- Analytics

- News and Tools

- Market News

- EUR/USD on the high side but capped near 1.0860 on Monday

EUR/USD on the high side but capped near 1.0860 on Monday

- EUR/USD up a quarter of a percent in thin market open.

- ECB President Lagarde spoke on Monday, reiterates inflation stance.

- Inflation prints due this week, US PCE to be a key data print on Thursday.

EUR/USD saw a thin start to a hectic week on the economic calendar as markets ease into Monday action. EUR/USD rose around a quarter of a percent on Monday as technicals remain crimped ahead of a slew of price inflation and growth figures due on both sides of the pond.

Tuesday kicks things off with US Durable Goods Orders, and Wednesday delivers EU Consumer Confidence and US Gross Domestic Product (GDP) growth figures in the midweek. Thursday sees the euro area make its late data entrance to the trading week with German Retail Sales and Consumer Price Index (CPI) inflation. January’s US Personal Consumption Expenditure Price Index is also due on Thursday.

Daily digest market movers: quiet Monday trading sees EUR/USD pinned as investors await key data

- European Central Bank (ECB) President Christine Lagarde noted on Monday that inflation continues to ease towards ECB targets, remains committed restrictive policy measures for the time being.

- Read more: ECB President Lagarde says restrictive policy stance acts as a safeguard against wage-price spiral.

- Germany’s Gfk Consumer Confidence Survey for March due Tuesday, expected to recover to -29.0 from -29.7.

- US Durably Goods Orders in January are also due Tuesday, forecast to decline 4.8% versus the previous 0.0%.

- Wednesday to hinge on US Q4 GDP, forecast to hold steady at 3.3% through the four quarters.

- Thursday’s German Retail Sales expected to slightly recover to -1.5% for the year ended January compared to the previous period’s -1.7%.

- German CPI for February forecast to ease to 2.7% YoY versus the previous 3.1%.

- US Core PCE Price Index expected to print at 0.4% MoM in January versus the previous 0.2%.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.21% | 0.00% | 0.09% | 0.46% | 0.18% | 0.24% | -0.03% | |

| EUR | 0.21% | 0.20% | 0.29% | 0.67% | 0.40% | 0.44% | 0.19% | |

| GBP | 0.01% | -0.20% | 0.09% | 0.47% | 0.20% | 0.25% | -0.02% | |

| CAD | -0.08% | -0.30% | -0.09% | 0.39% | 0.09% | 0.16% | -0.12% | |

| AUD | -0.48% | -0.67% | -0.46% | -0.38% | -0.27% | -0.22% | -0.48% | |

| JPY | -0.18% | -0.41% | -0.14% | -0.10% | 0.30% | 0.05% | -0.21% | |

| NZD | -0.24% | -0.44% | -0.23% | -0.15% | 0.23% | -0.04% | -0.27% | |

| CHF | 0.01% | -0.20% | 0.01% | 0.10% | 0.48% | 0.19% | 0.25% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

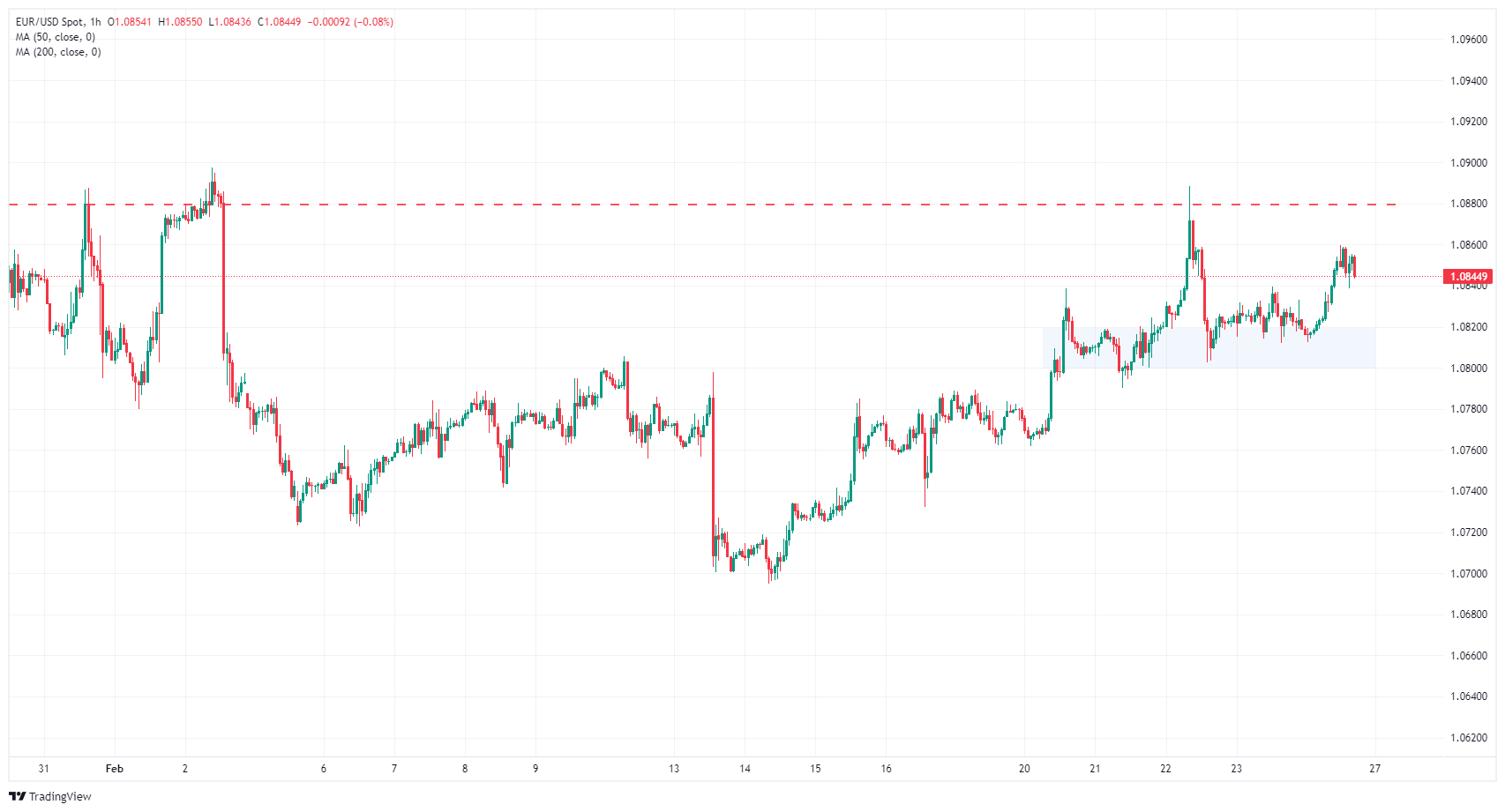

Technical analysis: EUR/USD pinned below 1.0860 in thin Monday churn

EUR/USD remains capped below 1.0860 on Monday, but near-term higher lows are keeping the pair bolstered into the high end. A heavy supply zone from 1.0800 to 1.0820 remains on the intraday charts, and 1.0880 represents the near-term technical ceiling.

Despite a thin bullish buildout that sees very little topside momentum, EUR/USD has closed in the green for eight consecutive trading days and is on pace to chalk in a ninth. Of the last 14 trading days, only two have managed to close in the red.

Significant technical pressure is squeezing the pair into the midrange at the 200-day Simple Moving Average (SMA) near 1.0830. EUR/USD is up a scant 1.3% from February’s low bids near 1.0695.

USD/CAD hourly chart

USD/CAD daily chart

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.