- Analytics

- News and Tools

- Market News

- EUR/GBP falling back from 0.8700 as markets gear up for EU CPI, UK GDP

EUR/GBP falling back from 0.8700 as markets gear up for EU CPI, UK GDP

- EUR/GBP backed down to 0.8660 on Wednesday.

- Economic calendar kicks off the end-week with EU CPI & UK GDP figures for Friday.

- Thursday to see the ECB's latest economic bulletin and September Consumer Confidence.

The EUR/GBP pulled back from recent highs to settle into 0.8660 after reaching a session peak of 0.8706.

The Euro (EUR) couldn't hang onto gains against the Pound Sterling (GBP) and lost the 0.8700 handle as markets gear up for the Thursday trading session.

The upcoming European market session will see the European Central Bank (ECB) drop their latest Economic Bulletin, which is published two weeks after each Governing Council meeting. Investors will find finer details of what the ECB discussed at the latest meeting, though market impact is likely to be limited after the ECB struck a notably dovish tone at their last meet.

The ECB has backed away from rate increases for the time being, and with the European economy on shaky ground it is unlikely that the central bank will be planning additional rate hikes any time soon.

Friday data dump sees EU CPI & UK GDP

Thursday will also see EU Consumer Confidence figures for September, and markets are forecasting the print to match the previous month's release at -17.8 as European consumers continue to fear growing recession conditions within the EU.

Friday kicks off a bumper economic calendar docket with UK Gross Domestic Product (GDP) figures at 06:00 GMT, and second-quarter GDP growth is expected to hold steady with the previous print of 0.2%.

EU Consumer Price Index (CPI) inflation numbers will be dropping on Friday at 09:00 GMT, and markets are forecasting the annualized September CPI inflation reading to clock in a half-percent decline from 5.3% to 4.8%.

EUR/GBP technical outlook

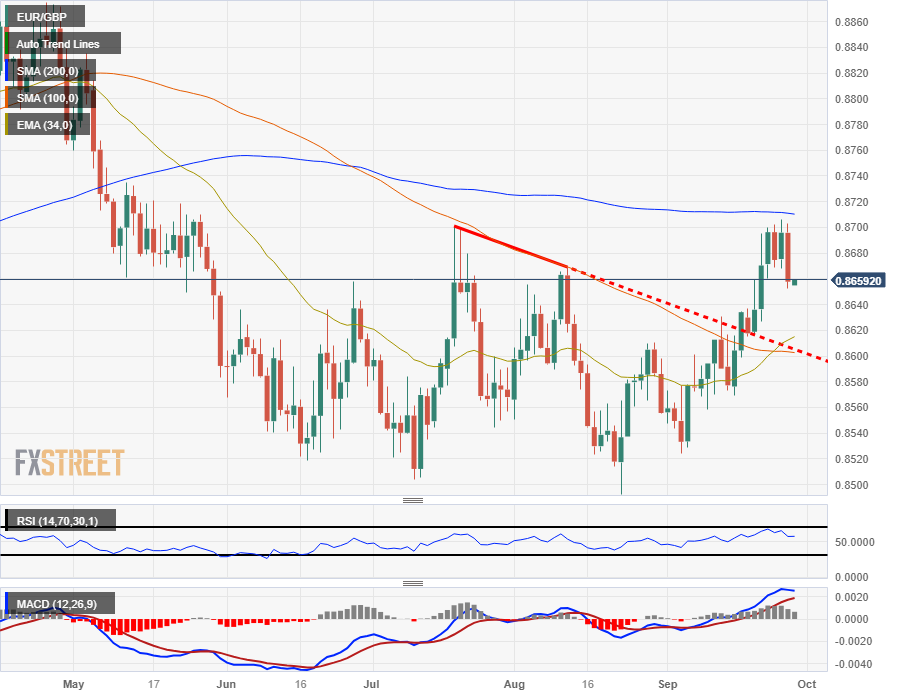

The EUR/GBP has slipped back to the 0.8660 level in intraday trading after losing the day's high above 0.8700, and daily candlesticks see the pair facing a rejection from the 200-day Simple Moving Average (SMA) in the near-term, currently pricing in near 0.8710.

The EUR/GBP is up over 1.5% from the last swing low into 0.8530, breaking cleanly through the descending trendline from July's failed run at the 0.8700 handle, a level that looks set to continue providing technical resistance as the Euro-Pound Sterling pair struggles to find long-term momentum.

EUR/GBP daily chart

EUR/GBP technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.