- Analytics

- News and Tools

- Market News

- USD/ZAR Price Analysis: Bulls lose steam ahead of Fed decision, South African data

USD/ZAR Price Analysis: Bulls lose steam ahead of Fed decision, South African data

- USD/ZAR declined towards 18.933, near the 20-day SMA.

- South Africa reports August Inflation figures and July Retail Sales on Wednesday.

- Federal Reserve (Fed) is expected to pause but leave the door open for further hikes.

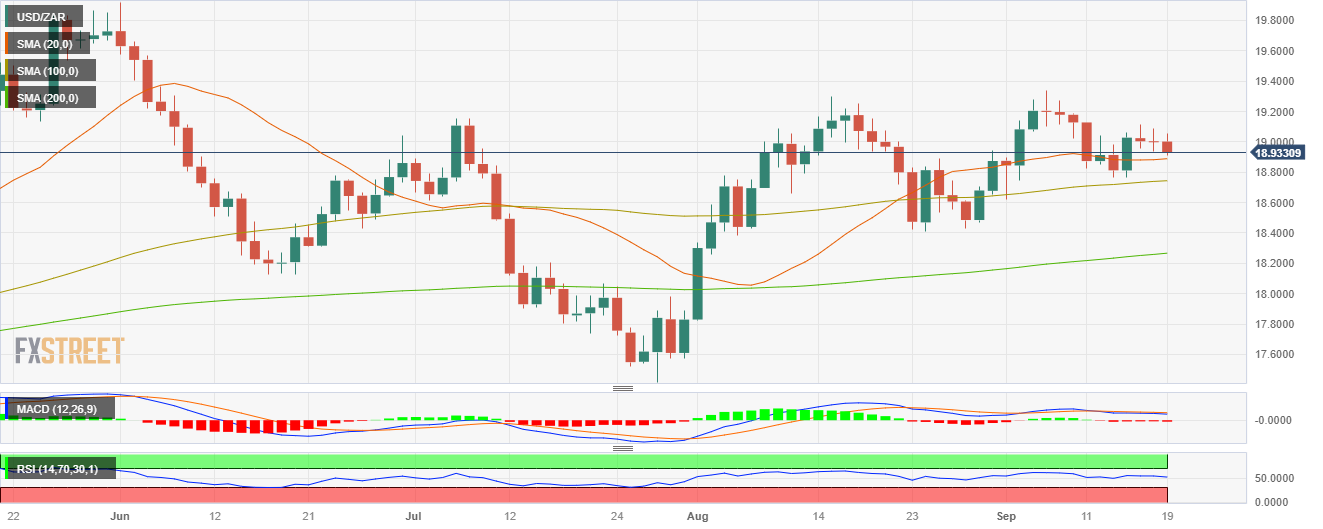

In Tuesday’s session, the USD/ZAR faced some selling pressure and declined to 18.933, down by 0.25%, and seems to be on its way to retest the 20-day Simple Moving Average at 18.880.

All eyes are on Wednesday. South Africa reports the August Consumer Price Index (CPI) with the headline figure expected to increase slightly to 4.8% YoY, while the core inflation rate is anticipated to remain stable at 4.7% YoY. Retail Sales from July are expected to come in at -1.0% YoY, compared to the 0.9% YoY decrease in June. Regarding the South African Reserve Bank meeting on Thursday, the decision will likely be to maintain its interest rates at 8.25% despite some previous expectations of a hike. As for now, for the next twelve years, markets aren’t foreseeing any hikes and discounts that the bank will maintain rates at 8.25%.

On the Fed’s side, Markets expect the bank to keep rates steady at 5.25-5.50%, but Chair Powell will likely show a hawkish tone and signal future rate hikes which could benefit the USD. Strong US economic performance, especially in services, and a mixed labour market suggest the Fed may leave room for one more hike to curb inflation risks.

USD/ZAR Levels to watch

The daily chart shows signs of bullish exhaustion for USD/ZAR. The Relative Strength Index (RSI) indicates a neutral stance above its midline, displaying a flat slope in the positive territory, while the Moving Average Convergence (MACD) presents neutral red bars. On the bigger picture, the pair is above the 20,100,200-day Simple Moving Average (SMA), suggesting that the bears are struggling to challenge the overall bullish trend.

Support levels: 18.880 (20-day SMA), 18.728 (100-day SMA). 18.500.

Resistance levels: 19.000, 19.050, 19.150.

USD/ZAR Daily Chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.