- Analytics

- News and Tools

- Market News

- Natural Gas drops as supply ample during frosty weather

Natural Gas drops as supply ample during frosty weather

- Natural Gas trades near $2.67, continuing a steep decline from Wednesday.

- Traders see ample amounts of supply, despite frost temperatures in Europe and China.

- The US Dollar steady above 102 ahead of US CPI numbers.

Natural Gas (XNG/USD) is unable to bank on the current elevated geopolitical tensions and winter in the Northern Hemisphere. While Israel is facing tribunal repercussions from a possible genocide accusation out of South Africa, negative temperateres across Europe, China and other parts of the Northern hemisphere are eating into Gas reserves. Supply is flowing, however, and ships are still making ports, despite longer routes to circumvent the Red Sea passage.

Meanwhile, the US Dollar (USD) is gearing up for a spike in volatility with the US inflation report due to be released this Thursday. Markets are positioned for quick rate cuts from the US Federal Reserve with expectations that the US Consumer Price Index (CPI) will continue its disinflationary path. Substantial US Dollar weakness is expected on the back of all this, which could support Natural Gas prices.

Natural Gas is trading at $2.67 per MMBtu at the time of writing.

Natural Gas Market Movers: Not cold enough

- European Gas prices are sinking with industrial demand not picking up at all and stockpiles still very much equipped to face a longer period of low temperatures on the continent.

- Several Norwegian Oil and Gas companies have launched projects for mining. Expectations are that nearly 40 to 50 wells will come online this year, from the 34 last year.

- German Gas storages drop to 88% while European Gas storage is still near 82%.

- This Tuesday the first hearings started in the United Nations Tribunal for Genocide against Israel after South Africa launched a formal complait with the tribunal.

