- Analytics

- News and Tools

- Market News

- USD/JPY dips below Ichimoku cloud on weak US PMI, Powell speech

USD/JPY dips below Ichimoku cloud on weak US PMI, Powell speech

- USD/JPY experiences a 0.52% decline in the North American session.

- A lower-than-expected ISM manufacturing reading for November weighed on the US Dollar.

- Fed Chair Jerome Powell acknowledges some easing in inflation but emphasizes that core inflation remains high and monetary policy decisions will be data dependent.

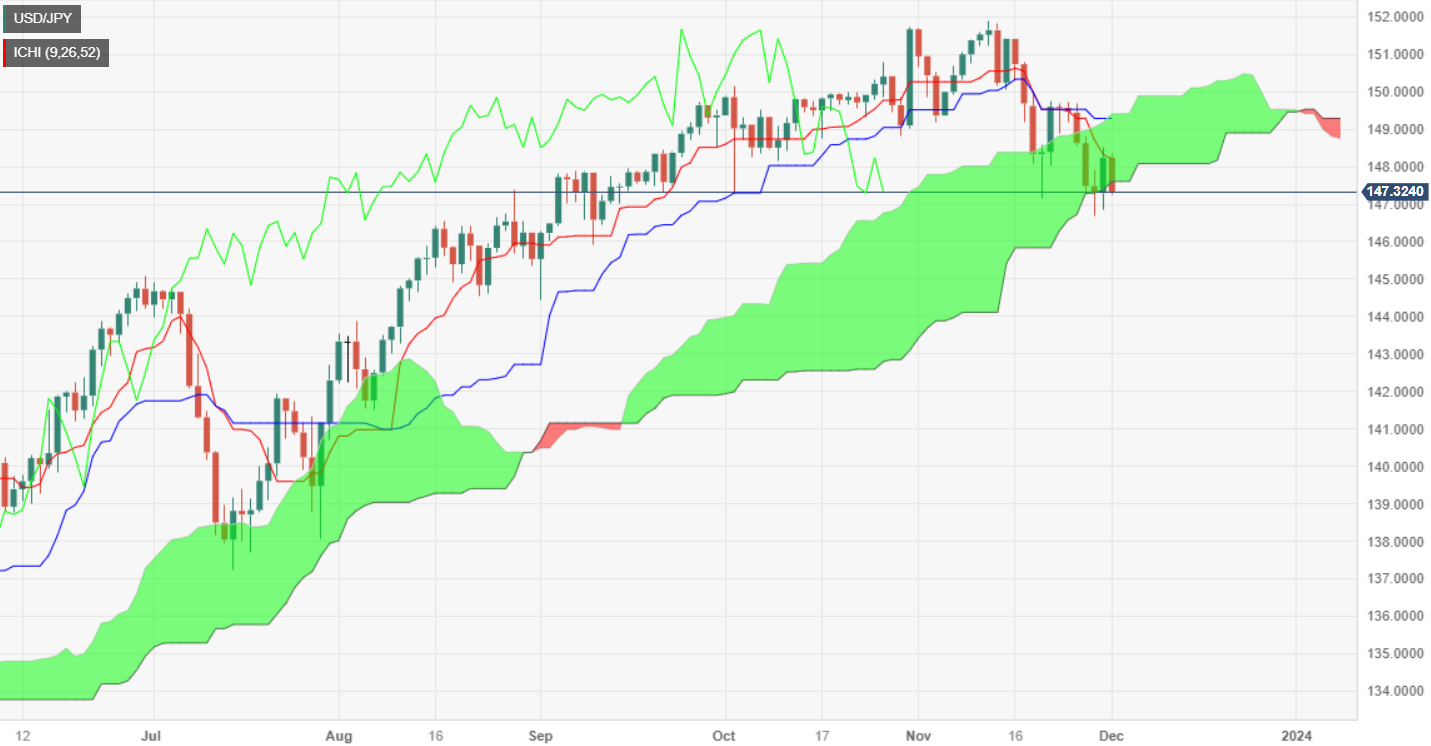

The USD/JPY trims some of its Thursday gains on Friday, diving below the Ichimoku Cloud (Kumo) early in the North American session. At the time of writing, the pair is exchanging hands at 147.35, registering losses of 0.58%.

USD/JPY drops due to a subdued ISM Manufacturing PMI, despite Powell’s neutral stance

The sudden US Dollar weakness was triggered by a softer Institute for Supply Management (ISM) reading for November, which showed that business activity remained subdued at 46.7, unchanged from the October reading, and the 13th straight month standing below 50, the expansion/contraction threshold, which indicates the manufacturing sector is underperforming. Estimates for the ISM were at 47.6, while some subcomponents of the index like Employment showed the labor market is easing. Regarding inflationary pressures, the prices subcomponent jumped from 45.1 to 49.9, which could prevent Federal Reserve’s (Fed) officials from reducing monetary policy.

In the meantime, Fed Chairman Jerome Powell is crossing the newswires. In prepared remarks, he acknowledged that inflation has eased, but core inflation is too high. He added that he needs to see more progress on lowering inflation to its 2% target. He said that rates are restrictive but it’s “premature” to say that monetary policy is restrictive enough. Chair Powell said decisions would be made meeting by meeting decisions.

On the Japanese front, the Jibun Bank Manufacturing PMI was 48.3 at contractionary territory, above estimates but below October’s 48.7. in the meantime, the Japanese labor market remains tight as the unemployment rate fell to 2.5% in October, data showed on Friday.

USD/JPY Price Analysis: Technical outlook

The downtrend remains in place, but the USD/JPY break below the Kumo could accelerate prices to fall toward the 146.00 figure. A daily close below 147.60, the bottom of the cloud, could open the door to test 147.00. A breach of the latter would expose the September 11 daily low of 145.89, before prices slump to September’s 1 swing low at 144.43. On the other hand, if buyers keep exchange rates inside the Kumo, that could pave the way for consolidation.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.