- Analytics

- News and Tools

- Market News

- USD/JPY rebounds despite BoJ’s hawkish remarks, eyes on US CPI

USD/JPY rebounds despite BoJ’s hawkish remarks, eyes on US CPI

- USD/JPY climbs to 147.20, up 0.43%, after BoJ Governor Ueda hints at ending negative interest rates.

- US 10-year Treasury yield holds steady at 4.292%, bolstering the dollar ahead of crucial August inflation data.

- Market anticipates Consumer Price Index (CPI) to rise from 3.2% to 3.6% YoY, potentially influencing Fed rate decisions.

The Greenback (USD) stages a comeback against the Japanese Yen (JPY) following hawkish remarks by the Bank of Japan (BoJ) Governor Kazuo Ueda over the weekend, as he spoke on the removal of negative interest rates. Hence, the USD/JPY retreated, but as Tuesday’s North American session began, the pair is exchanging hands at 147.20, gaining 0.43% after hitting a weekly low of 145.89.

Greenback gains ground against the Yen following hawkish remarks by BoJ governors, awaiting key US inflation numbers

A risk-off impulse and firm US Treasury bond yields are backing the US Dollar (USD) ahead of the release of August inflation data in the United States. The US 10-year benchmark note sits at 4.292%, unchanged compared to yesterday, contrary to the American Dollar (USD), as shown by the US Dollar Index (DXY). The DXY, which tracks the buck’s performance against a basket of six peers, prints solid gains of 0.30% at 104.83 after dropping to a four-day low of 104.42.

During the weekend, BoJ Governor Ueda said the bank could end its negative policy rate if inflation sustainably hits its 2% inflation target. After his remarks, the JPY strengthened against most G8 FX currencies, while the 10-year Japanese Government Bond (JGB) yield reached 0.70%.

Nevertheless, most JPY gains have been erased as market participants assessed Ueda’s remarks.

On the US front, the US Bureau of Labor Statistics (BLS) will release August’s inflation data on Wednesday. The Consumer Price Index (CPI) is expected to jump from 3.2% to 3.6% YoY, while core CPI to drop from 4.7% to 4.3%. A higher-than-expected inflation reading would reignite speculations about another rate hike by the US Federal Reserve.

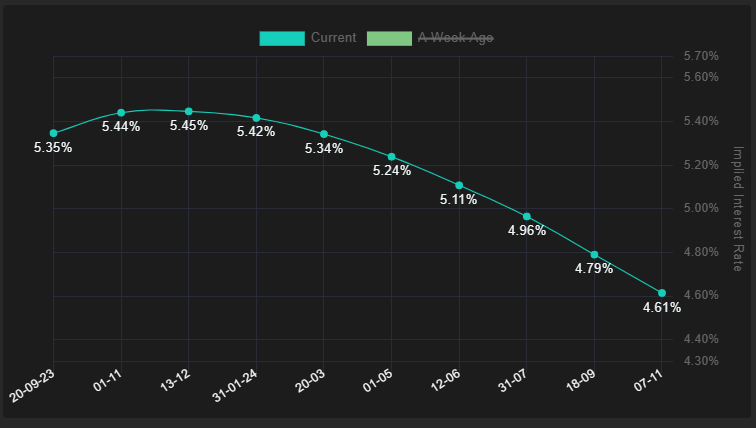

For the Fed’s upcoming meeting on September 21, money market futures expect no change to the Federal Fund Rates (FFR). For the November meeting, investors saw the FFR at around 5.48%, 15 bps above the effective FFR, as shown in the picture below.

Federal Reserve Interest Rate Probabilities

Source: Financialsource

In other data, the National Federation of Independent Business (NFIB) revealed that the Small Business Optimism Index fell to 91.3 in August from an eight-month high of 91.9 in July.

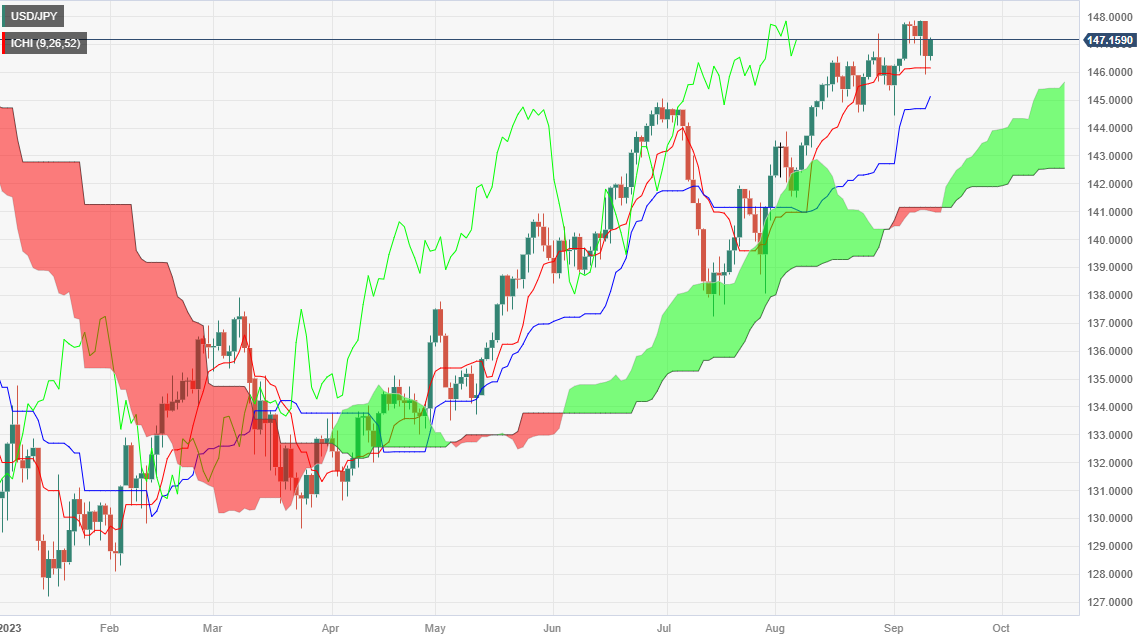

USD/JPY Price Analysis: Technical outlook

From a technical standpoint, Monday’s price action formed a hammer that breached the Tenkan-Sen line but ended the session at around 146.50s. If the USD/JPY achieves a new weekly high above 147.27, further confirmed with a daily close, the pair’s next stop would be the year-to-date (YTD) high of 147.87 before challenging the 148.00 mark. Downside risks would emerge with a daily close below the Tenkan-Sen line at 146.15.

© 2000-2026. All rights reserved.

This site is managed by Teletrade D.J. LLC 2351 LLC 2022 (Euro House, Richmond Hill Road, Kingstown, VC0100, St. Vincent and the Grenadines).

The information on this website is for informational purposes only and does not constitute any investment advice.

The company does not serve or provide services to customers who are residents of the US, Canada, Iran, The Democratic People's Republic of Korea, Yemen and FATF blacklisted countries.

Making transactions on financial markets with marginal financial instruments opens up wide possibilities and allows investors who are willing to take risks to earn high profits, carrying a potentially high risk of losses at the same time. Therefore you should responsibly approach the issue of choosing the appropriate investment strategy, taking the available resources into account, before starting trading.

Use of the information: full or partial use of materials from this website must always be referenced to TeleTrade as the source of information. Use of the materials on the Internet must be accompanied by a hyperlink to teletrade.org. Automatic import of materials and information from this website is prohibited.

Please contact our PR department if you have any questions or need assistance at pr@teletrade.global.