- Analytics

- News and Tools

- Market News

- EUR/GBP grinds back down into 0.8750

EUR/GBP grinds back down into 0.8750

- The Euro is slipping back against the Pound Sterling in thin Monday action.

- EUR/GBP testing back into 0.8750 as momentum drains out.

- EU, UK PMIs due later in the week.

The EUR/GBP is falling back to the 0.8750 level after last week's failed run at a fresh high. Markets dubbed the Euro (EUR) the weaker currency against the Pound Sterling (GBP), sending the EUR/GBP back down at the start of the trading week.

The economic calendar has a thin showing for both currencies in the early half of the week, leaving traders to sit and wait for Thursday's Purchasing Managers' Index (PMI) showings for both the EUR and the GBP.

European PMIs are expected to show a slight increase, while UK PMIs are forecast to stick tighter to previous readings.

The EU HCOB Composite PMI for November is expected to tick upwards from 46.5 to 46.9, with both the Services and Manufacturing components expected to show slight improvement.

The UK S&P Global/CIPS November Composite PMI is expected to hold flat at 48.7, with the Services component expected to hold at 49.5 and the Manufacturing component is forecast to show only a slight improvement from 44.8 to 45.0.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the weakest against the Japanese Yen.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.32% | -0.42% | 0.06% | -0.70% | -1.04% | -0.70% | -0.12% | |

| EUR | 0.32% | -0.11% | 0.38% | -0.38% | -0.72% | -0.38% | 0.20% | |

| GBP | 0.42% | 0.11% | 0.49% | -0.27% | -0.60% | -0.27% | 0.31% | |

| CAD | -0.06% | -0.38% | -0.50% | -0.76% | -1.10% | -0.76% | -0.16% | |

| AUD | 0.69% | 0.38% | 0.28% | 0.76% | -0.34% | 0.00% | 0.58% | |

| JPY | 1.04% | 0.72% | 0.37% | 1.09% | 0.34% | 0.34% | 0.91% | |

| NZD | 0.70% | 0.38% | 0.27% | 0.76% | 0.00% | -0.34% | 0.58% | |

| CHF | 0.11% | -0.21% | -0.31% | 0.18% | -0.59% | -0.93% | -0.58% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

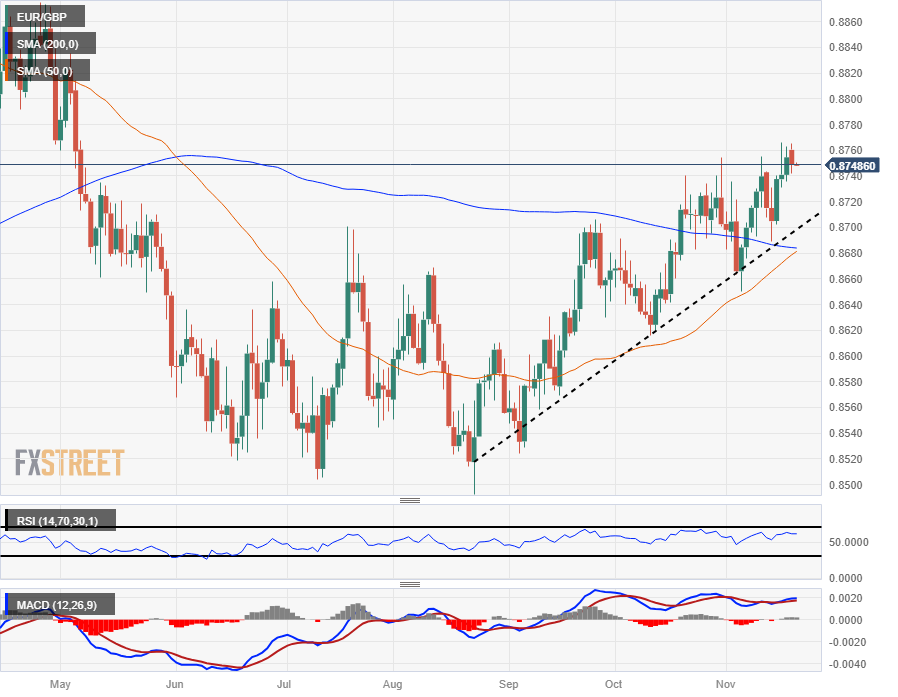

EUR/GBP Technical Outlook

Despite Monday's minor decline, the Euro remains well-bid against the Pound Sterling, and the pair is trading above the 200-day Simple Moving Average (SMA) that continues to grind lower into 0.8680. The Euro has risen over 3% against the Pound Sterling since August's swing low into the 0.8500 region.

The EUR/GBP pair set a fresh six-month high last week of 0.8766, and short-sellers will be looking to push the pair back below a rising trendline, while bidders will be trying to price in a technical floor from a bullish crossover of the 50- and 200-day SMAs.

EUR/GBP Daily Chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.