- Analytics

- News and Tools

- Market News

- USD/JPY gains traction following mixed US CPI data

USD/JPY gains traction following mixed US CPI data

- USD/JPY trades at 147.58, up 0.34%, after US CPI for August rises to 3.7% YoY, beating 3.6% estimates.

- US 10-year Treasury note yield remains steady at 4.28%, despite initial volatility following the inflation report.

- Market futures price in a 97% chance the Fed will hold rates steady; focus shifts to upcoming economic data from both countries.

The Greenback (USD) extended its rally versus the Japanese Yen (JPY) on Wednesday after an inflation report in the United States (US) came mixed, though suggesting there’s a slim chance for additional monetary policy tightening. The USD/JPY is trading at 147.58, gaining 0.34%.

Greenback rises against Yen as US CPI exceeds estimates, but market skeptical of imminent Fed tightening

The US Department of Labor revealed that inflation in August’s uptick was foreseen but exceeded estimates. The Consumer Price Index (CPI) rose by 3.7% YoY, above 3.6% estimates, and crushed July’s 3.2% reading, blamed on higher energy prices. The positive news was that core CPI edged lower to 4.3% YoY, as expected, from 4.7% in July.

On the data release, the USD/JPY wavered around the 147.12/147.74 area before stabilizing at around 147.40. Since then, the pair has steadily exchanged hands at current price levels. The US 10-year Treasury note is yielding 4.28%, unchanged, after seesawing towards 4.35%.

Even though the latest round of data, with the labor market remaining tight, inflation stickier than expected, should warrant another interest rate increase, market participants think otherwise. Money market futures have priced in a 97% chance the Federal Reserve would keep the Federal Funds Rate (FFR) at the current range. However, the odds stand at 41% for the November meeting, unchanged from last week’s reading.

Aside from this, USD/JPY traders would look forward to the release of economic data to take cues on the pair’s direction. The Japanese agenda will release figures for Machinery Orders. On the US side, Initial Jobless Claims, the Producer Price Index (PPI), and Retail Sales would update the status of the US economy.

USD/JPY Price Analysis: Technical outlook

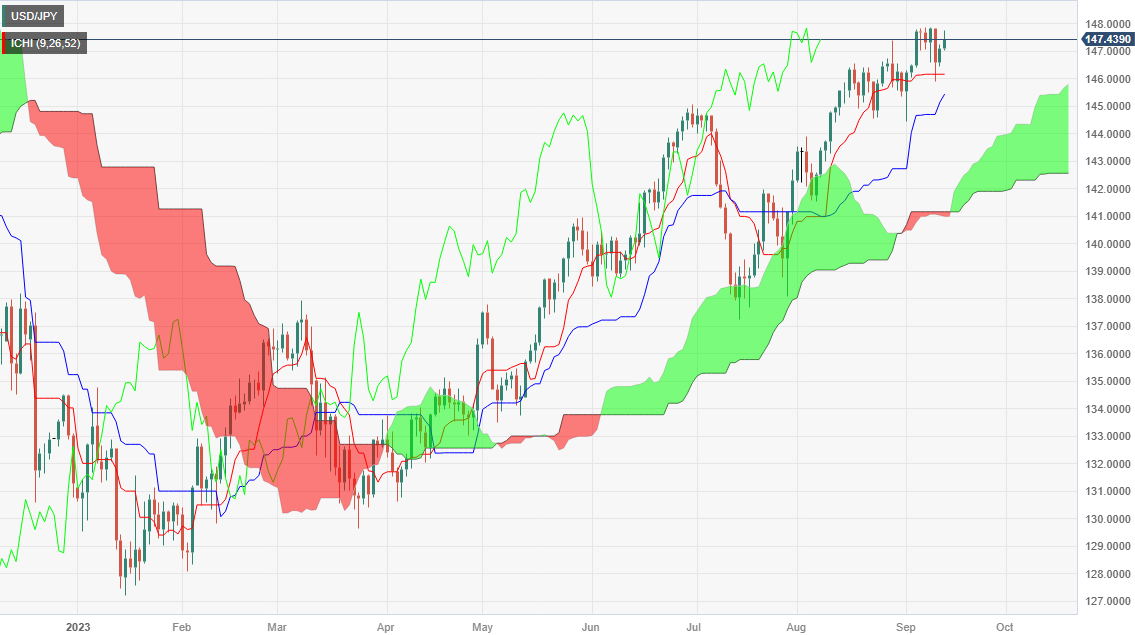

The USD/JPY has printed two straight days of positive price action, opening the door to test the year-to-date (YTD) high of 147.87. If Japanese authorities remain muted, there’s a change the major could challenge the psychological 148.00 area. Once cleared, the next stop would be the November 1 swing high at 148.82. On the flip side, a downward correction is seen if the USD/JPY drops below today’s low of 147.01.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.