nthe red about six tenths of a percent on Monday.

The DJIA’s top performers are UnitedHealth Group Inc. (UNH) and Nike Inc. (NKE), neck-and-neck at 2.5% apiece, closely followed by Walt Disney Co. (DIS), up 2% on Monday. The Dow Jones’ worst performer is Boeing Co. (BA), shedding 3.3%,

Boeing, beleaguered by multiple crashes and investigations in recent years, is once again slated to be the subject of a DOJ criminal investigation after a mishap with an Alaska Airlines flight could have been catastrophic. Boeing was forced to admit they could not find a maintenance record for the plane following the blowout that saw a panel fall off the plane mid-flight.

US CPI inflation in the crosshairs

Tuesday brings US inflation figures, and investors will be looking for signs that US price growth is cooling enough to push the Fed closer to making rate cuts. According to the CME’s FedWatch Tool, rate markets are pricing in nearly 70% odds of a first rate cut from the Fed at the June policy meeting.

US CPI Preview: Forecasts from 10 major banks, inflation still too high

February’s MoM US CPI is expected to tick upwards to 0.4% from 0.3% as lopsided inflation continues to weigh on the Fed’s rate cut outlook. Core MoM CPI is forecast to tick down to 0.3% from the previous 0.4%. YoY CPI is expected to hold steady at 3.1% with Core annualized CPI forecast to print at 3.7%, down slightly from 3.9%.

Dow Jones technical outlook

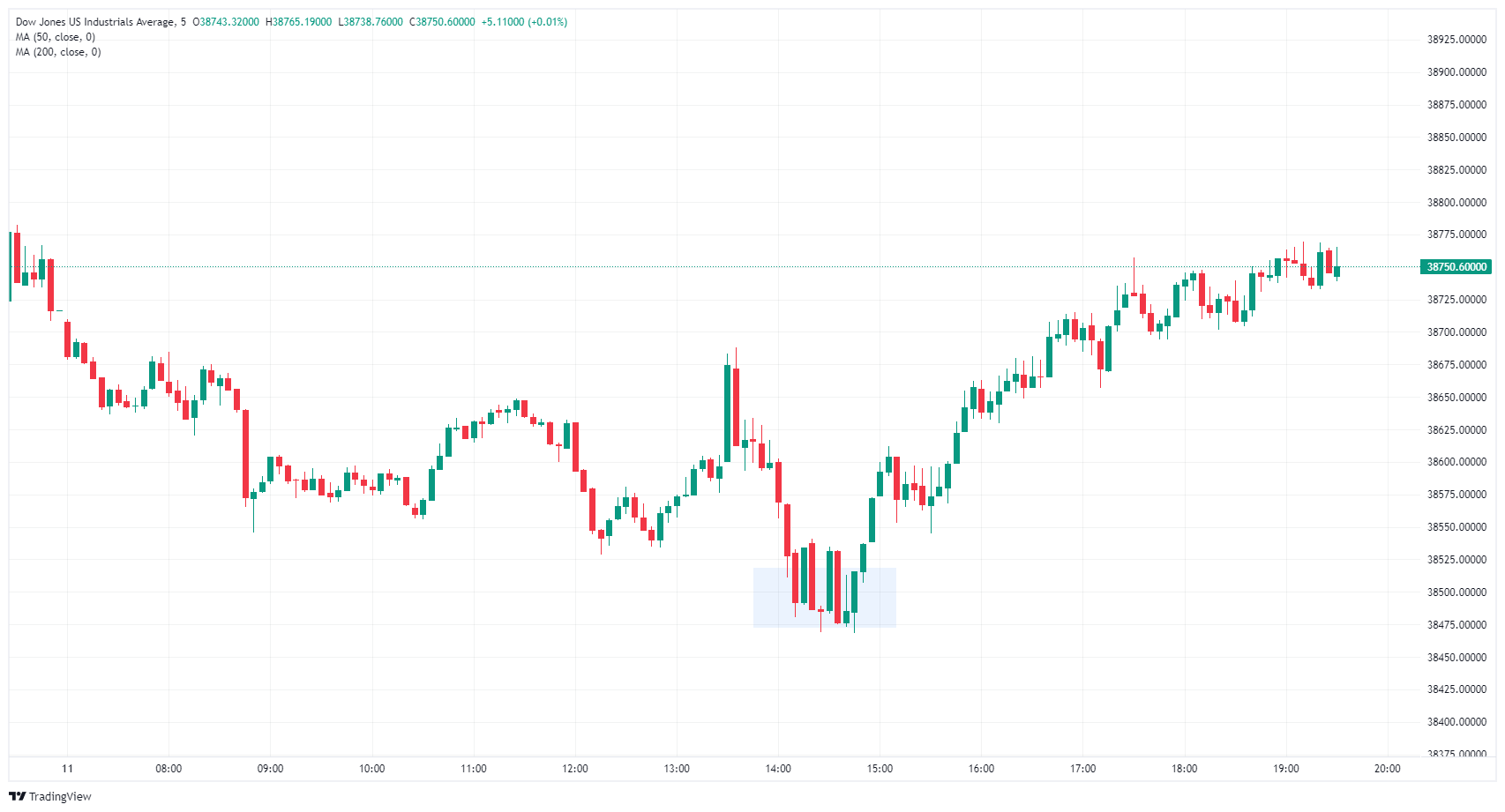

The Dow Jones Industrial Average (DJIA) grinds higher on Monday, climbing into 38,775.00 after bottoming out near 38,475.00 early in the day. The Dow Jones remains on the low side of last week’s peaks near 38,960.00.

The DJIA remains down from all-time peaks above 39,200.00 set in February, but a near-term floor sees the index trading north of the 50-day Simple Moving Average (SMA) at 38,295.00. The DJIA has outrun the 50-day and 200-day SMAs since crossing into bull country back in November.

Dow Jones chart, 5-minute

Dow Jones FAQs

The Dow Jones Industrial Average, one of the oldest stock market indices in the world, is compiled of the 30 most traded stocks in the US. The index is price-weighted rather than weighted by capitalization. It is calculated by summing the prices of the constituent stocks and dividing them by a factor, currently 0.152. The index was founded by Charles Dow, who also founded the Wall Street Journal. In later years it has been criticized for not being broadly representative enough because it only tracks 30 conglomerates, unlike broader indices such as the S&P 500.

Many different factors drive the Dow Jones Industrial Average (DJIA). The aggregate performance of the component companies revealed in quarterly company earnings reports is the main one. US and global macroeconomic data also contributes as it impacts on investor sentiment. The level of interest rates, set by the Federal Reserve (Fed), also influences the DJIA as it affects the cost of credit, on which many corporations are heavily reliant. Therefore, inflation can be a major driver as well as other metrics which impact the Fed decisions.

Dow Theory is a method for identifying the primary trend of the stock market developed by Charles Dow. A key step is to compare the direction of the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA) and only follow trends where both are moving in the same direction. Volume is a confirmatory criteria. The theory uses elements of peak and trough analysis. Dow’s theory posits three trend phases: accumulation, when smart money starts buying or selling; public participation, when the wider public joins in; and distribution, when the smart money exits.

There are a number of ways to trade the DJIA. One is to use ETFs which allow investors to trade the DJIA as a single security, rather than having to buy shares in all 30 constituent companies. A leading example is the SPDR Dow Jones Industrial Average ETF (DIA). DJIA futures contracts enable traders to speculate on the future value of the index and Options provide the right, but not the obligation, to buy or sell the index at a predetermined price in the future. Mutual funds enable investors to buy a share of a diversified portfolio of DJIA stocks thus providing exposure to the overall index.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.