- Analytics

- News and Tools

- Market News

- Euro keeps the price action subdued around 1.0550 ahead of data

Euro keeps the price action subdued around 1.0550 ahead of data

- The Euro looks offered vs. the US Dollar on Monday.

- European stocks open the week in a mixed tone.

- Germany’s flash GDP Growth Rate, Inflation Rate take centre stage.

Thus far, the Euro (EUR) appears vulnerable against the US Dollar (USD), prompting EUR/USD to trade within a tight scope around the mid-1.0500s early in the European morning on Monday.

In the interim, the Greenback manages to maintain its position in the upper limits of the recent range near 106.70, when calculated by the USD Index (DXY). The so-far modest strengthening of the index coincides with an equally languid climb in US yields across diverse timeframes.

Within the realm of monetary policy, a growing consensus has materialized amongst market participants that the Federal Reserve (Fed) will preserve its present stance of retaining interest rates unchanged at the upcoming meeting on November 1. The potential remains, however, for a potential shift in rates come December, a view that seems well reinforced by the resilience of the US economy and still elevated inflation levels.

Regarding the European Central Bank (ECB), no surprises arose at its event on October 26 following a unanimous decision to keep its interest rates unchanged. President Christine Lagarde reiterated once more that work remains to be done pertaining to inflation, while it is anticipated inflation will persist too elevated for too extensive a duration. Adding a bearish undertone to the meeting, Lagarde acknowledged that risks to the outlook appear skewed downward.

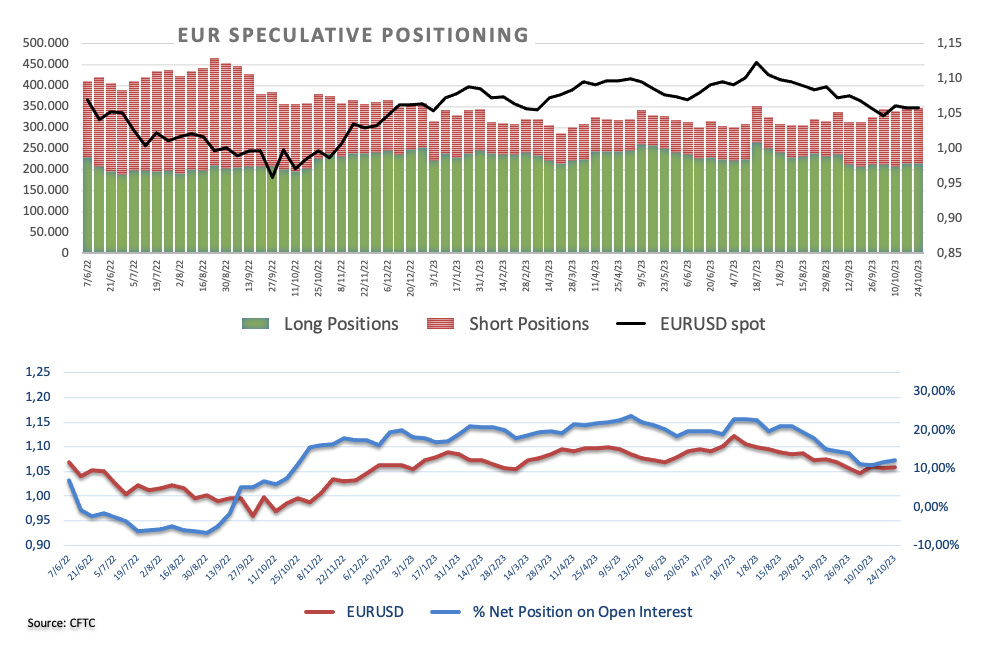

From the speculative community’s viewpoint, net longs in the single currency increased to four-week highs in the week ended on October 24 according to the CFTC report. The period under scrutiny coincides with some consolidation in the pair against the backdrop of persistent resilience of the US economy and rising cautiousness prior to the ECB event.

Busy day in the euro calendar, as Germany’s advanced figures for the GDP Growth Rate are due seconded by preliminary Inflation Rate for the month of October. In the broader euro area, final Consumer Confidence prints come first seconded by Economic Sentiment and Industrial Sentiment.

Daily digest market movers: Euro faces some downside pressure on USD strength

- The EUR remains on the defensive vs. the USD.

- US and German yields appear mixed at the beginning of the week.

- There is still scope for the Fed to raise rates in December.

- The ECB is seen extending its pause until H2 2024.

- The Middle East conflict threatens to extend to other regions.

- Investors continue to factor in further FX intervention around USD/JPY.

- Retail Sales in Australia expanded more than expected tin September.

- Preliminary Inflation Rate in Spain came in at 3.5% YoY in October.

Technical Analysis: Euro does not rule out extra losses

EUR/USD looks poised to extend the price action around the mid-1.0500s at the beginning of the week.

In case sellers push harder, EUR/USD could revisit the weekly low of 1.0495 (October 13), ahead of the lowest level in 2023 at 1.0448 (October 15), and the round number of 1.0400.

On the upside, the immediate short-term target for the pair emerges at the October high of 1.0694 (October 24), a level that appears reinforced by the proximity of the temporary 55-day SMA (1.0673). Further up comes the weekly top of 1.0767 (September 12) before the key 200-day SMA at 1.0810, and another weekly high of 1.0945 (August 30), all ahead of the psychological level of 1.1000. Beyond this zone, the pair might face resistance at the August top at 1.1064 (August 10), prior to the weekly peak of 1.1149 (July 27) and the 2023 high at 1.1275 (July 18).

So far, the pair’s outlook is expected to remain negative while below the critical 200-day SMA.

Euro FAQs

What is the Euro?

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day.

EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

What is the ECB and how does it impact the Euro?

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa.

The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

How does inflation data impact the value of the Euro?

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control.

Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

How does economic data influence the value of the Euro?

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency.

A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall.

Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

How does the Trade Balance impact the Euro?

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period.

If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.