- Analytics

- News and Tools

- Market News

- AUD/NZD middles ahead of RBA minutes, NZ GDP in the pipe for Wednesday

AUD/NZD middles ahead of RBA minutes, NZ GDP in the pipe for Wednesday

- The AUD/NZD lacks conviction for Monday, ending near where it started.

- The RBA is due early Tuesday with a new face at the helm of the organization.

- NZ GDP, Aussie PMIs to round out the thin data week.

The AUD/NZD pair spread to the middle for Monday, unable to develop momentum as the Reserve Bank of Australia (RBA) comes in for a landing early Tuesday.

The RBA held rates on pause for the third straight month at the Australian central bank’s last meeting, which was also the last appearance of Phillip Lowe as the RBA’s Governor.

Former Deputy Governor Michelle Bullock replaces Lowe at the helm of the RBA today. Markets are broadly not expecting Bullock to rock the boat with any policy changes for her first appearance as the RBA’s Governor.

Lowe's out, Bullock's in at the RBA

Governor Bullock has already stated that the RBA’s stance moving forward will be firmly data-dependent, and Governor Bullock will be preoccupied with significant structural changes underway at the RBA.

At the urging of the Australian government, the RBA will be implementing operational adjustments that are expected to streamline the central bank. Most notably, the RBA will be moving to a twice-quarterly appearance schedule, from the current monthly outing.

Wednesday will bring New Zealand’s Gross Domestic Product (GDP) figures into focus. Quarter-on-quarter figures for the diminutive Antipodean economy last printed a meager 0.1% decline, and Kiwi traders will want to keep an eye on the updated figures for 2023’s second quarter.

NZ trade balance figures and Australia’s Purchasing Manager Index (PMI) data will also be dropping on Thursday to round out the week’s Oceania economic data docket.

AUD/NZD technical outlook

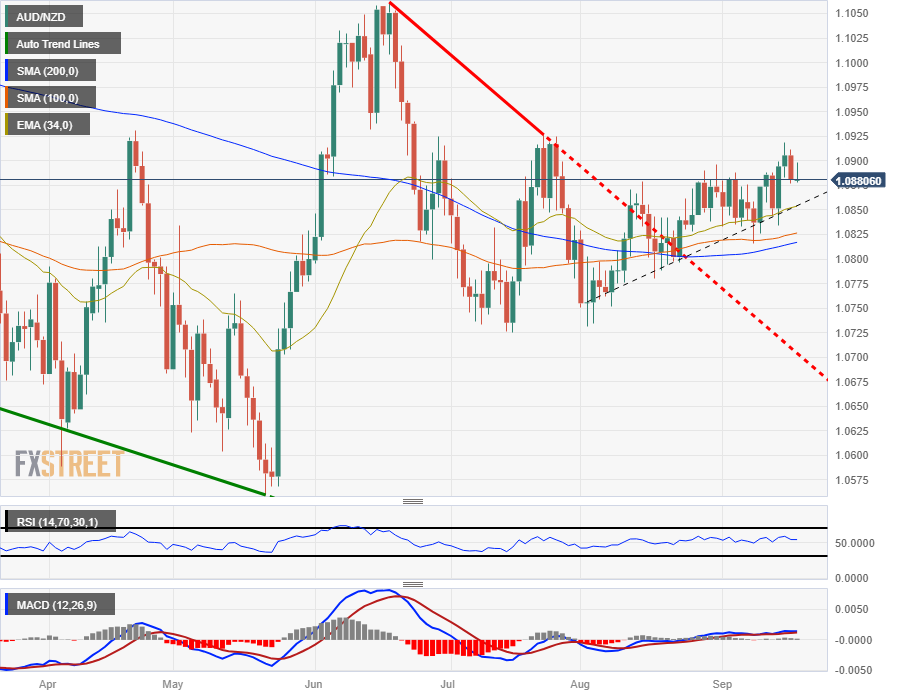

The AUD/NZD pair has twisted to the upside in recent weeks, clipping into a seven-week high last Thursday, but the Aussie-Kiwi pairing remains constrained by unconvinced market sentiment in either direction.

Daily candlesticks have the pair supported by the 200-day Simple Moving Average (SMA) from 1.0817. Higher lows from August’s opening prices near 1.0750 are bolstering upside gains, with price action getting a bump from the 34-day Exponential Moving Average climbing into the 1.0850 neighborhood.

AUD/NZD daily chart

AUD/NZD technical levels

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.