- Analytics

- News and Tools

- Market News

- Gold Price Forecast: XAU/USD advances due to USD weakness, eyes on NFPs

Gold Price Forecast: XAU/USD advances due to USD weakness, eyes on NFPs

- The XAU/USD holds ground with bullish outlook at $2,055, showing a 0.78% rally.

- Weak Jobless Claims data weakened the USD during the session.

- Indicators stand near overbought conditions on the four-hour chart, a consolidation may be incoming.

In Thursday's session, the XAU/USD was spotted rallying to $2,055, depicting a bullish outlook on the daily chart with buyers gaining ground. The momentum is echoed in the four-hour chart, where indicators show a levelling near overbought conditions, suggesting potential market saturation. On the fundamental side, markets await key Nonfarm Payrolls figures from January due on Friday while higher-than-expected weekly Jobless Claims figures from the US weakened the Greenback during the session.

Federal Reserve’s Chair Powell considered not likely that the bank will reach a level of confidence by March to start easing. As a reaction, the US Dollar rallied on Wednesday as markets started to give up on the expectations of sooner cuts, but incoming data will ultimately guide the bank on the timing of the easing cycle. In case labor markets figures on Friday come in weak, the metal could see further upside, as the expectations on lower interest rates tend to benefit non-yielding assets.

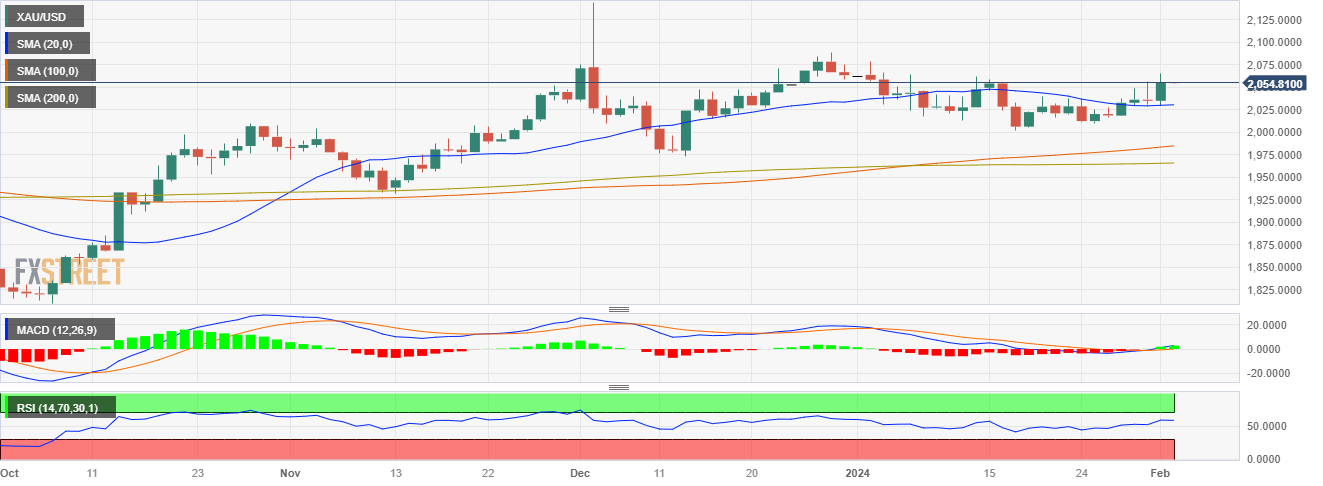

XAU/USD daily chart

XAU/USD levels to watch

The daily chart indicators reflect a bullish momentum in the market. With a positive slope in the Relative Strength Index (RSI) and increasing green bars in the Moving Average Convergence Divergence (MACD), it signifies a rising trend and an ongoing domination by the buyers. Contributing to this bullish sentiment, the asset's position above the 20, 100, and 200-day Simple Moving Averages (SMAs) reinforces the current control held by the bulls.

Switching to a shorter timeframe view based on a four-hour chart, the indicators appear to flatten, with the RSI approaching the overbought territory, indicating a slowing momentum which is typical in highly bought situations. However, nearing the 70 threshold, it could signify a potential reversal as buyers might start taking profits, slowing the incoming buying force.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.