- Analytics

- News and Tools

- Market News

- EUR/JPY Price Analysis: Closes week higher despite daily losses, buyers eye 163.00

EUR/JPY Price Analysis: Closes week higher despite daily losses, buyers eye 163.00

- EUR/JPY finishes week with a 0.66% gain, reflecting persistent JPY softness against a backdrop of economic data.

- Technical analysis shows YTD high at 163.21, with support and resistance levels indicating potential upward momentum.

- Key technical levels outlined for potential reversals or further advances in the EUR/JPY pair's trajectory.

The EUR/JPY wraps up Friday session with losses of 0.02% but is set to finish the week with 0.66% gains, courtesy of overall Japanese Yen (JPY) weakness, as economic data doesn’t justify the Bank of Japan (BoJ) finishing negative interest rates. At the time of writing, the cross exchanges hands at 162.86, virtually unchanged.

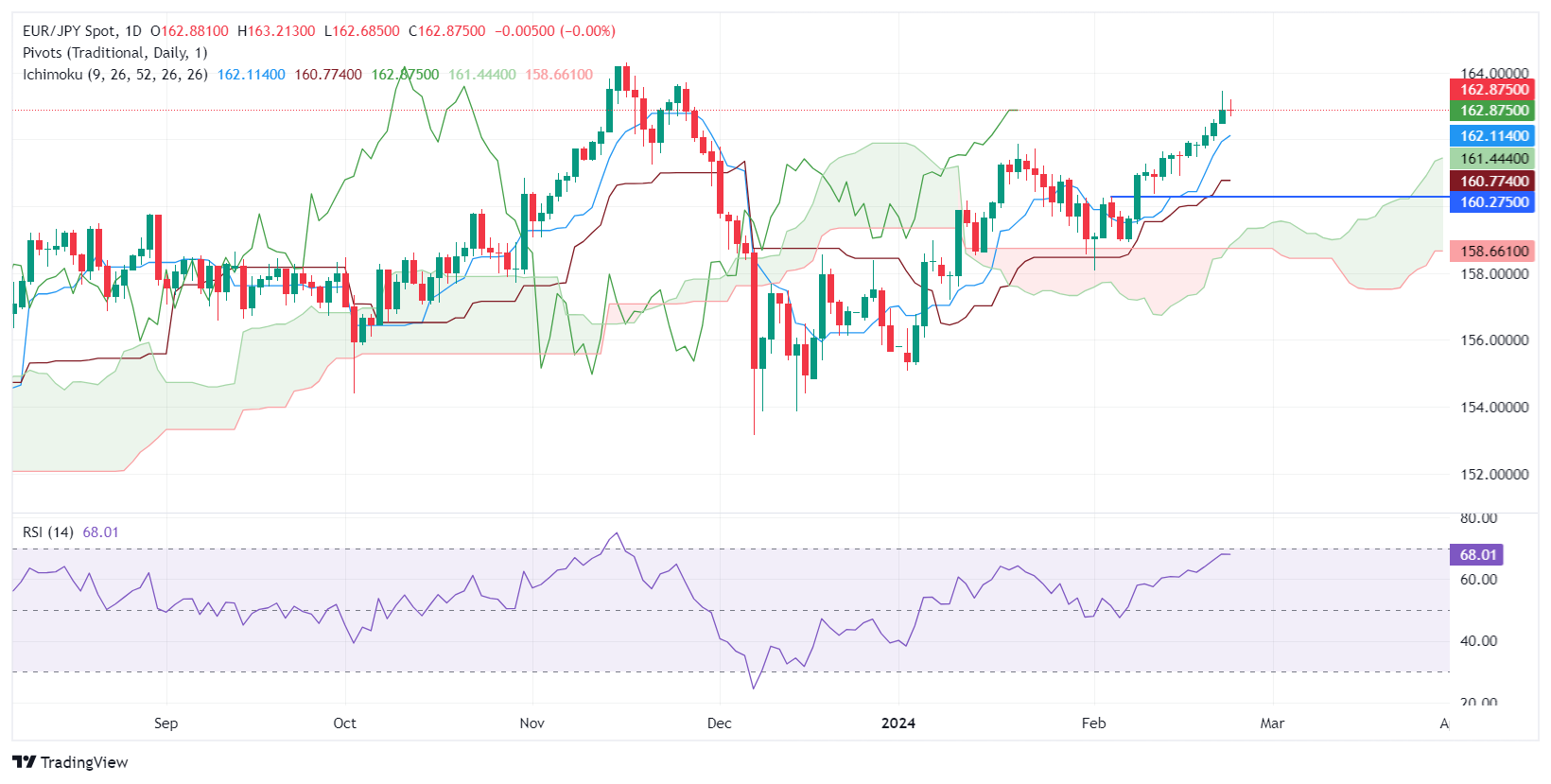

From a technical standpoint, the pair printed a new year-to-date (YTD) high at 163.21 but failed to cling to gains above the 163.00 figure. That opened the door for a pullback, capped at around the day’s low of 162.64, which keeps buyers hopeful of higher prices. Achieving a daily close above 163.00 would open the door to testing the November 27 high at 163.72, ahead of the 164.00 mark.

Conversely, if sellers step in, they would clash with the Tenkan-Sen, first support at 162.11. the next support will emerge at January’s 19 high turned support at 161.87, followed by the Senkou Span A at 161.44.

EUR/JPY Price Action – Daily Chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.