- Analytics

- News and Tools

- Market News

- EUR/GBP rebounding from last week's tumble, UK Gross Domestic Product looms ahead

EUR/GBP rebounding from last week's tumble, UK Gross Domestic Product looms ahead

- The Euro is seeing limited recovery against the Pound Sterling after a half percent backslide last Friday.

- The EUR/GBP tested into a 14-day low on Monday before bouncing back.

- Euro traders to keep an eye out for EU Retail Sales in the mid-week.

The EUR/GBP is seeing a rebound on Monday after tipping into a 14-day low of 0.8650, heading for 0.8700 as the Euro recovers following an improved reading of the Euro Sentix Investor Confidence.

The EUR/GBP kicked off the new trading week slipping to a 3-week low before an improvement in the Sentix Investor Confidence indicator, which reversed course from September's -21.9 to print at -18.6 for October. The indicator remains deeply in bearish territory despite the improvement, and Euro upside gains are set to be limited.

Pound Sterling traders will be looking out for any drastic swings in BRC Like-For-Like Retail Sales due on Tuesday, which is expected to decline from 2.8% to 2.4% for the year into October.

Wednesday will see a speech from Bank of England (BoE) Governor Andrew Bailey, while the Euro side sees EU Retail Sales, which is expected to accelerate into the downside for the year into September, from -2.1% to -3.2%.

Room to moderate hawkish expectations for the UK – TDS

The big barn-buster for UK data this week will be UK Gross Domestic Product (GDP), slated to cap off the trading week on Friday.

UK quarterly Gross Domestic Product last printed at 0.2% for the 2nd quarter, and the 3rd quarter print is forecast to slump back into negative territory at -0.1%.

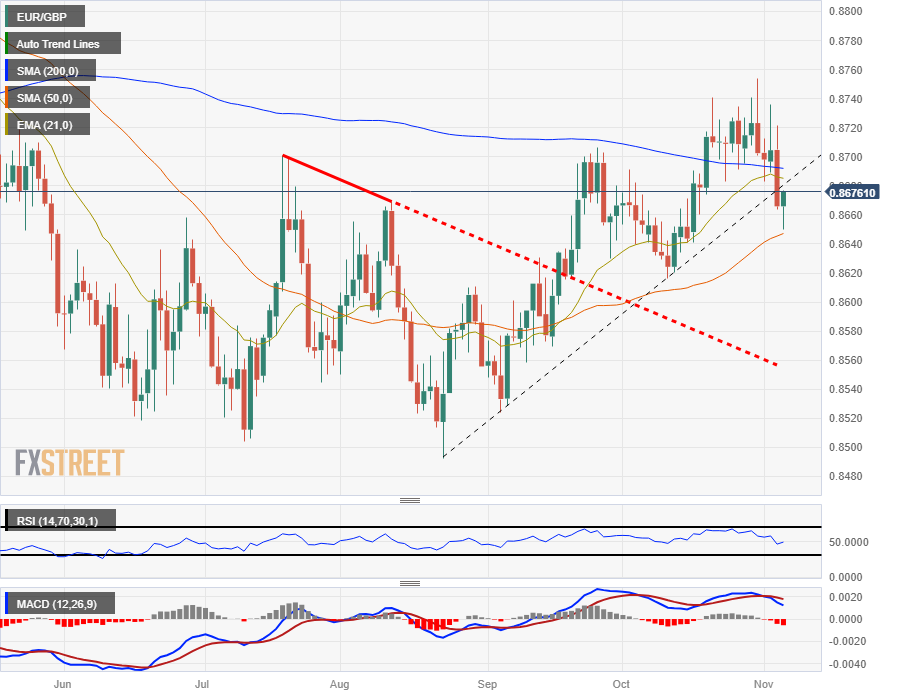

EUR/GBP Technical Outlook

Friday's Euro backslide saw the EUR/GBP tumble through a rising trendline from late August's swing low below 0.8500, and Monday's Euro rebound could see the pair set to re-challenge the trendline break, with the 200-day Simple Moving Average (SMA) acting as a hard barrier just below 0.8700.

The EUR/GBP saw a Monday rebound from just above the 50-day SMA near 0.8650, and a bullish continuation will see a higher lower etched in from here, while a bearish reversal will see a challenge of the previous swing low near 0.8620.

EUR/GBP Daily Chart

EUR/GBP Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.