- Analytics

- News and Tools

- Market News

- USD/JPY finds support at 150.20, US Durable Goods miss the mark

USD/JPY finds support at 150.20, US Durable Goods miss the mark

- USD/JPY recovered after US Durable Goods declined more than expected.

- Japanese National CPI inflation fell, but less than expected.

- US GDP, PCE inflation due in the back half of the trading week.

USD/JPY fell early Tuesday before finding a floor near 150.20, with the US Dollar (USD) paring away near-term losses after US Durable Goods Orders declined more than expected in January. Markets will be pivoting to focus on US Gross Domestic Product (GDP) growth and Personal Consumption Expenditure Price Index (PCE) inflation data due on Wednesday and Thursday, respectively.

Japan’s National Consumer Price Index (CPI) eased from previous figures, but still fell less than expected. Headline annualized National CPI slipped to 2.2% from 2.6% for the year ended January. Core National CPI fell to 2.0% from 2.3% for the same period, but markets were expecting a print of 1.8%.

US GDP, PCE inflation in the barrel

US MoM Durable Goods Orders declined to -6.1% in January, missing the -4.5% forecast. The previous print also got revised lower to -0.3% from 0.0%.

Wednesday will see US GDP growth for 2023’s fourth quarter, and the annualized Q4 GDP is forecast to hold steady at 3.3%. Thursday’s US PCE inflation is expected to see a slight uptick on the near end of the curve, with MOM Core PCE forecast to rise to 0.4% from 0.2% in January. Core annualized US PCE is expected to ease to 2.8% from 2.9% for the year ended January.

USD/JPY technical outlook

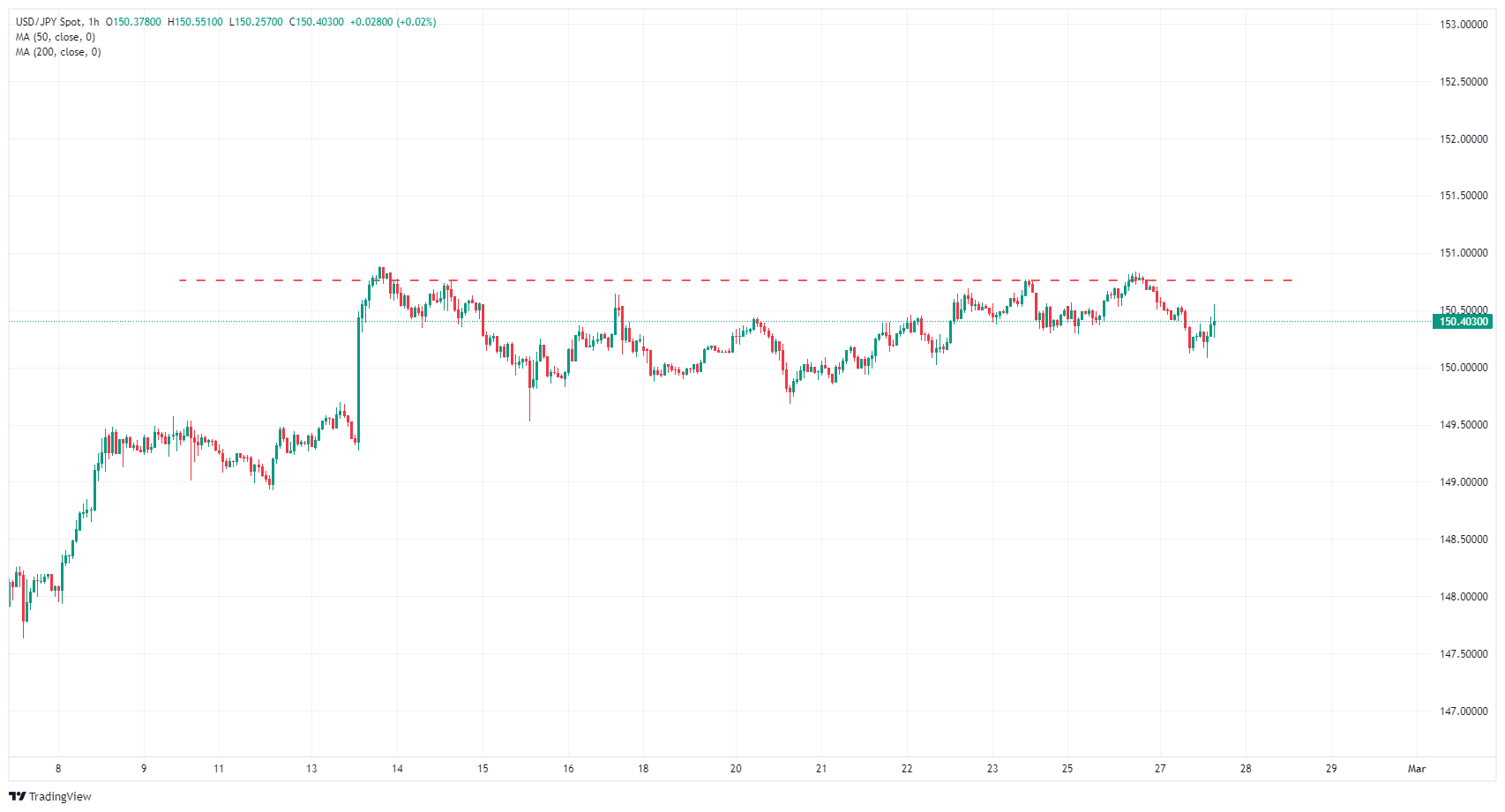

USD/JPY sees near-term technical resistance from 150.75 as the pair struggles to mount the 151.00 handle. The pair remains capped into the midrange as markets churn, and 150.50 remains a key cycle level for USD/JPY.

Longer term, the pair remains firmly pinned into bull country, with the pair trading into technical resistance near last November’s peak bids near 152.00. USD/JPY has closed in bullish territory for six of the last seven consecutive trading weeks.

USD/JPY hourly chart

USD/JPY daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.