- Analytics

- News and Tools

- Market News

- EUR/JPY Price Analysis: Bears are in charge but losing steam at around 158.30s

EUR/JPY Price Analysis: Bears are in charge but losing steam at around 158.30s

- EUR/JPY down for eighth day but holds above Ichimoku Cloud; Yen weakness cushions potential bearish momentum.

- ECB's Isabel Schnabel welcomes inflation data, signaling potential rate cuts ahead, diverging from the US Federal Reserve's stance.

- Key levels: For bearish momentum, watch for breach of 158.38, targeting Kumo bottom at 157.61; upside potential with 159.00 psychological figure.

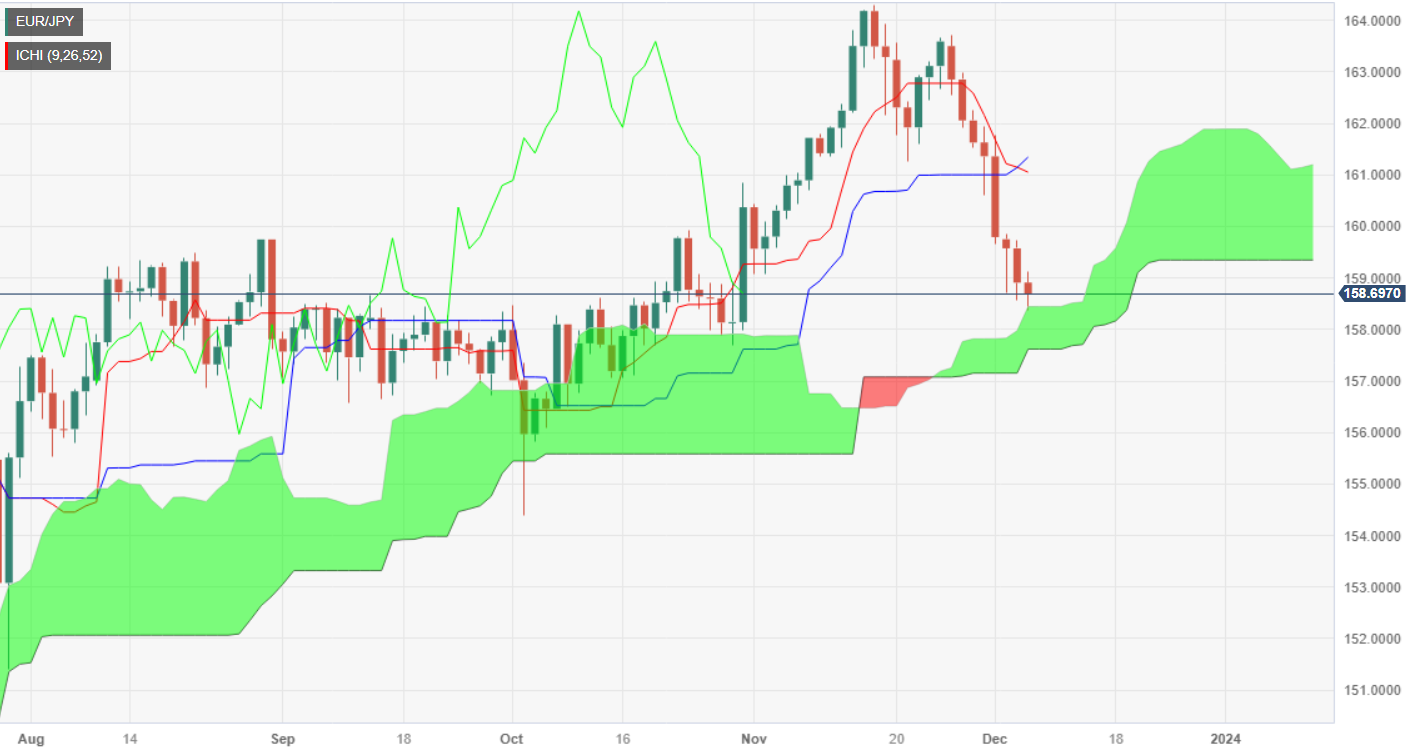

The EUR/JPY slides for the eighth straight day, though it remains above the Ichimoku Cloud (Kumo), which could be seen as the downtrend, is losing steam amidst overall Japanese Yen (JPY) weakness across the board on Wednesday. At the time of writing, the EUR/JPY is trading at 158.68 after hitting a daily high of 159.12.

The fundamental bias changed since yesterday’s words from the European Central Bank (ECB) member Isabel Schnabel, which welcomed inflation data, suggesting that November’s CPI was “a very pleasant surprise.” Since then, rate cuts for the ECB augmented, with market participants seeing the ECB slashing rates before the US Federal Reserve.

Hence, the EUR/JPY daily chart has shown some Euro’s (EUR) weakness, but so far the pair has failed to gain traction amid a soft Yen. Nevertheless, the pair clashed with the top of the Kumo at around 158.38 and stabilized at around 158.70.

For a bearish resumption, bears must reclaim 158.38, so they could drag the spot price towards the bottom of the Kumo at 157.61. A breach of the latter will expose a five-month-old upslope support trendline around 157.13. further downside is seen below that level, at the October 3 low of 154.34.

On the flip side, if buyers hold prices above the top of the Kumo, they could remain hopeful of higher prices. The first resistance would be the 159.00 psychological figure, followed by the December 5 high at 159.72.

EUR/JPY Price Action – Daily Chart

EUR/JPY Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.