- Analytics

- News and Tools

- Market News

- USD/SEK soars to multi-month high after soft inflation figures from Sweden

USD/SEK soars to multi-month high after soft inflation figures from Sweden

- USD/SEK increased more than 0.60% towards 11.2000, its highest since November 2022.

- Sweden’s August CPI came in lower than expected.

- The USD’s strengths amid strong economic figure contributes to the upward momentum.

The USD/SEK tallied a fresh multi-month high around 11.2000 as the SEK lost interest following soft inflation figures from Sweden from August. On the other hand, the Greenback continues to trade strong, with its DXY advancing to highs since March 9 after positive mid-tier economic figures were released.

On the Swedish front, headline Consumer Price Index (CPI) inflation in August was registered at 7.5% YoY, slightly below the expected 7.7%. In addition, the Consumer Price Index with a Fixed Interest Rate (CPIF) ex-energy came in at 7.2% YoY vs. 7.4% and lower than the previous 8.0% reading. Despite soft inflation figures, the SEK’s losses may be cushioned by the Riskbank’s hawkish stance as it hinted in its last meeting that it will hike one more time in 2023, as the weakness of its currency contributes to inflationary pressures. In that sense, a hike to 4% is priced in for next week’s meeting.

On the other hand, the US economy doesn’t cool down and continues to report strong data. The Producer Price Index (PPI) surged by 0.7% MoM, leading to a 1.6% YoY increase, surpassing predictions. Retail Sales also demonstrated strength, posting a 0.6% MoM growth, well above the expected 0.2% rise. Meanwhile, during the second week of September, Jobless Claims increased to 220,000, slightly exceeding the previous week's 217,000 but staying below the anticipated 225,000. Focus now shifts to next week’s Federal Reserve (Fed) decision, where investors will look for clues to continue modelling their expectations in the policy statement and Chair Powell’s presser. As for now, the CME FedWatch tool indicates that the odds of one last 25 basis point (bps) hike have slightly declined to nearly 35%.

USD/SEK Levels to watch

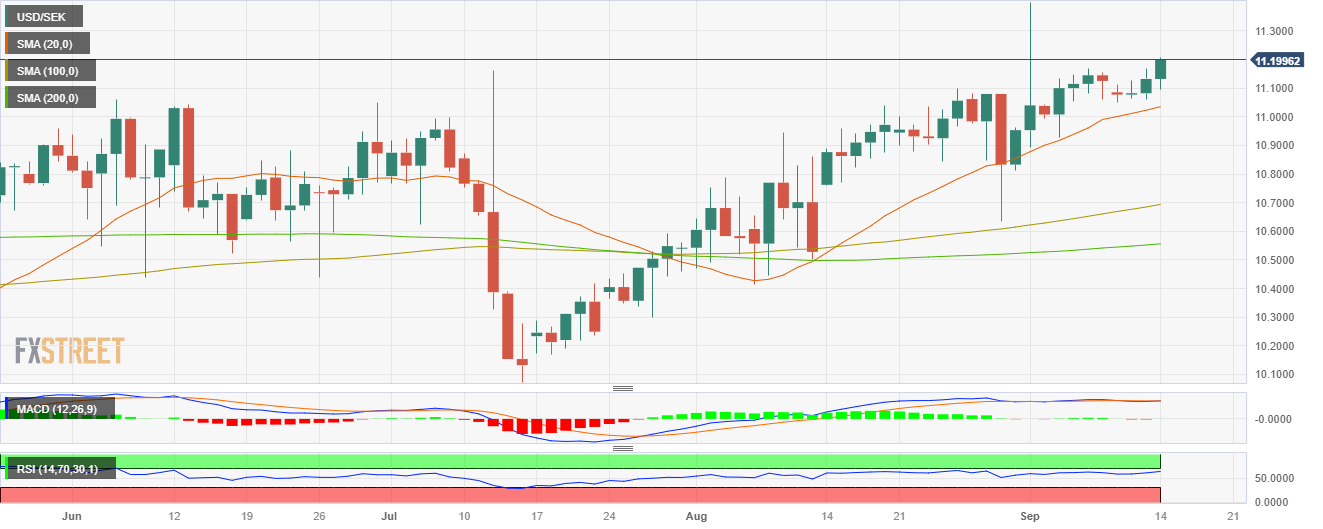

Observing the daily chart, USD/SEK suggests a bullish sentiment for the near future. Relative Strength Index (RSI) remains in the positive zone above its midline, showing an upward slope. Concurrently, the Moving Average Convergence Divergence (MACD) reflects encouraging green bars, reinforcing the growing bullish momentum and both indicators are about to reach overbought conditions, which could fuel a downward correction in the near term. Furthermore, the pair is above the 20,100,200-day Simple Moving Average (SMA), highlighting the continued dominance of bulls on the broader scale.

Support levels: 11.0960, 11.0650, 11.0550.

Resistance levels: 11.2300, 11.2400, 11.2940.

USD/SEK Daily chart

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.