- Analytics

- News and Tools

- Market News

- Canada CPI Preview: Headline inflation expected to tick up, core pressures to abate further in December

Canada CPI Preview: Headline inflation expected to tick up, core pressures to abate further in December

- The Canadian Consumer Price Index is seen growing 3.3% YoY in December.

- The BoC released its Business Outlook Survey (BOS).

- The Canadian Dollar navigates the area of four-week lows against the US Dollar.

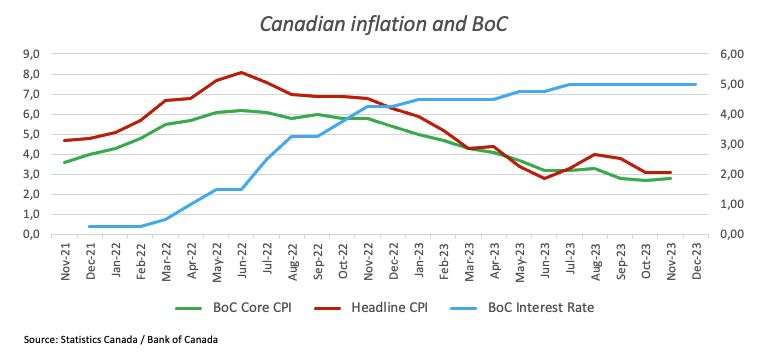

Canada is set to release important inflation-related data on Tuesday. Statistics Canada will publish Consumer Price Index (CPI) for December, which is expected to show a year-on-year increase of 3.3%, slightly higher than the 3.1% recorded in November. On a monthly basis, the index is anticipated to decline by 0.3% following a 0.1% increase in the previous month. The data release has the potential to move the Canadian Dollar (CAD), which has remained weak against the US Dollar (USD) and is currently trading around four-week lows near the 1.3400 zone.

In addition to the CPI data, the Bank of Canada (BoC) will also publish the Core Consumer Price Index. This index excludes volatile components such as food and energy prices. In November, the BoC Core CPI showed a monthly increase of 0.1% and a year-on-year increase of 2.8%. These figures will be closely watched as they have the potential to impact the direction of the Canadian Dollar (CAD) and shape expectations for the Bank of Canada's monetary policy.

What to expect from Canada’s inflation rate?

Analysts anticipate additional softening of price pressures across Canada in December. Inflation, as quantified by annual shifts in the Consumer Price Index, is projected to resume the uptrend in the last month of the year, in line with what happened in most of Canada’s G10 peers, particularly its neighbour, the US. Following August's uptick to 4%, the CPI has trended downward, while all inflation gauges, such as the Core CPI, are expected to have moderated as well, signaling more tempered cost increases but persistence above the Bank of Canada's 2% objective.

If the impending data validates the expected loss of momentum in disinflationary pressures, investors may factor in the likelihood that the central bank could maintain the current rates for longer than initially anticipated, although extra tightening of the monetary conditions appears to be off the table.

With the global discussion centered on prospective interest rate reductions by monetary authorities in 2024, the unexpected pick-up of inflationary pressures would, at this point, prompt central banks to maintain their ongoing restrictive stance rather than lean towards further tightening. The latter scenario should require a sharp and persistent resurgence of price pressures and a sudden bout of consumers’ demand, all of which appear highly unlikely for the foreseeable future.

In his final remarks of the year in December, BoC Governor Tiff Macklem reported that the Governing Council would continue discussing whether monetary policy is sufficiently restrictive and the duration it should remain in that state. He anticipated that growth and employment would show improvement later in 2024, with inflation approaching the 2% target. Acknowledging the economic growth slowdown until mid-2023, he projected it to persist into 2024. Macklem mentioned that it was premature to contemplate reducing the policy rate, emphasizing that although inflation had decreased, it remained elevated.

When is the Canada CPI data due and how could it affect USD/CAD?

Canada is scheduled to unveil the Consumer Price Index for December 2023 on Tuesday at 13:30 GMT. The potential influence on the Canadian Dollar stems from shifts in monetary policy expectations by the Bank of Canada. Nevertheless, the impact may be restrained, given that – similar to the Federal Reserve and other central banks – the Bank of Canada is anticipated to have completed rate hikes amid declining inflation and a slowdown in economic growth.

The USD/CAD has started the new trading year in quite a bullish fashion, although the uptrend appears to have met a decent barrier around the 1.3450 zone. This initial area of resistance also looks underpinned by the proximity of the critical 200-day Simple Moving Average (SMA) around 1.3480.

According to Pablo Piovano, FXStreet’s Senior Analyst, “USD/CAD would likely face the prospects for extra losses as long as it trades below the significant 200-day SMA. The bearish tone is also seen intensifying in the event of a sustainable breach of the December low of 1.3177 (December 27).”

Pablo adds: “A substantial pick-up of market activity in CAD would necessitate surprising inflation figures. While below-expectation numbers might favour the view of potential interest rate cuts by the BoC in the next month and hence put the Loonie under further selling pressure, the rebound in the CPI – in line with its neighbour, the US – could lend some wings to the Canadian Dollar, albeit to a moderate extent. A higher-than-expected inflation reading would increase pressure on the Bank of Canada to sustain elevated rates for an extended period, potentially resulting in a prolonged period of many Canadians facing challenges with higher interest rates, as underscored by Bank of Canada Governor Macklem in his December remarks.”

Economic Indicator

Canada Consumer Price Index (YoY)

The Consumer Price Index (CPI), released by Statistics Canada on a monthly basis, represents changes in prices for Canadian consumers by comparing the cost of a fixed basket of goods and services. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Canadian Dollar (CAD), while a low reading is seen as bearish.

Read more.Next release: 01/16/2024 13:30:00 GMT

Frequency: Monthly

Source: Statistics Canada

Inflation FAQs

What is inflation?

Inflation measures the rise in the price of a representative basket of goods and services. Headline inflation is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core inflation excludes more volatile elements such as food and fuel which can fluctuate because of geopolitical and seasonal factors. Core inflation is the figure economists focus on and is the level targeted by central banks, which are mandated to keep inflation at a manageable level, usually around 2%.

What is the Consumer Price Index (CPI)?

The Consumer Price Index (CPI) measures the change in prices of a basket of goods and services over a period of time. It is usually expressed as a percentage change on a month-on-month (MoM) and year-on-year (YoY) basis. Core CPI is the figure targeted by central banks as it excludes volatile food and fuel inputs. When Core CPI rises above 2% it usually results in higher interest rates and vice versa when it falls below 2%. Since higher interest rates are positive for a currency, higher inflation usually results in a stronger currency. The opposite is true when inflation falls.

What is the impact of inflation on foreign exchange?

Although it may seem counter-intuitive, high inflation in a country pushes up the value of its currency and vice versa for lower inflation. This is because the central bank will normally raise interest rates to combat the higher inflation, which attract more global capital inflows from investors looking for a lucrative place to park their money.

How does inflation influence the price of Gold?

Formerly, Gold was the asset investors turned to in times of high inflation because it preserved its value, and whilst investors will often still buy Gold for its safe-haven properties in times of extreme market turmoil, this is not the case most of the time. This is because when inflation is high, central banks will put up interest rates to combat it.

Higher interest rates are negative for Gold because they increase the opportunity-cost of holding Gold vis-a-vis an interest-bearing asset or placing the money in a cash deposit account. On the flipside, lower inflation tends to be positive for Gold as it brings interest rates down, making the bright metal a more viable investment alternative.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.