- Analytics

- News and Tools

- Market News

- USD/MXN surpasses 17.45 on high US T-bond yields, risk aversion

USD/MXN surpasses 17.45 on high US T-bond yields, risk aversion

- USD/MXN is on an uptrend, with the pair trading at 17.4904, driven by the hawkish stance of the US Federal Reserve.

- US Federal Reserve's projections indicate higher interest rates in the coming years, with rates expected to be 5.6% in 2023 and 5.1% in 2024.

- USD/MXN traders are eyeing Thursday's Bank of Mexico (Banxico) interest rate decision.

The Mexican Peso (MXN) slips further against the US Dollar (USD) amid risk aversion and high US bond yields, driving price action in the Forex markets. Expectations that interest rates in the United States (US) would remain higher for an extended period underpins the USD. The USD/MXN is trading at 17.4904 after hitting a new two-week high.

USD/MXN hits a new two-week high on the Fed’s hawkish stance, while Banxico is set to keep rates unchanged

The USD/MXN resumed its uptrend after the US Federal Reserve (Fed), despite holding rates unchanged, delivered a hawkish hold, as revealed by the “dot-plots” in the Summary of Economic Projections. Fed officials foresee rates at 5.6% in 2023 and 5.1% in 2024, higher than the 4.6% projected in June 2023.

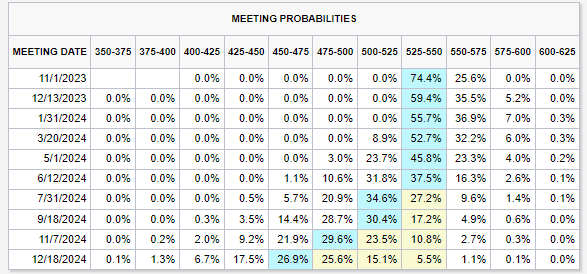

Consequently, US Treasury bond yields have skyrocketed since Wednesday, with the US 10-year benchmark note rate gaining 4.34% or 19 basis points, currently at 4.548%. Although the CME FedWatch Tool does not price in another hike by the US central bank, Fed’s policymakers emphasized that curbing inflation towards its 2% goal is their primary objective.

Source: CME FedWatch Tool

Recently, Fed officials stressed that although a soft landing could be achieved, further tightening is needed, as the Minnesota Fed President Neil Kashkari expressed on Tuesday. He said, “After potentially one more 25-basis-point federal funds rate increase later this year, the FOMC holds policy at this level long enough to bring inflation back to target in a reasonable period of time.”

Data-wise, Consumer Confidence, as the Conference Board (CB) reported, reached a four-month low. This decline is attributed to a deteriorating economic outlook for the overall economy.

Earlier, housing data was revealed, as August’s Building Permits in the US increased from July's 1.443 million to 1.541 million, indicating continued growth in construction. However, the housing market shows signs of weakness as New Home Sales plummeted by -8.7% compared to the 8% increase in July. The decline is mainly due to higher mortgage rates, as the Federal Reserve embarked on an aggressive tightening cycle that witnessed interest rates hit the 5.25%-5.505 area.

On the Mexican front, the lack of economic data left USD/MXN traders adrift to US Dollar dynamics. However, ahead of the week, the agenda will feature the Balance of Trade, Unemployment Rate, and the Bank of Mexico (Banxico) interest rate decision. On the US front, the docket would feature Fed speakers led by Bowman, Durable Goods Orders, GDP, Initial Jobless Claims, and the Fed’s preferred gauge for inflation, Core PCE.

USD/MXN Price Analysis: Technical outlook

From a technical standpoint, the USD/MXN is neutral-biased but slightly tilted to the upside, but it remains shy of registering a break to a new cycle high. That would be achieved with the exotic pair claiming the September 7 high of 17.7074, exposing the 200-day moving average (DMA) on the upside at 17.8604, followed by the psychological 18.0000 figure. Once cleared, the next resistance would emerge at the April 5 high at 18.4010, followed by the March 24 high at 18.7968.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.