- Analytics

- News and Tools

- Market News

- GBP/USD halts decline ahead of Fed and BoE’s decisions, traders eye UK CPI

GBP/USD halts decline ahead of Fed and BoE’s decisions, traders eye UK CPI

- GBP/USD trades at 1.2395, showing slight gains, but remains below the key 1.2400 level.

- Federal Reserve expected to hold rates steady, while the Bank of England is anticipated to raise rates by 25 basis points.

- UK inflation data and the US Federal Reserve’s monetary policy decision are the key events to watch this week.

The British Pound (GBP) halts last week’s fall against the buck (USD) and prints minuscule gains vs. the latter despite rising US Treasury bond yields, as the UK and US central banks are expected to reaffirm its restrictive stance. Therefore, the GBP/USD is trading at 1.2395 after hitting a daily low of 1.2369, though it is still below the 1.2400 figure.

The British Pound steadies against the US Dollar as the Federal Reserve and the Bank of England are set to announce their monetary policy decisions

US equities extended its losses as sentiment deteriorates ahead of the central bank bonanza. The Federal Reserve is expected to hold rates unchanged amid the latest round of economic data, which revealed inflation in the consumer and producer side rose. In contrast, consumer spending expanded, though at a slower rhythm.

The Federal Funds Rate (FFR) would likely remain at the 5.25%-5.50% range, and in the same meeting, Fed officials would update their economic projections. In the June Summary of Economic Projections (SEP) the Fed anticipated 1% economic growth, a 4.1% unemployment rate, 3.2% PCE inflation, 3.9% core PCE inflation, and a peak FFR of 5.60%.

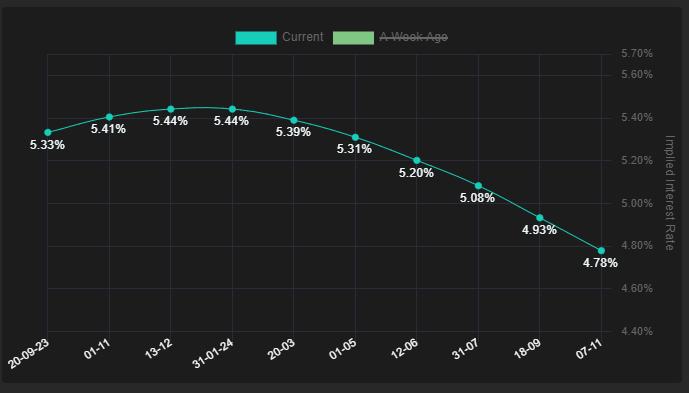

The swaps market shows the FFR would peak at current pricing, while estimates for the first rate cut are seen in July 2024, as shown by the picture below.

Source: Financialsource

Across the pond, the Bank of England’s (BoE) is foreseen to raise rates 25 bps to 6.50%, which, according to STIRs markets, would be the highest level expected. Even though the UK’s inflation has fallen from 11.1% to 6.8%, it’s the highest among developed countries, and it’s getting lowered at a slower pace than estimated. In addition, the economy in the UK is slowing more than economists forecast, which could deter the BoE from continuing to increase the Bank Rate amid risks of triggering a recession.

The UK economic docket will reveal inflation data ahead of the BoE’s decision on Wednesday. The Consumer Price Index (CPI) is expected to jump, while the core CPI would decelerate a tick. The week’s main event on the US front would be the Federal Reserve’s monetary policy decision, followed by the Fed Chair Jerome Powell press conference.

GBP/USD Price Analysis: Technical outlook

The downward bias remains intact, as shown by the daily chart. With the GBP/USD trading below the 50 and 200-day Moving Averages (DMAs) while drifting lower and printing successive series of lower highs and lows would keep the GBP/USD at around current levels. To shift its bias neutral, buyers must break the August 25 latest swing low at 1.2548; otherwise, further falls are expected, with sellers eyeing the May 25 low of 1.2308. Further downside is expected below that level, with the March 15 swing low at 1.2010.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.