- Analytics

- News and Tools

- Market News

- USD Index appears side-lined around 106.60, focus is on Fed, NFP

USD Index appears side-lined around 106.60, focus is on Fed, NFP

- The index trades without direction around 106.60.

- Cautiousness should prevail ahead of the FOMC event.

- Nonfarm Payrolls will be the salient release later in the week.

The USD Index (DXY), which tracks the greenback vs. a bundle of its main competitors, extends the consolidative mood around the 106.60 at the beginning of the week.

USD Index remains capped by 107.00

The index trades in a vacillating mood on Monday on the back of increasing prudence among investors in light of key upcoming events in the US economy, namely: the Federal Reserve’s interest rate decision (Wednesday) and the publication of October’s Nonfarm Payrolls (Friday).

In the meantime, US yields navigate in an equally directionless pattern in the upper end of the recent range, particularly in the belly and the short end of the curve vs. some loss of momentum in the short end.

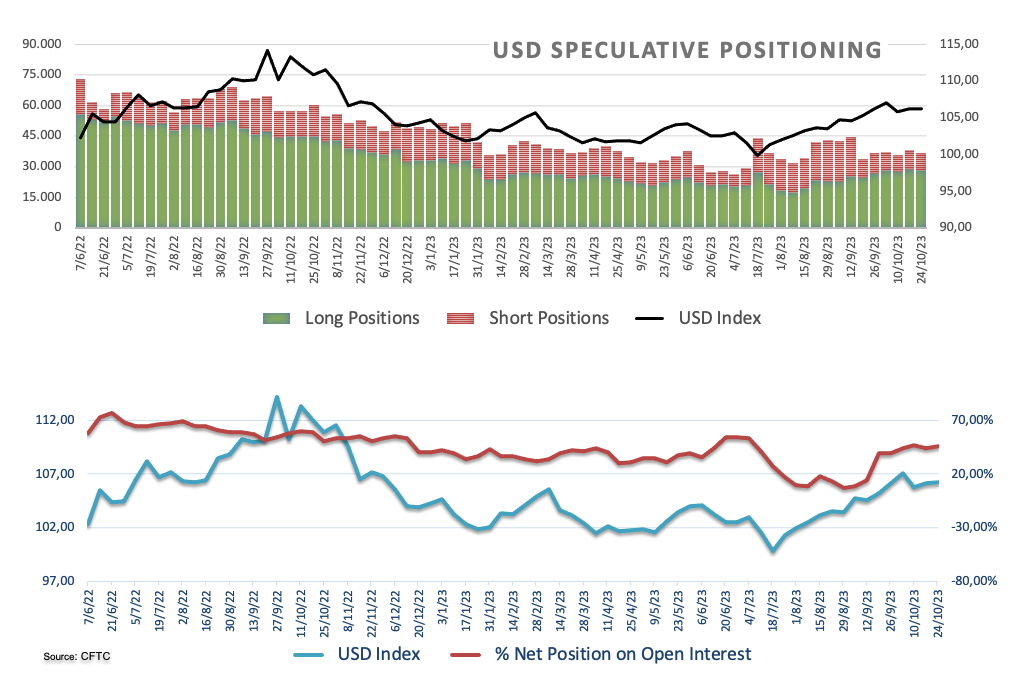

On another front, speculators increased their USD net longs positions to the highest level since mid-December 2022 during the week ended on October 24, as per the CFTC report. During this period, the greenback remained side-lined amidst speculation that the Fed might extend its restrictive stance for longer than anticipated, a view that appeared propped up by auspicious results from US fundamentals.

There will be no scheduled data releases on Monday in the US calendar.

What to look for around USD

The upside momentum in the index seems to have met some initial obstacle just below the 107.00 barrier so far this week.

In the meantime, support for the dollar keeps coming from the good health of the US economy and still elevated inflation, which morphs into higher yields and underpins the renewed tighter-for-longer narrative from the Federal Reserve.

Key events in the US this week: Employment Cost, FHFA House Price Index, CB Consumer Confidence (Tuesday) – MBA Mortgage Applications, ADP Report, Final Manufacturing PMI, ISM Manufacturing, Construction Spending, FOMC Interest Rate Decision, Powell press conference (Wednesday) - Initial Jobless Claims, Factory Orders (Thursday) – Nonfarm Payrolls, Unemployment Rate, Services PMI, ISM Services PMI (Friday).

Eminent issues on the back boiler: Persistent debate over a soft or hard landing for the US economy. Speculation of rate cuts in late 2024. Geopolitical effervescence vs. Russia and China. Potential spread of the Middle East crisis to other regions.

USD Index relevant levels

Now, the index is up 0.06% at 106.64 and the breakout of 106.88 (weekly high October 26) could expose 107.34 (2023 high October 3) and finally 107.99 (weekly high November 21 2022). On the downside, initial contention aligns at 105.36 (monthly low October 24) ahead of 104.42 (weekly low September 11) and then 103.41 (200-day SMA).

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.