Natural Gas Technical Analysis: Close but no cigar

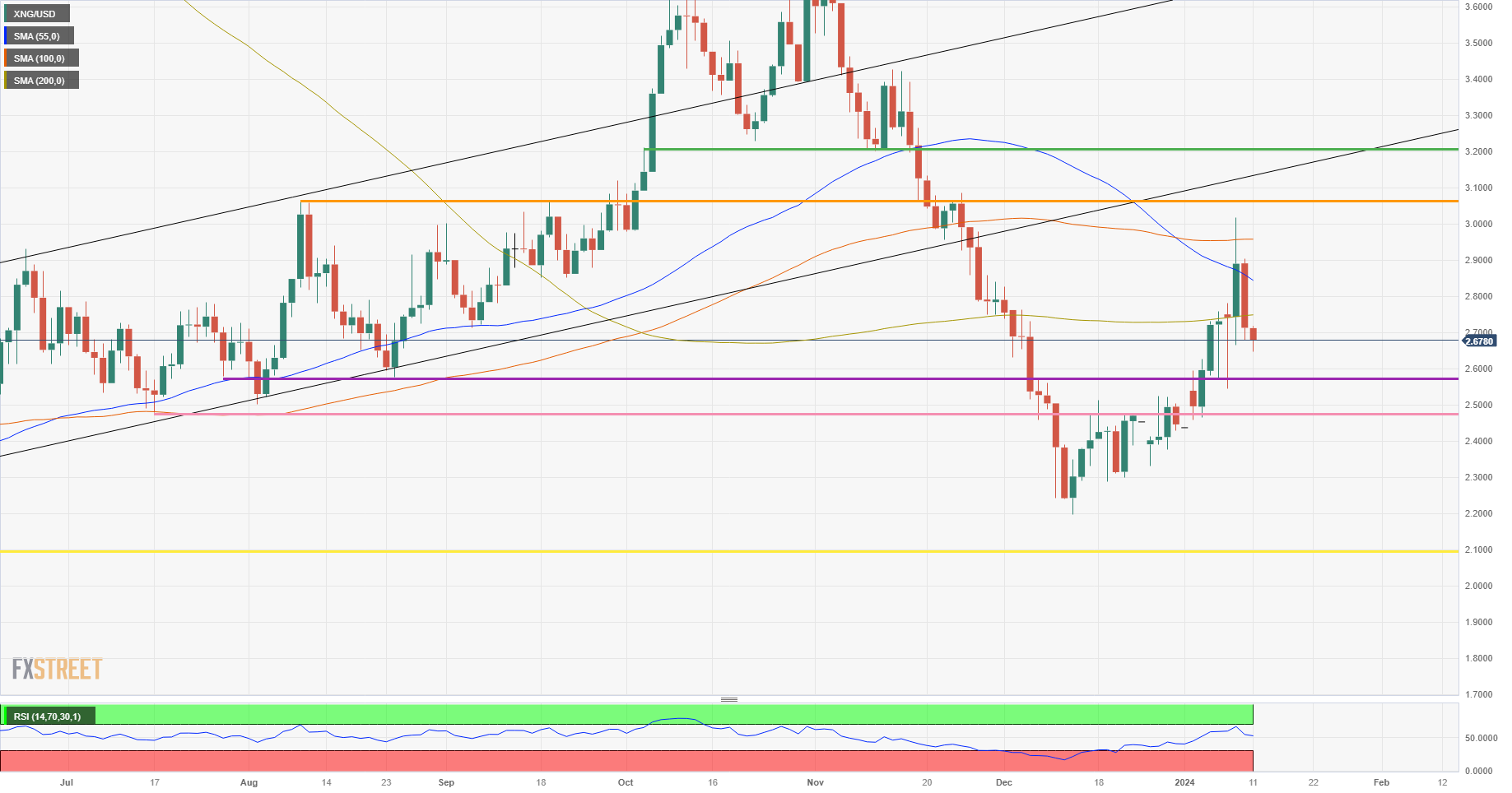

Natural Gas was on a tear earlier this week, nearing $3 finally. The price action plunged back to $2.70, however, after markets saw no supply issues and lacklustre demand from the industry for the commodity. Expect to see still fairly muted reactions to the upside, unless a supply hiccup could emerge at one point out of the Middle East.

On the upside, Natural Gas is facing all the important Simple Moving Averages (SMA) as resistance levels to the upside. First up, nearby is the 200-day SMA near $2.75. Next up is the 55-day SMA at $2.85. Last but not least is the 100-day SMA at $2.95, near $3.

One big element that is always returning when it comes to Natural Gas, is that there is always an ample amount of supply. Each initial bullish reaction is being backtracked thereafter with the realisation that more supply is present. In that case, expect to see a continuing drop lower to $2.60 with a test at the low of December near $2.20 as not unthinkable.

XNG/USD (Daily Chart)

Natural Gas FAQs

What fundamental factors drive the price of Natural Gas?

Supply and demand dynamics are a key factor influencing Natural Gas prices, and are themselves influenced by global economic growth, industrial activity, population growth, production levels, and inventories. The weather impacts Natural Gas prices because more Gas is used during cold winters and hot summers for heating and cooling. Competition from other energy sources impacts prices as consumers may switch to cheaper sources. Geopolitical events are factors as exemplified by the war in Ukraine. Government policies relating to extraction, transportation, and environmental issues also impact prices.

What are the main macroeconomic releases that impact on Natural Gas Prices?

The main economic release influencing Natural Gas prices is the weekly inventory bulletin from the Energy Information Administration (EIA), a US government agency that produces US gas market data. The EIA Gas bulletin usually comes out on Thursday at 14:30 GMT, a day after the EIA publishes its weekly Oil bulletin. Economic data from large consumers of Natural Gas can impact supply and demand, the largest of which include China, Germany and Japan. Natural Gas is primarily priced and traded in US Dollars, thus economic releases impacting the US Dollar are also factors.

How does the US Dollar influence Natural Gas prices?

The US Dollar is the world’s reserve currency and most commodities, including Natural Gas are priced and traded on international markets in US Dollars. As such, the value of the US Dollar is a factor in the price of Natural Gas, because if the Dollar strengthens it means less Dollars are required to buy the same volume of Gas (the price falls), and vice versa if USD strengthens.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.