- Analytics

- News and Tools

- Market News

- USD/JPY remains strapped in near-term congestion close to 148.00

USD/JPY remains strapped in near-term congestion close to 148.00

- Markets are pulled into the midrange on thin action.

- Thin data remains a key theme of the trading week.

- Central bankers continue to populate headlines.

USD/JPY is caught in consolidation near the 148.00 handle in the midweek market session as a thin economic calendar leaves markets to churn on rate cut expectations and the odd appearance from central bank policymakers.

Wednesday saw several heads from the US Federal Reserve (Fed) hit markets with soundbites that failed to generate much momentum in either direction.

The Japanese Yen (JPY) saw a broad-market pullback in the midweek, but improving risk sentiment also kept the US Dollar (USD) pinned on the low side, leaving USD/JPY to waffle into near-term congestion levels.

Several Fed officials spoke up on Wednesday, noting that while progress on inflation continues, there still remain risks across multiple fronts, with Boston Fed president Susan Collins specifically highlighting the risk that inflation progress could easily stall. Fed speakers on Wednesday broadly stuck close to the Fed’s projections of two or three rate cuts in 2024, while the market continues to price in a hopeful six cuts beginning possibly in May.

USD/JPY traders will be left in the lurch until next week, with US Consumer Price Index (CPI) inflation figures due on Tuesday, to be followed by Japanese Gross Domestic Product (GDP) growth on the docket for Wednesday.

US CPI headline inflation is forecast to tick down from 0.3% to 0.2% in January, while Japan’s GDP growth is expected to rebound from -0.7% to 0.3% in the fourth quarter.

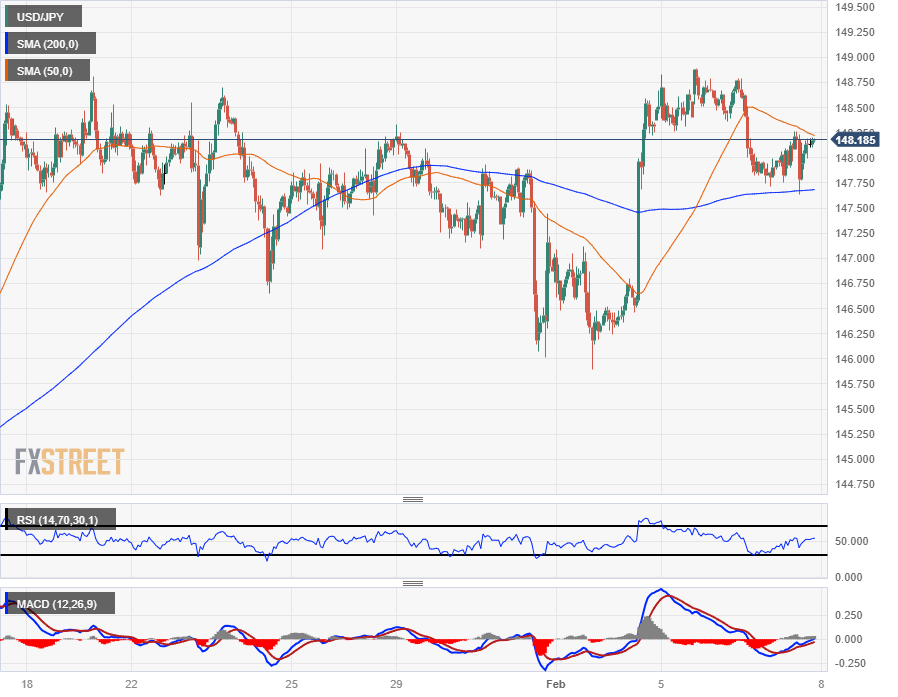

USD/JPY technical outlook

USD/JPY finds itself trapped in near-term congestion as the pair battles into familiar technical levels near the 200-hour Simple Moving Average (SMA) at 147.75 as the USD/JPY strings along the 148.00 handle.

USD/JPY remains buoyed above the 146.00 level as the pair remains on the higher side of the 200-day SMA near 145.00, but bullish momentum is draining out of the pair that is recovering from December’s dip into 140.25 after the USD/JPY’s declining from just below the 152.00 handle in the last half of 2023.

USD/JPY hourly chart

USD/JPY daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.