- Analytics

- News and Tools

- Market News

- GBP/JPY sees additional losses for Friday, ends the week near recent lows at 181.60

GBP/JPY sees additional losses for Friday, ends the week near recent lows at 181.60

- The GBP/JPY extended losses into Friday trading, tapping into 181.27 and ending the week on the low side.

- The Pound Sterling rose to 183.82 in the mid-week, but bad data buds and souring market sentiment sent the Guppy back into the week's lows.

- Coming up next week: UK labor and wages figures on Tuesday, UK CPI on Wednesday.

The GBP/JPY chalked in another red bar to settle Friday, bringing the pair back into range of the week's lows set on Monday near 181.25, and the closing bell finds the Guppy trading into 181.60.

The pair spent the first half of the trading week on the climb, tapping into four-week highs at 183.82 before market turned broadly risk-off and sent the Pound Sterling (GBP) sharply lower against the Yen (JPY), sending the GBP/JPY down over 1% to end the trading week in the red, down about 60 pips.

UK economic indicators broadly came in red for Thursday, with Manufacturing Production for August declining 0.8%, down from the forecast -0.4% and seeing a mild rebound from the previous -1.2%, which was revised sharply down from -0.8%.

Coming up next week will be a quiet Monday on the Guppy's calendar, with Tuesday opening up with a speech from the Bank of England's (BoE) Huw Pill, followed by labor and wage data, with the UK's Employment Change for August forecast to moderate from -207K to -195K, and Average Earnings are expected to hold steady at 7.8% for the quarter into August.

After that will be the big read for the week on the Pound Sterling side with UK Consumer Price Index (CPI) inflation figures on Wednesday, and investors will be looking for CPI inflation for September to tick upwards slightly from 0.4% to 0.3% as inflation pressures continue to weigh on the United Kingdom.

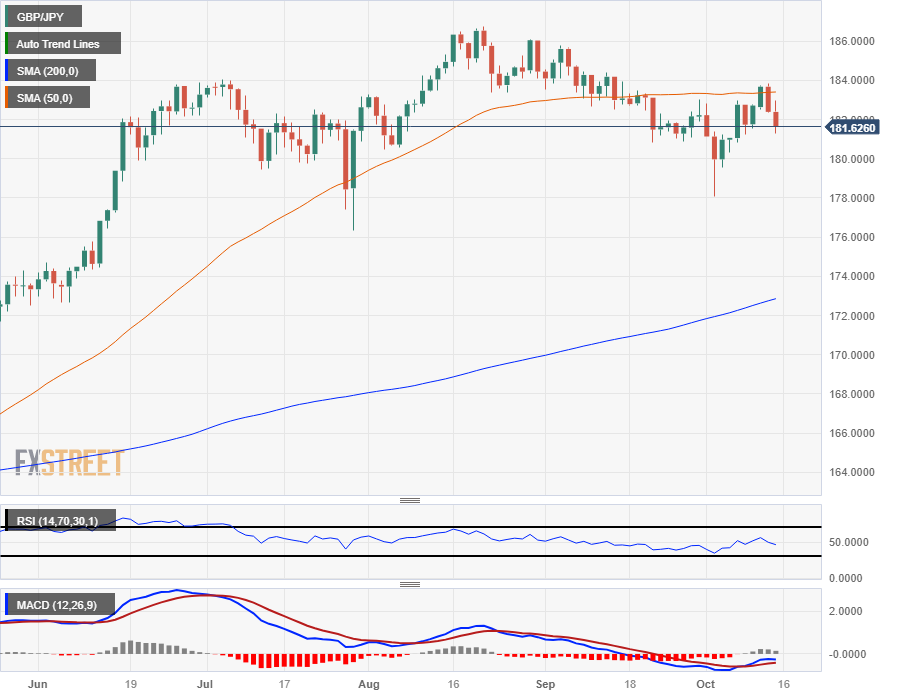

GBP/JPY Technical Outlook

The GBP/JPY slipped below the 200-hour Simple Moving Average (SMA) in Friday's trading, declining from the day's early high of 182.94.

On the daily candlesticks the GBP/JPY remains well-bid, albeit with some bearish cracks starting to show; the 50-day SMA is capping off near-term price action from 183.40.

The 180.00 handle has been holding steady as a technical floor for the Guppy, but this week's turnaround from just south of 184.00 could see the GBP/JPY facing a bearish extension if bidders aren't able to scrape together enough confidence to pull the pair back up the charts.

GBP/JPY Daily Chart

GBP/JPY Technical Levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.