- Analytics

- News and Tools

- Market News

- AUD/USD slumping back into 0.6600 as Aussie backslides ahead of RBA rate call

AUD/USD slumping back into 0.6600 as Aussie backslides ahead of RBA rate call

- The AUD/USD is down over a full percent in one-sided action on Monday.

- The Aussie has seen Friday’s gains entirely pared away as markets bid up the US Dollar.

- RBA broadly expected to stand pat on rates once more as the Australian economy weakens.

The AUD/USD has steadily fallen on Monday, backsliding a full percent plus extra and paring back last week’s late rally, sending the Aussie (AUD) back towards the 0.6600 handle against the US Dollar (USD).

The Reserve Bank of Australia (RBA) is broadly expected to hold interest rates at 12-year highs of 4.35% for the December rate call, scheduled to be announced at 03:30 GMT.

See More: Australia Interest Rate Decision Preview

Market focus will be on RBA Governor Michele Bullock’s ensuing press conference as investors attempt to glean as much forward guidance out of the RBA’s statements as possible.

The RBA gave an additional 25 basis point rate hike in November as inflation continues to plague the Australian economy, but hampered economic growth and unsteady domestic market pressures are leaving the RBA stuck between a rock and a hard place.

RBA expected to hold at 4.35%

Further rate hikes threaten to further destabilize the Australian economy, and too little action on rates in the face of still-high inflation threatens to exacerbate inflation in a self-fulfilling prophecy cycle of prices running ahead of consumer expectations of further inflation.

With Aussie markets focusing squarely on the RBA, the Aussie central bank’s rate statement will dictate the near-term flows of the AUD, but near-term moves will be quickly capped off heading into the mid-week as investors gear up for 2023’s final US Nonfarm Payrolls print due on Friday.

AUD/USD Technical Outlook

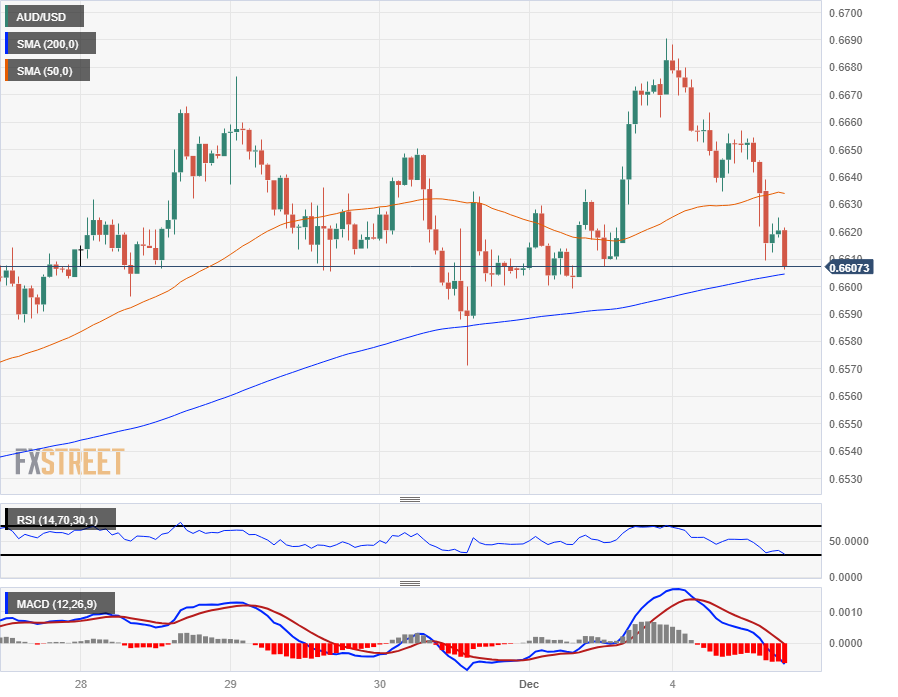

The Aussie’s Monday backslide sees 0.6600 back on the table, wiping away Friday’s bull rally into 0.6690. The AUD/USD’s inability to reclaim the 0.6700 handle is exacerbating downside flows, and the pair is set for an intraday clash with the 200-hour Simple Moving Average (SMA).

The AUD/USD has seen a bullish recovery in recent weeks, climbing nearly 7% from October’s bottom bids at 0.6270. Further bullish topside is looking limited with prices struggling to develop momentum at the 200-day SMA, but bidders will be looking for an upside continuation if an extended decline sees the pair challenging the 50-day SMA rising into 0.6450.

AUD/USD Hourly Chart

AUD/USD Daily Chart

AUD/USD Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.