- Analytics

- News and Tools

- Market News

- EUR/JPY hits just shy of 161.00, etches in a 15-year high

EUR/JPY hits just shy of 161.00, etches in a 15-year high

- The EUR/JPY is bidding into its highest prices since 2008.

- Dovish BoJ pulling the rug out from underneath Japanese Yen.

- EU Sentix Investor Confidence improves, EU Retail Sales in the pipe.

The EUR/JPY is clipping into new 15-year highs near 161.00, coming within inches of the price handle in Monday trading. The pair hit high bids of 160.98, and further upside could be on the cards for the Euro (EUR) as the Japanese Yen (JPY) flounders under the weight of a dovish Bank of Japan (BoJ).

The European Sentix Investor Confidence Index improved for November to -18.6. October previously printed at -21.9, its second-worst reading in a year.

Eurozone Sentix Investor Confidence Index improves to -18.6 in November vs. -21.9 prior

Next up of note will be European Retail Sales on Wednesday, with the annualized figure for September expected to accelerate to the downside from -2.1% to -3.2%.

BoJ: Another disappointment for JPY bulls – TDS

The Bank of Japan (BoJ) hit Yen markets with further dovish comments, with BoJ Governor Kazuo Ueda noting that the BoJ is firmly dedicated to hyper-easy momentary policy. The Japanese central bank continues to remain concerned about inflation and wage growth both declining below the BoJ's minimum targets in the future.

A dovish BoJ stance is pummeling the Yen, sending it to multi-year lows.

BoJ Governor Ueda: Will continue massive bond buying even under new operation decided last week

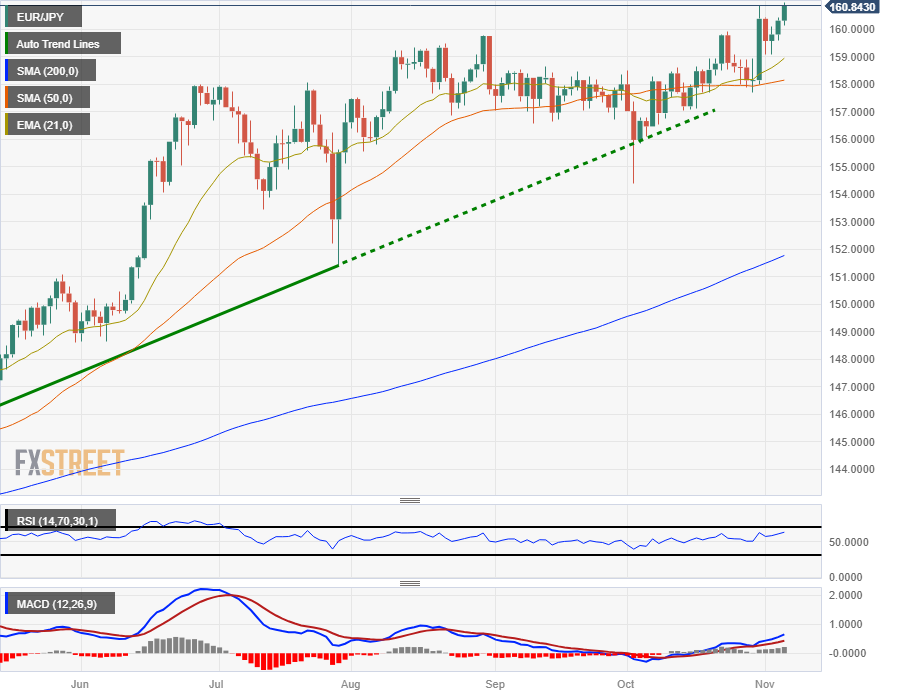

EUR/JPY Technical Outlook

The EUR/JPY tipped into a 15-year high near the 161.00 handle on Monday, climbing as the JPY gets sent into the floorboards across the broad marketspace.

The pair has accelerated away from the 50-day Simple Moving Average (SMA) currently lifting from 158.00, and little remains in the way of technical resistance with the pair tapping multi-year highs.

The EUR/JPY pair's recent consolidation has left technical oscillators hung along the midrange, and the Relative Strength Index (RIS), despite holding firmly in upper bound territory, still hasn't flashed overbought signals.

EUR/JPY Daily Chart

EUR/JPY Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.