- Analytics

- News and Tools

- Market News

- AUD/USD steady above 0.6700 amid mixed US economic signals

AUD/USD steady above 0.6700 amid mixed US economic signals

- AUD/USD shows marginal gains in volatile session, reacting to US job strength and services sector deceleration.

- Solid US Nonfarm Payrolls and a decline in Services PMI create a mixed economic landscape, impacting currency dynamics.

- Traders eye upcoming US inflation data and Australian Retail Sales for further directional cues in the week ahead.

The AUD/USD is almost flat during the North American session, after mixed economic data from the United States (US) keeps the Greenback seesawing between gains and losses. A solid employment report in the US and weaker business activity in the services sector keep investors scratching their heads about the economy's outlook. The pair, post minuscule gains of 0.11%, trades at 0.6711.

AUD/USD remains afloat above 0.6700 amid mixed US economic data

The Institute for Supply Management (ISM) revealed the services sector slowed in December, as the Services PMI slid from 50.7 to 43.3, the lowest since May 2023. Today’s reading, along with the Manufacturing PMI revealed earlier this week, suggests the economy is slowing faster than foreseen, with both readings in recessionary territory.

Earlier, the US Department of Labor (DoL) disclosed the US economy created 216K jobs, as illustrated by December’s Nonfarm Payrolls data, while the Unemployment Rate cooled from 3.8% to 3.7%. According to Average Hourly Earnings, wages rose to 4.1% YoY from 3.9%.

In the meantime, the AUD/USD reversed its earlier gains post US NFP and ISM Services PMI release, which witnessed the pair hitting a daily high of 0.6748, before retreating somewhat toward the 0.6710 region.

Ahead of the next week, the US economic docket will feature December’s inflation data. On the Australian front, traders would be looking for Retail Sales.

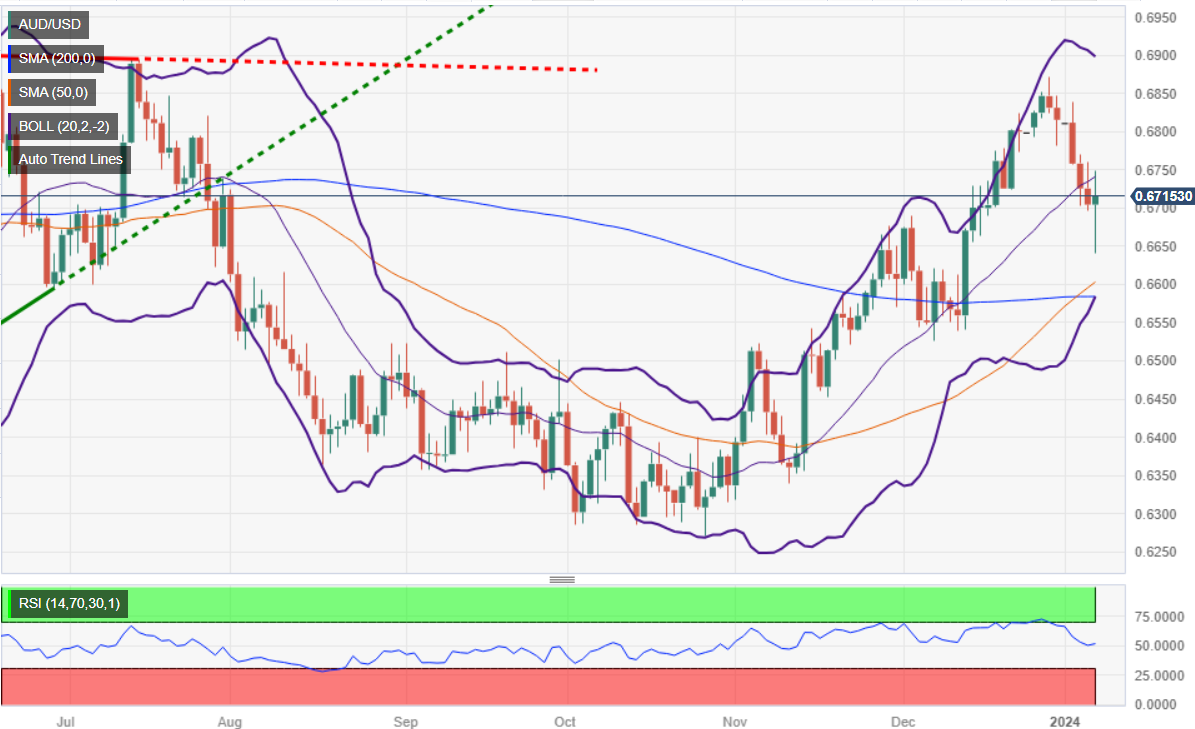

AUD/USD Price Analysis: Technical outlook

After dropping toward 0.6640, AUD/USD buyers moved in, lifting the pair shy of testing the 0.6750 area before reversing its course. If the pair closes around current exchange rates, that would form a large doji, meaning that traders remain uncertain about the pair's direction. For a bullish resumption, buyers must reclaim 0.6750, which would expose the 0.6800 figure. On the downside, if sellers drag prices below the 0.6700 figure, that could pave the way to test the confluence of the 50-200-day moving averages (DMA), at 0.6582/92.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.