- Analytics

- News and Tools

- Market News

- USD/JPY inches towards 146.00 as Yen declines on falling Japanese real wages

USD/JPY inches towards 146.00 as Yen declines on falling Japanese real wages

- USD/JPY climbs further as Yen declines across the board.

- Yen weakness sparked by tumbling Japanese real wages, down 3% YoY.

- Backsliding real wages leaves the BoJ less likely to start raising interest rates.

The USD/JPY witnessed a notable upswing in Wednesday’s trading, reaching 145.80 and approaching the key resistance level of 146.00 as markets gear up for Thursday’s Asia market session. This upward movement is attributed to a significant depreciation of the Japanese Yen (JPY) across the market, sparked by disappointing Japanese wage figures released earlier in the day. Consequently, the Yen is undergoing a decline across various market segments mid-week.

Japan's economic landscape faces challenges as nominal wages rose by 0.2%, but real incomes experienced a 3% decline for the year ending November. Ongoing inflation is eroding consumers' earnings and purchasing power, contributing to this downturn.

The likelihood of the Bank of Japan (BoJ) implementing rate hikes, contingent on rising real wages, is diminishing. This has resulted in a weakening Yen and is triggering another extended flight away from the JPY.

Japanese real wages tumble 3% despite 0.2% increase in nominal wages

Despite inflation's persistent impact on real wages, the BoJ maintains a highly accommodative monetary policy, with slightly negative rates at or near -0.1%. This cautious stance stems from concerns about inflation falling below the 2% threshold in 2025. Japanese annual inflation stood at 2.8% in November, down from its peak of 4.3% in January of the preceding year.

Looking ahead, the USD/JPY may gain additional momentum on Thursday as the United States publishes its latest Consumer Price Index (CPI) inflation figures for December.

US headline CPI inflation is expected to slightly increase month-over-month, from 0.1% to 0.2%. The annualized inflation for the year ending in December is projected to climb from 3.1% to 3.2%.

US CPI Preview: Forecasts from 10 major banks

In contrast, core US CPI inflation, excluding volatile food and energy prices, is predicted to remain stable month-over-month in December at 0.3%. However, the year-over-year Core CPI is forecasted to decrease slightly from 4.0% to 3.8%.

Investors are closely monitoring any signs that could prompt the Federal Reserve (Fed) to initiate the next rate-cut cycle. A decline in US inflation may boost risk appetite, while an unexpected increase in US CPI inflation could lead to a decrease in risk appetite and potentially drive up the value of the US Dollar against major currencies.

USD/JPY Technical Outlook

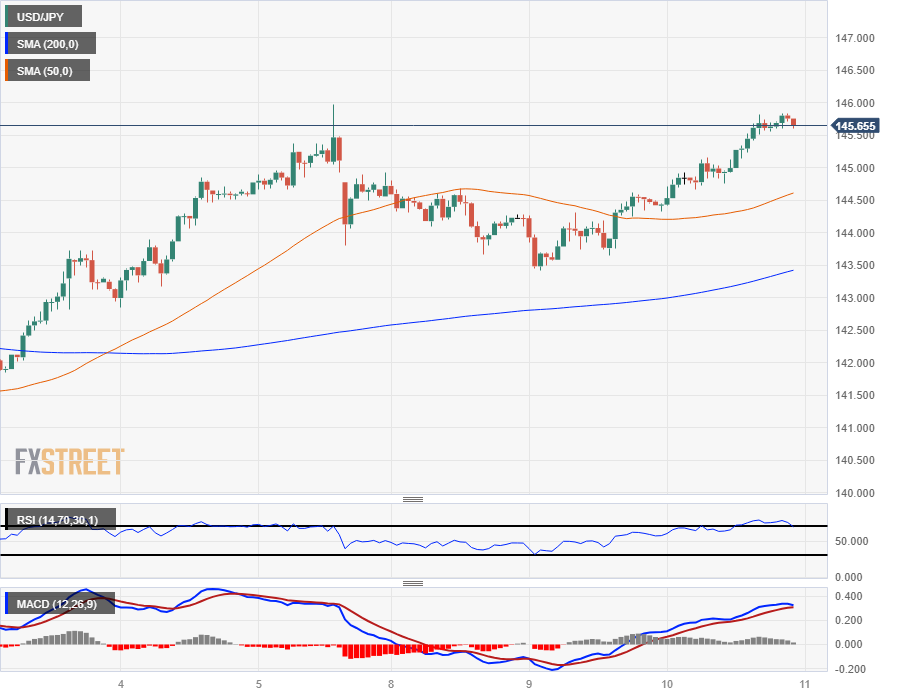

The recent decline in the Yen on Wednesday has propelled the USD/JPY pair, positioning it for a potential retest of last week's peak at the 146.00 level. Short-term momentum suggests a bullish trend, with the 200-hour Simple Moving Average (SMA) ascending towards 143.50, aligning with Wednesday's low point.

Despite the current consolidation between the 50-day and 200-day SMAs, the 2024 price action signals a bullish trend following the recent rebound of the USD/JPY from the 200-day SMA around 143.00.

USD/JPY Hourly Chart

USD/JPY Daily Chart

USD/JPY Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.