- Analytics

- News and Tools

- Market News

- Canadian Dollar falling back as markets pivot out of Loonie

Canadian Dollar falling back as markets pivot out of Loonie

- The Canadian Dollar is seeing pullback as investors seek Greenback pastures.

- Canada Trade Balance improves but fails to inspire CAD bidding.

- Broad-market risk sentiment is wobbling, sending safe havens higher.

The Canadian Dollar (CAD) is moving lower, giving up last week’s gains against the US Dollar (USD) as broader market sentiment twists on Tuesday. A large miss for Chinese trade data coupled with hawkish statements from Federal Reserve (Fed) officials are jointly hampering risk appetite.

Canada trade balance figures improved over previous figures, Exports and Imports both printed slight gains for September. Canadian Exports edged higher to $67.03 billion from $65.28 billion (revised upward from $64.56 billion), while Imports saw minor gains to $64.99 billion from August’s $64.33 billion, which was also revised higher from $63.84 billion.

Canada’s overall International Merchandise Trade for September increased to CAD $2.04 billion from August’s $950 million, revised higher from $720 million.

Daily Digest Market Movers: Canadian Dollar paring back recent gains as markets rotate into US Dollar once more

- The CAD is losing steam with global markets seeking safe harbor as last week’s risk-on mood evaporates.

- A miss for China trade figures sent early Tuesday’s markets into the red after Chinese Trade Balance numbers unexpectedly declined.

- Hawkish Fed appearances are chipping away at last week’s rally as Fed officials reiterate that the US central bank is not pre-committed to an end of rate hikes.

- Crude Oil prices are slumping in risk-off flows, further cutting support from the CAD.

- Russia reaffirmed their production reduction, potentially extending through next year’s first quarter, to little Crude Oil market effect.

- The US is acquiring additional Crude shipments to shore up national reserves, and throughput at both Chinese and US refineries is missing demand expectations, leaving more barrels in the pipeline than expected.

- US Treasury yields are easing, 10-year T-note down to 4.587% from 4.66%.

Technical Analysis: Canadian Dollar heading back to 1.3800 as US Dollar bids return

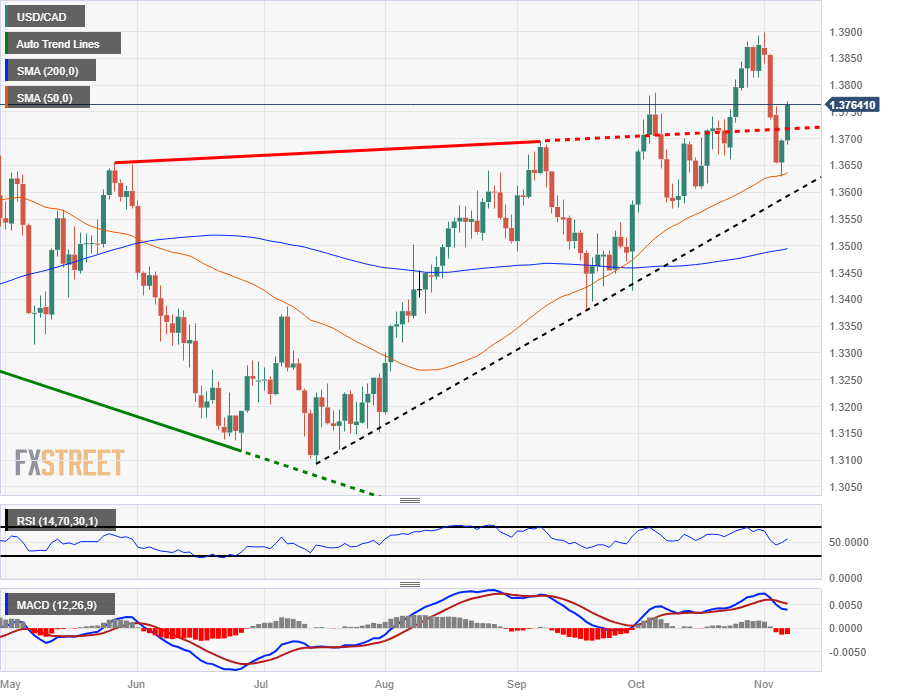

The Canadian Dollar (CAD) has pared back about half of last week’s gains against the US Dollar (USD), sending the USD/CAD back toward the 1.3800 handle after taking a clean bounce from the 50-day Simple Moving Average (SMA) near 1.3630.

A bullish continuation from here will see the pair marking an accelerating pace of higher lows as the USD/CAD begins to break away to the topside from a bullish trendline rising from July’s bottom bids near 1.3100. The near-term technical ceiling for bullish Greenback bidders sits at the last swing high into the 1.3900 handle.

The US Dollar is up over 5% against the Loonie from 2023’s low bids of 1.3092 and up over 1.5% on the year.

USD/CAD Daily Chart

Canadian Dollar FAQs

What key factors drive the Canadian Dollar?

The key factors driving the Canadian Dollar (CAD) are the level of interest rates set by the Bank of Canada (BoC), the price of Oil, Canada’s largest export, the health of its economy, inflation and the Trade Balance, which is the difference between the value of Canada’s exports versus its imports. Other factors include market sentiment – whether investors are taking on more risky assets (risk-on) or seeking safe-havens (risk-off) – with risk-on being CAD-positive. As its largest trading partner, the health of the US economy is also a key factor influencing the Canadian Dollar.

How do the decisions of the Bank of Canada impact the Canadian Dollar?

The Bank of Canada (BoC) has a significant influence on the Canadian Dollar by setting the level of interest rates that banks can lend to one another. This influences the level of interest rates for everyone. The main goal of the BoC is to maintain inflation at 1-3% by adjusting interest rates up or down. Relatively higher interest rates tend to be positive for the CAD. The Bank of Canada can also use quantitative easing and tightening to influence credit conditions, with the former CAD-negative and the latter CAD-positive.

How does the price of Oil impact the Canadian Dollar?

The price of Oil is a key factor impacting the value of the Canadian Dollar. Petroleum is Canada’s biggest export, so Oil price tends to have an immediate impact on the CAD value. Generally, if Oil price rises CAD also goes up, as aggregate demand for the currency increases. The opposite is the case if the price of Oil falls. Higher Oil prices also tend to result in a greater likelihood of a positive Trade Balance, which is also supportive of the CAD.

How does inflation data impact the value of the Canadian Dollar?

While inflation had always traditionally been thought of as a negative factor for a currency since it lowers the value of money, the opposite has actually been the case in modern times with the relaxation of cross-border capital controls. Higher inflation tends to lead central banks to put up interest rates which attracts more capital inflows from global investors seeking a lucrative place to keep their money. This increases demand for the local currency, which in Canada’s case is the Canadian Dollar.

How does economic data influence the value of the Canadian Dollar?

Macroeconomic data releases gauge the health of the economy and can have an impact on the Canadian Dollar. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the CAD. A strong economy is good for the Canadian Dollar. Not only does it attract more foreign investment but it may encourage the Bank of Canada to put up interest rates, leading to a stronger currency. If economic data is weak, however, the CAD is likely to fall.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.