- Analytics

- News and Tools

- Market News

- EUR/JPY slides amid BoJ policy shift, mixed global data

EUR/JPY slides amid BoJ policy shift, mixed global data

- EUR/JPY retreats, influenced by potential changes in BoJ's monetary policy and wage negotiation outcomes.

- Japan's GDP outperforms expectations, stoking anticipations for a BoJ rate adjustment in the near future.

- ECB's hawkish tone tempers immediate easing expectations, with policy shifts eyed for June amidst inflation concerns.

The Euro registered losses against the Japanese Yen in the morning of the North American session. It was down 0.13% and traded at 160.55 after hitting a daily high below the 161.00 mark. Rumors that the Bank of Japan (BoJ) could end negative rates sponsored a neg-down in the EUR/JPY pair.

Euro dips against Yen on growing speculations over BoJ rate hikes

According to sources cited by Reuters, some BoJ policymakers are considering ending the negative rate. Officials are eyeing wage negotiations between big companies and unions on March 13. A significant increase in salaries could increase the odds of a rate hike by the BoJ as soon as the March 18-19 meeting.

Data-wise, the Gross Domestic Product (GDP) in Japan for the last quarter of 2023 indicated the economy dodged a recession, coming at 0.1% QoQ, exceeding estimates and the prior’s reading at -0.1%. Annually based, GDP was 0.4%, less than expected, above the previous estimate of -0.4%.

In the Euro area (EU), the European Central Bank (ECB) held rates unchanged at last Thursday's meeting, though ECB President Christine Lagarde opened the door to easing policy in June. Initially, the EUR/JPY paired its losses, but it resumed its downtrend last Friday and carried onto Monday’s session.

During the European session, ECB’s Kazimir delivered hawkish remarks, pushing the first rate cut until June. He acknowledged that risks of inflation are “alive and kicking.” He added that discussions should already start and favor a “smooth and steady” cycle of policy easing.

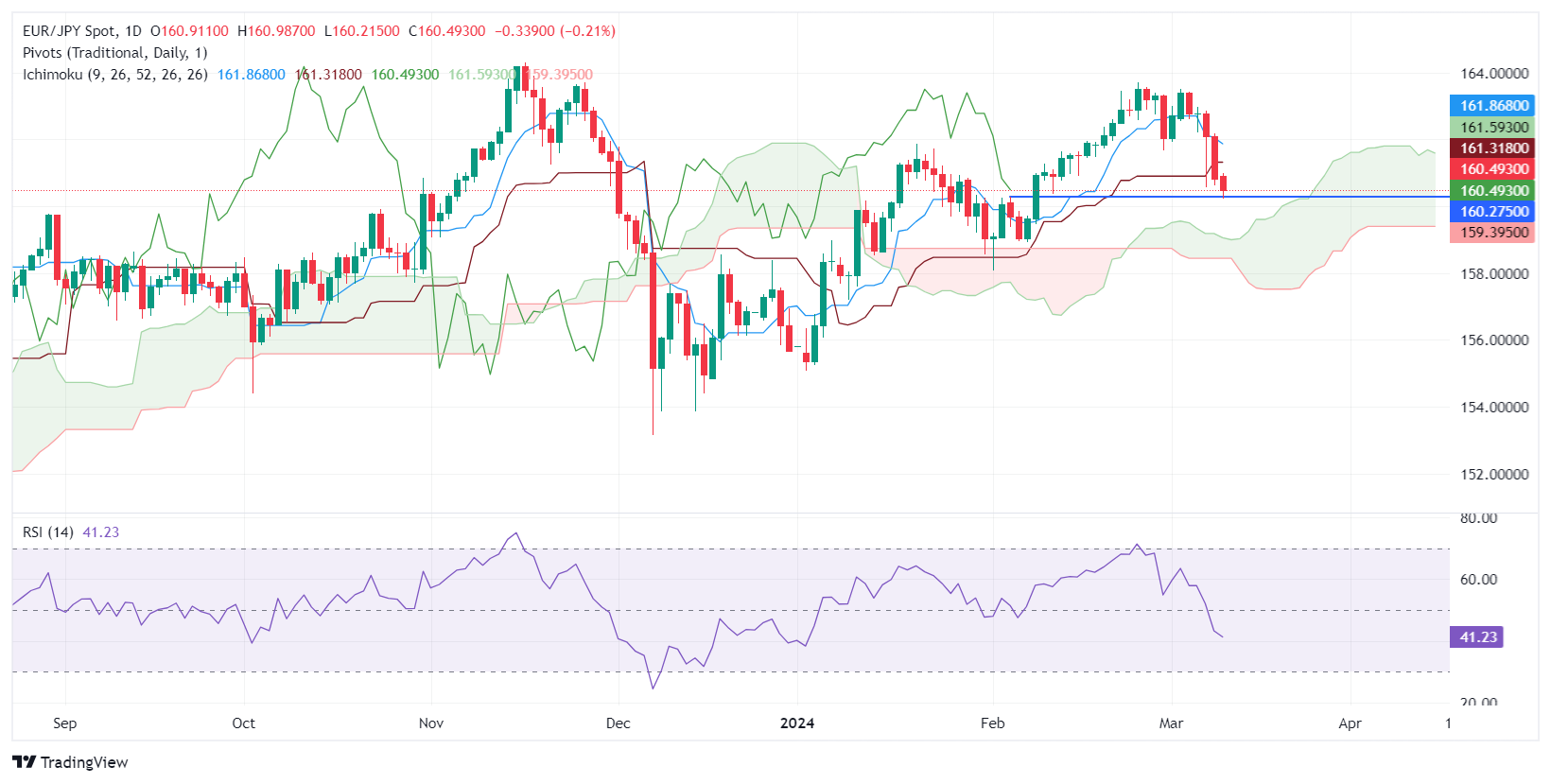

EUR/JPY Price Analysis: Technical outlook

Since last week, the EUR/JPY has extended its losses to more than 1.70%, breaking key support levels like the Tenkan and Kijun Sen, and the psychological 161.00 level. If sellers remain in charge, the pair could aim towards the top of the Ichimoku Cloud (Kumo) at 158.90/159.00, though firstly a break of the 160.00 mark is a must. On the other hand, if buyers move in and push the exchange rate above 161.00, look for a test of the Kijun-Sen at 161.31.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.